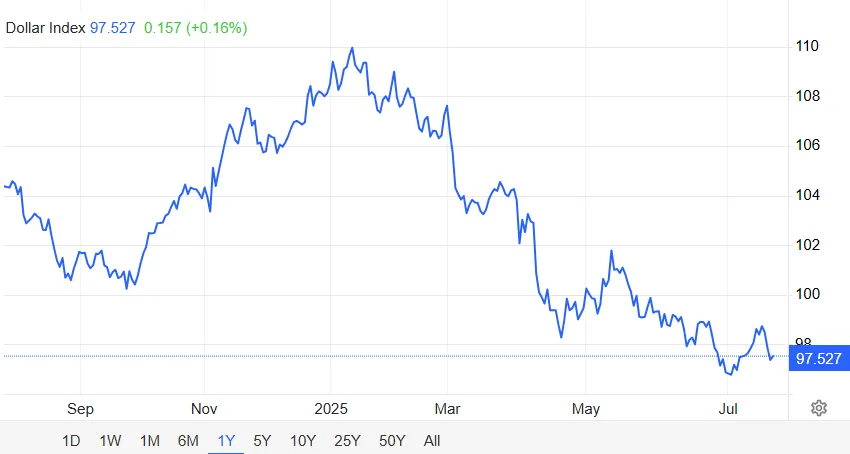

Dollar Plummets 6.6% as Trump Slashes Japan Tariffs to 15% in Massive $550B Trade Shake-Up

The greenback takes a nosedive as Washington rewrites the trade rulebook—again.

Trump's latest deal axes Japan tariffs to 15%, sending shockwaves through currency markets. The dollar's 6.6% freefall marks its worst day since the 2020 pandemic rout.

Behind the numbers: That $550B figure isn't just wallpaper—it's the size of the economic battlefield. Tariff cuts might boost trade, but currency traders are voting with their sell orders.

Funny how 'America First' keeps turning into 'Dollar Worst' when the printing presses don't stop.

Stock market performance charts – Source: TradingView

Stock market performance charts – Source: TradingView

Trump’s Japan Trade Deal Shakes Markets as Dollar Drops, Stocks Rise

The Trump’s Japan trade deal announcement came during a White House press conference where the president outlined the massive $550 billion agreement. The Japan tariff cut represents a dramatic policy shift that has actually been welcomed by manufacturers on both sides of the Pacific, and some industry leaders are calling it unprecedented.

Trump said:

Currency Markets React to Trade Agreement

The US dollar drops accelerated following the tariff announcement, with currency traders repositioning portfolios rapidly. The market reaction Trump deal was swift and dramatic, as institutional investors adjusted their positions along with retail traders. Trading volumes spiked as the greenback fell against major currencies, reflecting concerns over reduced protectionist policies and also uncertainty about future trade moves.

Automotive Sector Sees Major Gains

Auto stocks surge became the dominant theme across markets, with manufacturers posting significant gains right now. The Japan tariff cut from 25% to 15% on automotive imports has been welcomed by industry leaders, and the response has been overwhelmingly positive. Japanese automakers saw particularly strong moves, with major gains recorded on the Tokyo Stock Exchange along with some European markets.

The news sent stocks higher in Tokyo on Wednesday, with the Nikkei index up around 3% by lunchtime, according to market data.

The Trump Japan trade deal includes provisions for increased Japanese investment in US manufacturing facilities, and investors see this as a win-win situation. The market reaction Trump deal continues to reverberate through global markets as traders digest the full implications. Auto stocks surge reflects Optimism about reduced costs and also improved market access for manufacturers.

The deal is one of the most important trade policy shifts to date and the cutting down of Japan tariff is likely to cushion the consumers by cutting down the prices of the vehicles. As the US dollar falls further, the Trump Japan trade deal is establishing new precedent of future trade negotiations with other trade partners and as of this writing the markets are just digesting the implication of Trump Japan deal.