Global Dollar Dominance Craters to 47% as China Accelerates De-Dollarization Push

The greenback's reign is faltering—hard. Central banks worldwide now hold just 47% of reserves in USD, the lowest level ever recorded. And Beijing isn't just watching from the sidelines.

Xi's financial artillery: China's aggressive yuan promotion and bilateral trade deals are shredding the dollar's monopoly. From oil contracts to digital yuan pilots, every move strategically bypasses SWIFT.

Wall Street's uncomfortable truth: The 'exorbitant privilege' of dollar hegemony looks increasingly like a relic. But don't expect the suits on Park Avenue to admit it—not while they're still collecting those sweet, sweet FX transaction fees.

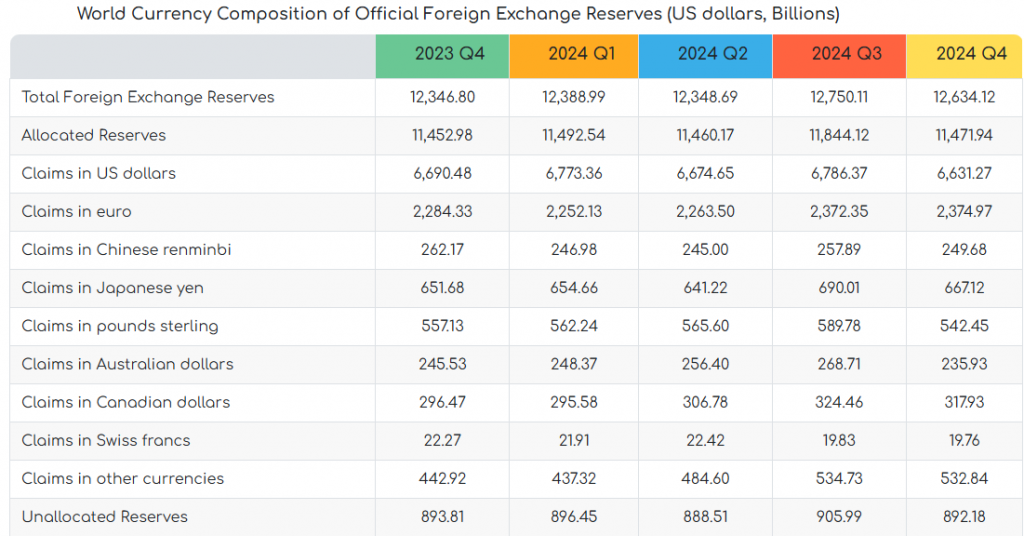

World currency composition chart showing US dollar reserves declining from $6.69 trillion to $6.63 trillion between Q4 2023 and Q4 2024 – Source: IMF

World currency composition chart showing US dollar reserves declining from $6.69 trillion to $6.63 trillion between Q4 2023 and Q4 2024 – Source: IMF

BRICS Currency Strategy Sparks Global Reserve Shift and US Dollar Decline

China’s de-dollarization push has sent some serious shockwaves through global markets as the US Dollar Index actually crashed 11% in the first half of 2025. This BRICS currency strategy represents the steepest decline since 1973, and the index was plummeting an additional 7% after Trump’s tariff announcement on April 2.

Central banks worldwide are being forced to abandon dollar holdings amid mounting tariff retaliation risks. The Official Monetary and Financial Institutions Forum survey revealed that 80% of central banks express serious concerns over US political developments, while 32% plan to increase their Gold reserves over the next 12-24 months.

European Central Bank President Christine Lagarde stated:

Trump’s Tariff Threats Actually Accelerate Global Reserve Shift

The China de-dollarization push has intensified following Trump’s aggressive stance. TRUMP declared:

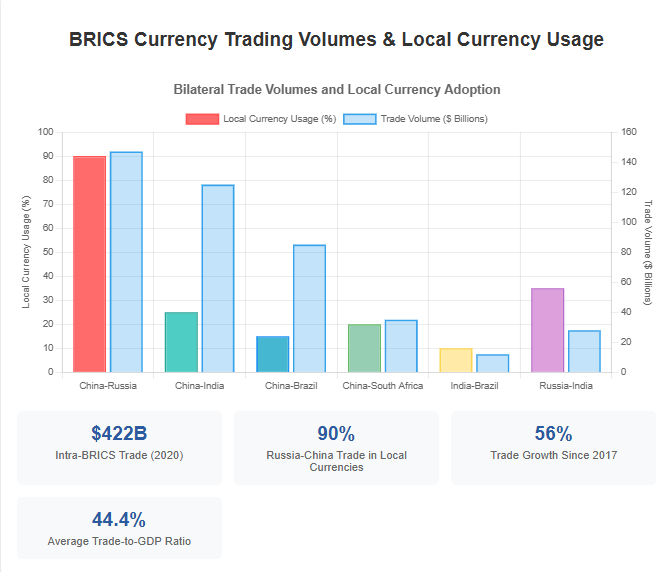

This BRICS currency strategy has proven resilient, with bilateral trade between Russia and China now operating at over 90% in rubles and yuan. The US dollar decline continues as China keeps the yuan tightly pegged, maintaining competitive export prices in European markets along with some other advantages.

People’s Bank of China Governor Pan Gongsheng warned:

The tariff retaliation risks have backfired spectacularly, and the dollar has been falling over 12% against the euro since January. US total debt stands at $37 trillion right now, with interest payments consuming 20% of federal tax revenues, which further undermines confidence in America’s fiscal position.

Robin Brooks of the Brookings Institution noted the challenges ahead:

Despite these limitations, the global reserve shift continues gaining momentum as 95% of central banks expect to increase their gold holdings throughout 2025, marking what experts consider the most significant challenge to dollar dominance in modern history.