BREAKING: Grab Philippines Embraces Bitcoin—Crypto Payments Go Mainstream in 2025

Grab just flipped the script in Southeast Asia's fintech race. The superapp now accepts Bitcoin payments across the Philippines—no stablecoin middlemen, just pure Satoshi vision.

Why this stings traditional banks: Grab's 30 million regional users can now bypass peso conversions entirely. Morning coffee? Paid in sats. Midnight pancit? Lightning Network settles the tab.

The cynical take: Banks will spin this as 'progress' while quietly lobbying regulators. Because nothing terrifies legacy finance like users opting out of their 3% FX racket.

One thing's clear—when ride-hailing apps become crypto on-ramps, the bull case writes itself. Next stop: mass adoption.

Grab Stock Rises After Bitcoin Acceptance

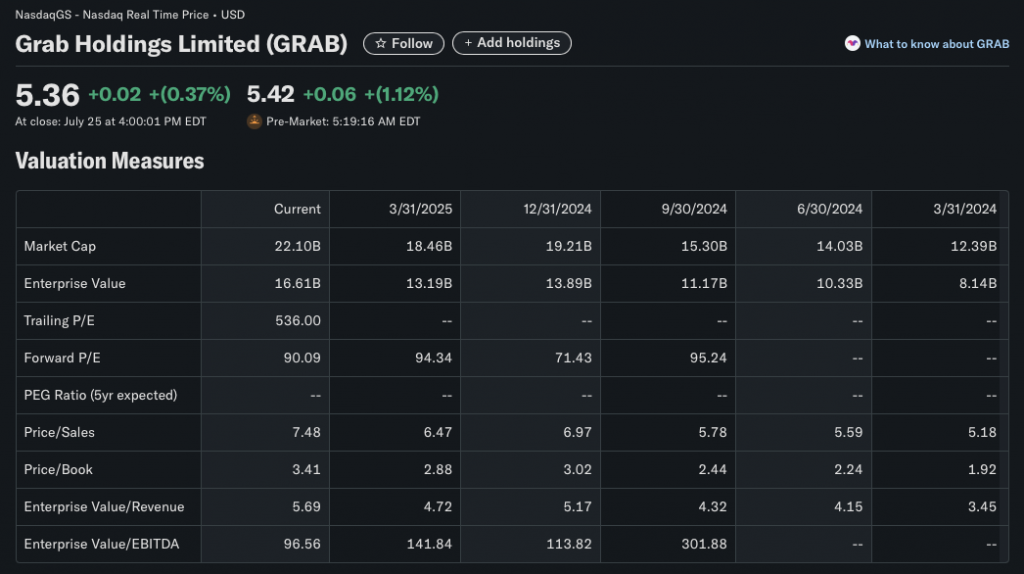

According to Yahoo Finance regarding GRAB, Grab Holdings Limited saw a 0.37% rise in its stock value at market close on July 25. The stock has risen by 1.12% on the pre-market on July 28. It is possible that investors viewed the decision to accept BTC as payment as a bullish development. GRAB’s stock could see further rise over the coming days.

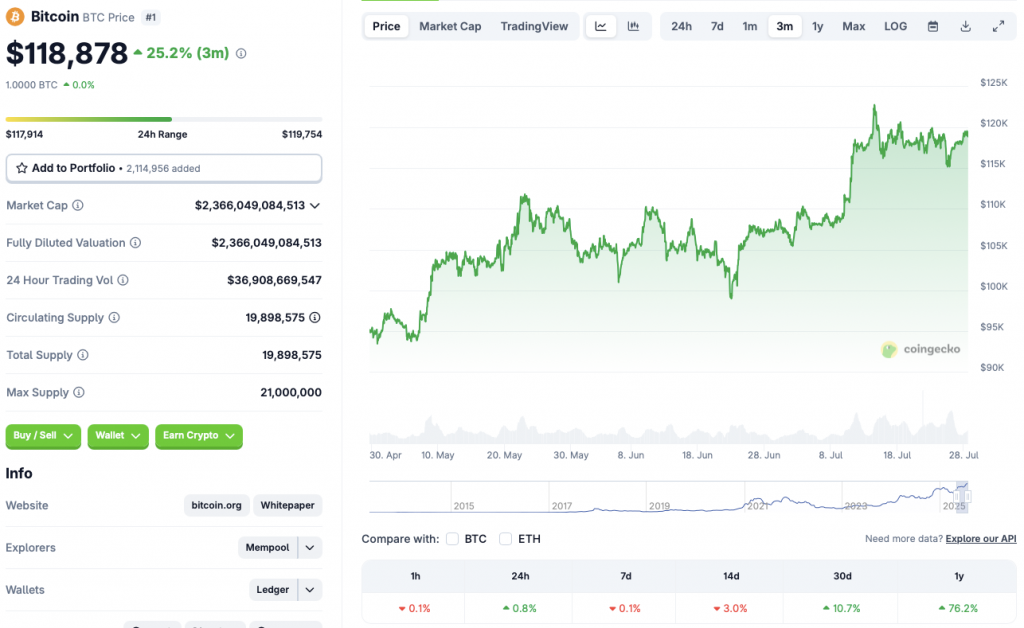

Bitcoin (BTC) has also experienced a rebound after its Friday correction. BTC’s price briefly fell to below $115,000. The original cryptocurrency has since reclaimed the $118,000 price level. BTC currently faces some resistance at $119,000. According to CoinGecko’s BTC data, the asset’s price has dipped 0.1% in the weekly charts and 3% in the 14-day charts. Despite the pullback, BTC is up 0.8% in the daily charts, 10.7% in the monthly charts, and 76.2% since July 2024.

BTC’s correction came after a Satoshi-era wallet offloaded 80,000 coins on the market. The MOVE led to a rise in volatility, causing substantial price dips. The market has since made a slight recovery. BTC hit an all-time high of $122,838 earlier this month on July 14. We may see additional volatility as investors await the Federal Open Market Committee (FOMC) meeting on July 29. There is a low chance of an interest rate cut. The lack of an interest rate cut could lead to retail investors backing away from risky assets, such as cryptocurrencies.