🚀 TSLA Rockets Toward $500 as Tesla Diner Rakes in $47K Daily – Is This the Next Bull Run?

Elon's empire strikes again—Tesla stock surges toward a $500 target as its quirky diner concept proves shockingly profitable. Here's why Wall Street's sweating.

The diner effect: More than just fries with that Cybertruck?

While analysts obsess over delivery numbers, Tesla's unorthodox $47K/day revenue stream from its retro diners might be the dark horse propping up its valuation. Classic Musk misdirection—or genius vertical integration?

Short sellers beware: The $316 floor looks solid

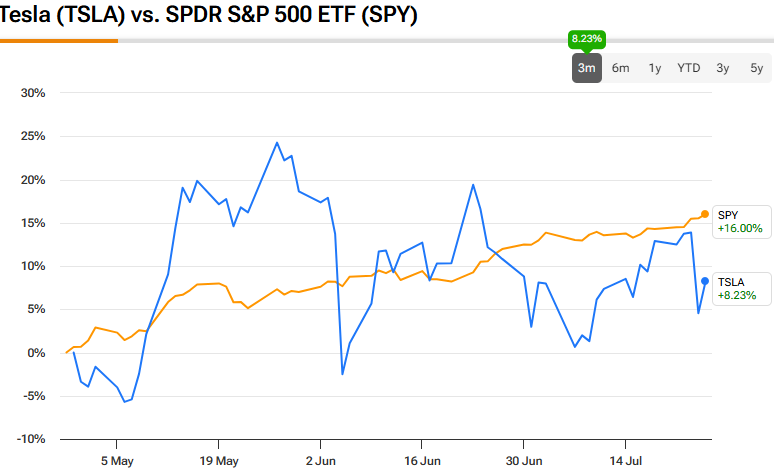

With TSLA holding firm above $316 despite macroeconomic headwinds, the path to $500 appears clearer than a Tesla windshield (pre-recall). Cue the inevitable 'but valuations!' chorus from hedge funds missing the rally.

One thing's certain: When Tesla wins, it wins sideways—whether through car sales, AI hype, or frankly absurd burger-flipping robots. Just don't ask about the solar roof division.

TSLA Stock Price Target Rises as Tesla Diner Sparks Revenue Buzz

The performance of the diner is actually so good that Wall Street analysts are revising their price prediction models on Tesla. It is said that the facility garnered 47,000 dollars within a span of six hours, and this implies that the facility overshadowed local McDonalds restaurants in comparable periods by nearly 30 percent.

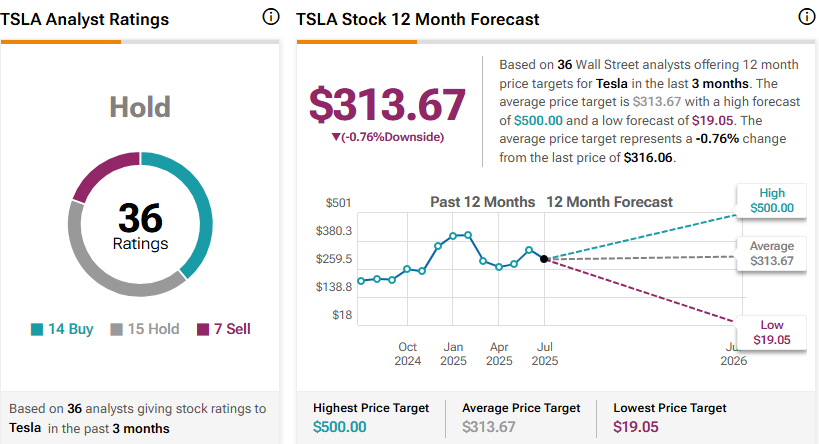

Based on 36 analysts who are offering Tesla stock forecast ratings right now, the average TSLA stock price target is sitting at $313.67, with the highest one reaching $500.00. Current analyst sentiment shows 14 buy ratings, along with 15 hold recommendations, and also 7 sell ratings.

Revenue Stream Changes and Impact

Tesla’s diner revenue represents a new income source that could actually be scaled across the entire Supercharger network. The concept combines food service, merchandise sales, and charging fees, creating multiple revenue streams from a single location.

These several Elon Musk business endeavors are causing analysts to modify the Tesla price prediction models. This shows the strength of the brand not only related to cars but also in the ability of people to pay a higher price on a Tesla-brand experience at the diner.

Market Response and What’s Next

Tesla stock forecast indicators are showing positive momentum right now, with TSLA trading at $316.06, up 3.52% in the current session. The company’s $1.02 trillion market cap reflects investor confidence in these diversified revenue streams.

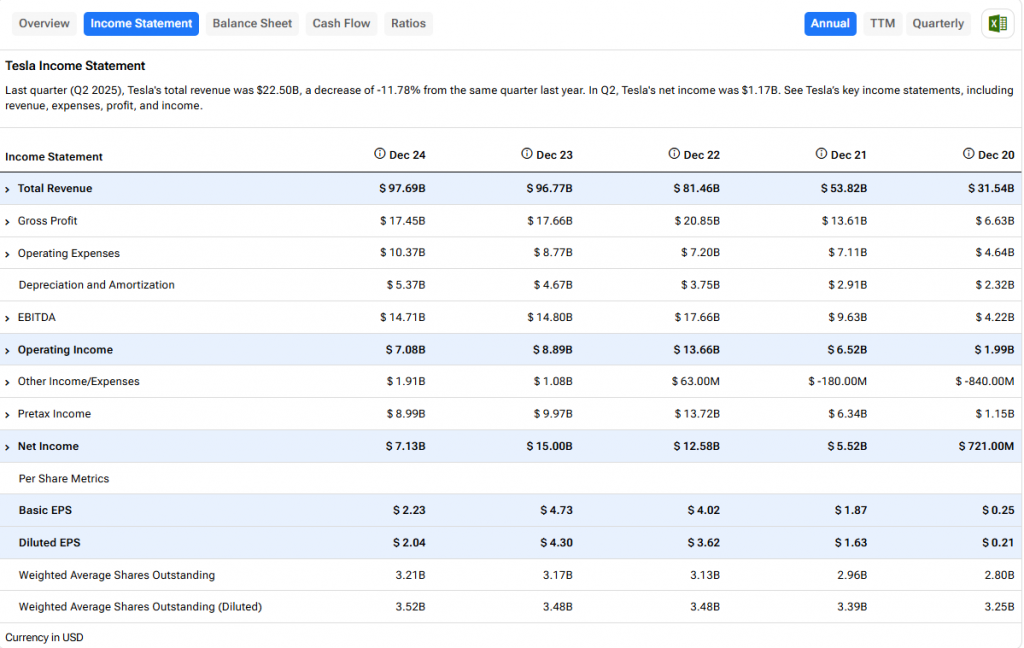

According to the latest data on finance releases, Tesla Q2 2025 generated a total revenue of 22.50B, which is a 11.78 percent decrease over the same period a year ago at the time of this writing. The net income is also approaching the guideline of approximately $1.17B which arguably contributes to the further investment in Elon Musk business projects such as the brand new best new restaurant ever project.

Dining combined with charging infrastructure will fill the needs of the customers as long as they are charging their devices. This method will actually make a difference in further TSLA stock price target calculations because the concept will extend to the whole country.