Justin Sun’s Father Makes $1B TRX Power Move as SEC Closes In

Family ties meet high-stakes crypto drama as Justin Sun’s dad drops a billion-dollar bet on TRX.

SEC shadows loom—but the Sun family isn’t backing down. A $1B buy-in screams confidence (or desperation) as regulators circle.

Who needs compliance when you’ve got generational wealth and a taste for volatility? The crypto carnival rolls on—grab your popcorn.

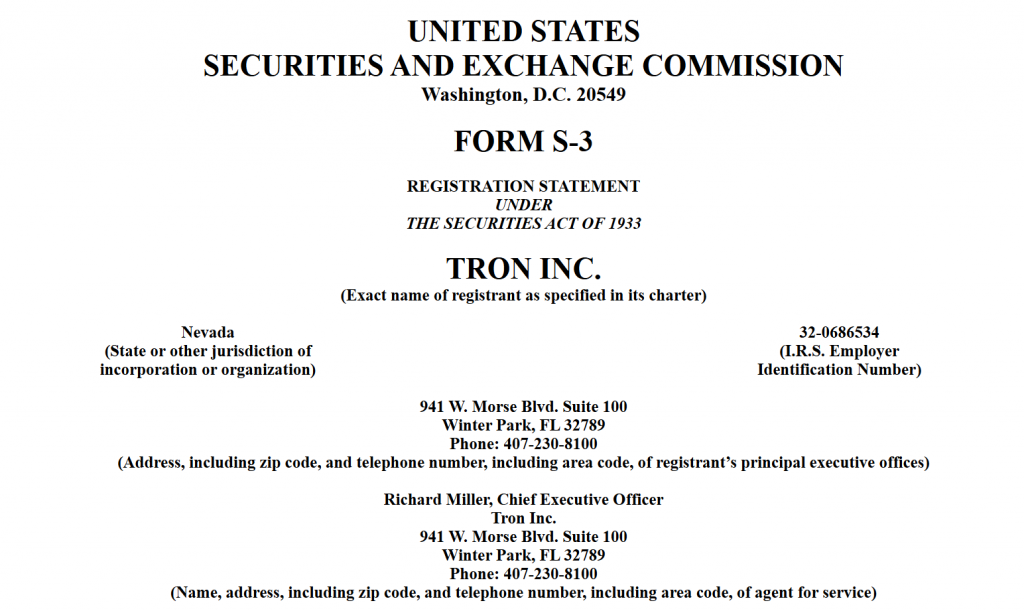

Tron Inc securities filing document – Source: SEC.gov

Tron Inc securities filing document – Source: SEC.gov

Tron Token Sale Sparks TRX Price Outlook Amid SEC Pressure

$1 Billion Registration for TRX Accumulation

The crypto regulatory filing outlines how Tron Inc. plans to issue stock, debt, and even other instruments to fund ongoing TRX token purchases. This TRX $1B securities filing represents an aggressive pivot from the company’s traditional toy business into crypto treasury operations, which is quite a shift when you think about it.

Vincent Liu, chief investment officer at Kronos Research, had this to say:

The company has been struggling with its toy business lately, and actually disclosed that itin 2024. So this tron token sale strategy makes sense as a way forward.

Family Ties Complicate Regulatory Picture

The strategy faces some scrutiny due to leadership connections, and rightfully so. Tron Inc.’s board is chaired by Weike Sun, father of Justin Sun, whose companies were charged by the SEC in 2023. This familial overlap raises governance questions as the Justin SUN SEC investigation continues to unfold.

Liu characterized the MOVE as anthat bridges traditional finance capital directly into the Tron ecosystem, which is an interesting way to put it.

The filing notes several directors havecreating potential conflicts of interest for this crypto regulatory filing. At the time of writing, these connections are being closely watched by regulators.

Market Risks and TRX Price Outlook

The company warned that declining TRX prices could actually make raising capital more difficult, which is a real concern. Unlike Bitcoin treasury strategies, the TRX price outlook faces unique challenges due to lower market liquidity and some other factors.

Liu noted:

The filing acknowledges TRX isthan traditional reserves andcompared to cash investments. This TRX $1B securities filing strategy comes with risks that investors need to consider carefully.