SHIB Primed for Explosion: 97% Inflow Plunge Fuels 57% Rally Speculation

Shiba Inu's liquidity crisis just turned into a bullish paradox—fewer coins moving sparks bigger price dreams.

The meme coin that refuses to die

While traditional investors hyperventilate over 'responsible asset allocation,' SHIB whales are playing a different game. The 97% inflow drop suggests either catastrophic disinterest or a coiled spring—and crypto's never been good at moderation.

Technical traders are salivating

That 57% rally target isn't just hopium. It's the exact kind of stupidly specific prediction that somehow always plays out in crypto charts. Resistance levels? More like suggestions for degens with leverage.

Remember: In a market where 'fundamentals' mean Elon's dog's sleep patterns, liquidity crunches either bankrupt you or make you a legend. No in-between.

SHIB daily price chart with technical indicators and moving averages – Source: TradingView

SHIB daily price chart with technical indicators and moving averages – Source: TradingView

Whale Activity And Breakout Signal Fuel SHIB $0.000015 Prediction

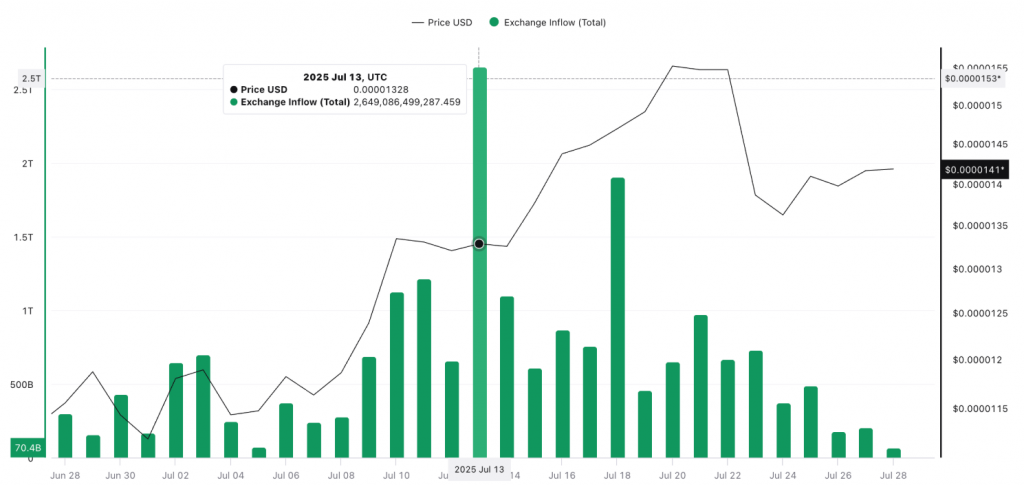

The shiba inu inflow drop from July 13 to July 28, as CoinMarketCap reveals, represents one of the most significant reductions in exchange activity this year, and actually this Shiba Inu whale activity pattern typically precedes major price movements. Fewer tokens flowing to exchanges suggests that large holders are maintaining their positions rather than preparing to sell right now.

Technical Setup Points to Major Rally

SHIB currently trades near $0.000014, along with the Shiba Inu breakout signal pointing toward resistance at $0.000015. The Shiba Inu price rally potential becomes clear when examining holder distribution data, which shows that only 18.25% of addresses are actually profitable while 78.37% remain out of the money at the time of writing.

The largest cluster of holders sits between $0.000015-$0.000019, and this creates overhead resistance. However, once this zone gets cleared, the path opens for a 57% surge toward $0.000022. The Shiba Inu $0.000015 prediction serves as the critical breakout level that could actually trigger this massive rally.

Volume Concerns and Risk Factors

Despite the bullish Shiba Inu inflow drop, volume analysis reveals declining trading activity during recent green candles right now. This “on zero” breakthrough pattern has been shown historically to have weakness, though the RSI at 56 provides some room for upward movement.

The Shiba Inu whale activity reduction creates favorable conditions, but any Shiba Inu price rally needs volume confirmation along with momentum. If the $0.000012 support breaks, the Shiba Inu breakout signal could actually turn bearish, invalidating the Shiba Inu $0.000015 prediction.

The combination of reduced exchange inflows and technical resistance creates a setup where the Shiba Inu inflow drop could fuel significant upward momentum once key levels break, even though volume remains a concern.