UBS Dumps FX After Trump Fallout—Swiss Banking Titan Flees Volatility

UBS just slammed the door on forex trading—and Washington's chaos might be to blame.

The Swiss banking behemoth is cutting ties with FX markets after political turbulence hammered its positions. No official numbers yet, but insiders whisper Trump-era policies triggered the retreat.

Why banks hate uncertainty

When geopolitics turns toxic, even 166-year-old institutions bail. UBS joins a growing list of traditional players fleeing erratic markets—while crypto traders feast on the volatility.

The irony?

Banks preach 'risk management' until actual risk shows up. Meanwhile, decentralized finance keeps stacking wins as legacy finance trips over its own red tape.

One thing's clear: when the giants retreat, the rebels advance.

UBS FX Product Retreat Tied to Trump’s Forex Market Impact, Risks

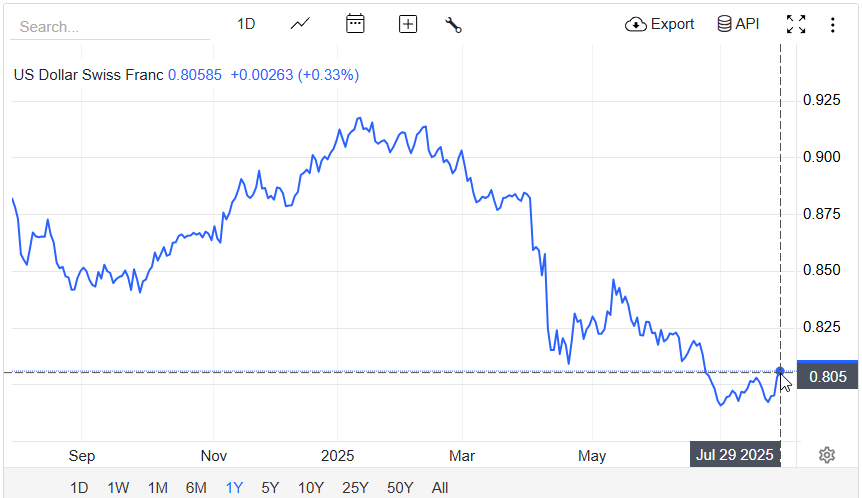

Trump’s tariff proposals in early April actually sparked the Swiss franc’s largest monthly gain since 2015, and this devastated clients who were invested in UBS’sThis UBS trading desk cuts response comes after several hundred customers, primarily in Switzerland, experienced substantial losses that collectively reached into hundreds of millions of Swiss francs.

Todd Tuckner, UBS Chief Financial Officer, had this to say:

UBS Currency Derivatives Crisis Actually Unfolds

The UBS FX product retreat centers on exotic derivatives that allowed clients favorable currency exchange rates but also carried devastating downside risks. UBS currency derivatives losses were accumulated rapidly when exchange rates moved beyond predetermined thresholds, with one client losing over 50% of their February investment by May.

UBS acknowledged in an official statement:

Client Risk Concerns Drive Policy Changes Right Now

UBS client risk concerns have intensified as affected customers argue the bank sold them products that were inappropriate for their investment sophistication. The Swiss Association for the Protection of Investors reported that over 30 individuals came forward regarding UBS-marketed structured currency derivatives losses.

Trump Forex market impact created unprecedented volatility that traditional risk models couldn’t adequately price, and this UBS trading desk cuts decision reflects the institution’s recognition that UBS currency derivatives marketing practices require fundamental review.

The UBS FX product retreat represents a strategic withdrawal from what was a previously profitable business line. As UBS client risk concerns mount, the bank continues discussions about potential compensation while implementing new safeguards to prevent similar TRUMP Forex market impact scenarios from devastating client portfolios again.