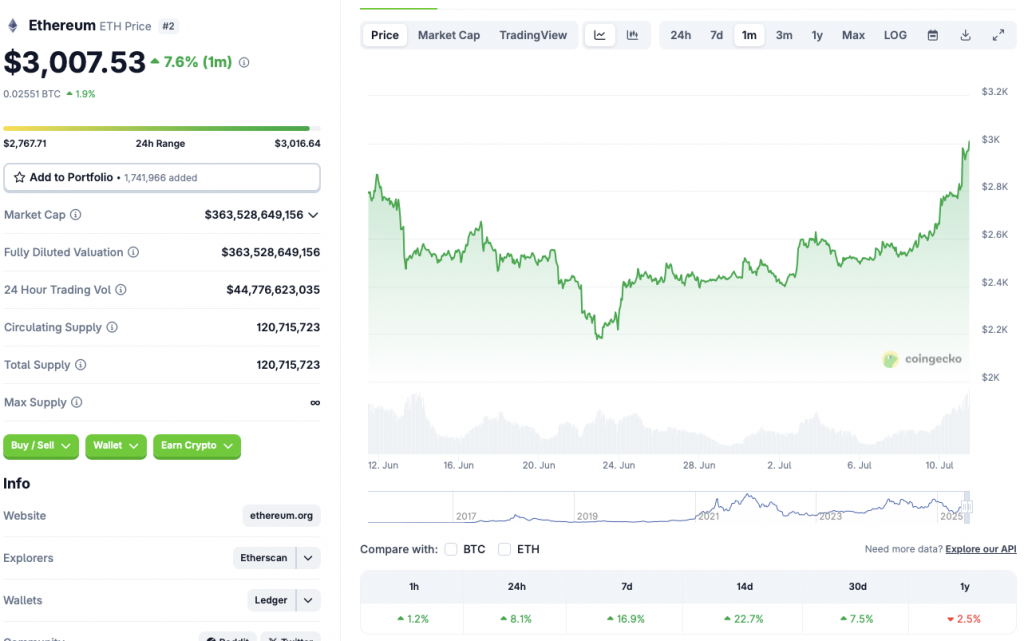

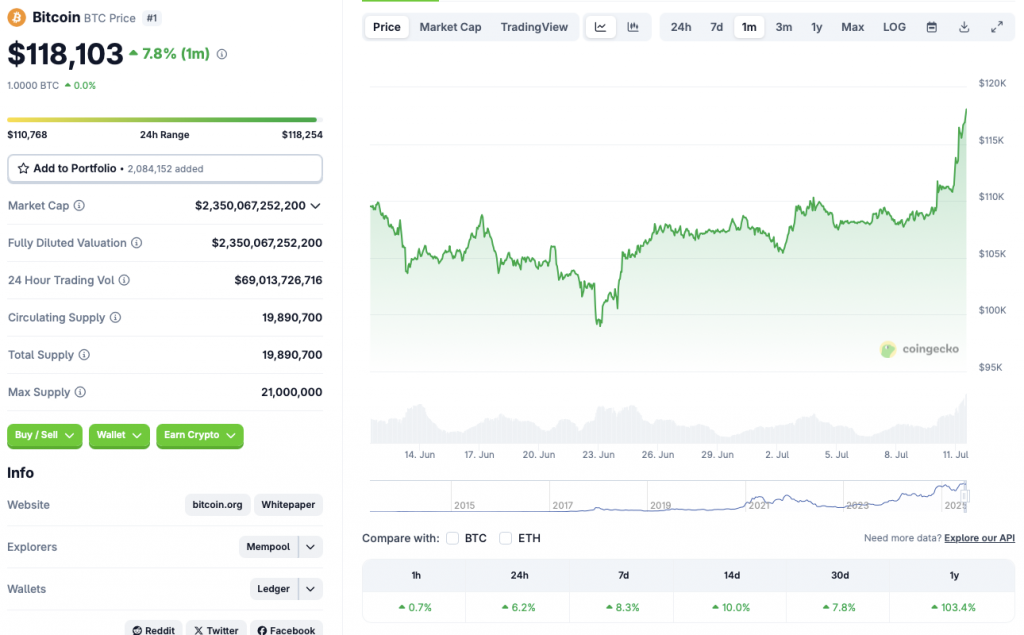

🚀 Ethereum Soars Past $3000 While Bitcoin Smashes $118K: The Crypto Bull Run Isn’t Done Yet

Crypto markets are defying gravity—again. Ethereum just pierced the $3,000 barrier as Bitcoin blasted past $118,000, leaving traditional finance clutching its spreadsheets. Here’s why this rally has legs.

The ETH Factor: More Than Just Gas Money

Ethereum’s surge isn’t just DeFi degens overleveraging—institutional adoption is quietly eating Wall Street’s lunch. Meanwhile, Bitcoin’s price action makes gold bugs look like they’re trading with dial-up.

What’s Next? Watch These Triggers

Regulators are scrambling to keep up (as usual), and the ‘halving effect’ on Bitcoin is now a self-fulfilling prophecy. Traders betting against this market? Enjoy your margin calls.

One cynical footnote: If your hedge fund still hasn’t allocated to crypto, don’t worry—your LP’s grandchildren will ask why during their family office meeting.

Source: CoinGecko

Source: CoinGecko

Ethereum Follows Bitcoin’s Trajectory

Bitcoin (BTC) has delivered incredible returns over the last year. The original crypto is up by 6.2% in the daily charts, 8.3% in the weekly charts, 10% in the 14-day charts, 7.8% in the monthly charts, and 103.4% since July 2024.

BTC’s rally has triggered a market-wide rally. ethereum (ETH) and other crypto assets are likely following BTC’s trajectory. BTC and ETH ETFs have seen non-stop inflows over the last month. The inflows did not stop even during uncertain times.

Institutional money has played a significant role in the latest market rally. Retail players may be waking up right now. Small wallets were stagnant for quite some time as volatility took hold. Global geopolitical tensions and trade wars may have spooked retail investors.

What’s Next For The Two Biggest Cryptocurrencies?

There is a high probability that Bitcoin (BTC) will breach the $120,000 mark very soon. Ethereum (ETH) may follow BTC’s path. BTC could face a slight correction after it hits $120,000. Investors may begin to book profits. BTC may also continue its rally till around September, before facing a dip. Historically, BTC has faced a dip about 18 months after its halving. We could see a similar pattern this year.

Ethereum (ETH) could rise to around $3,500 if BTC hits the $120,000 mark. ETH could face a correction if BTC faces a dip.

How the market unfolds is yet to be seen.