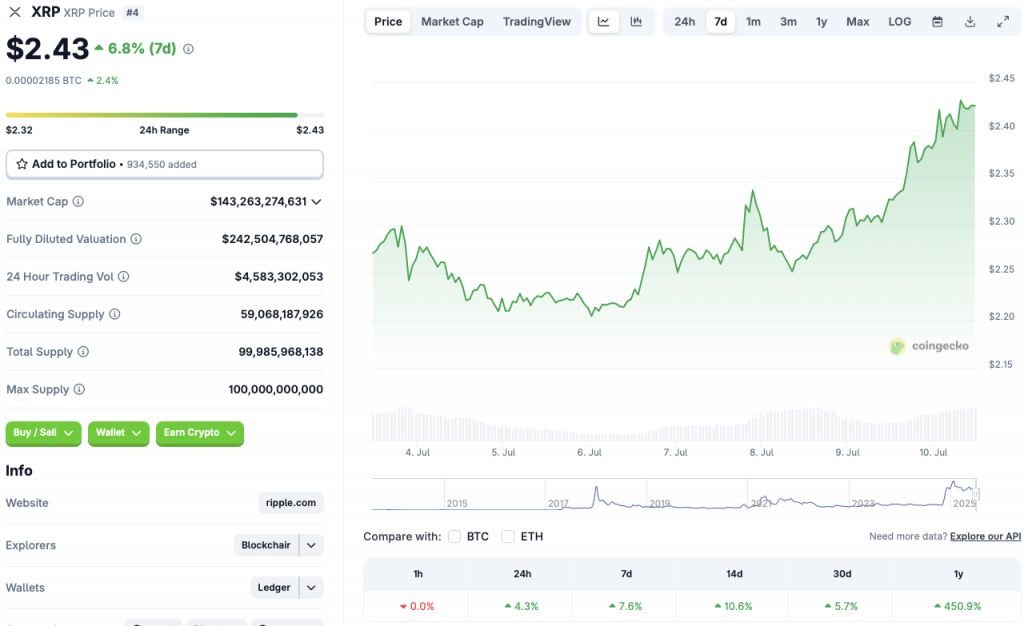

XRP Surges 450% Since 2024: Here’s What Your $1000 Investment Looks Like Now

XRP just flipped the script—again. The crypto that banks love to hate (and secretly use) has rocketed 450% since 2024. We crunched the numbers so you don't have to.

From pocket change to profit machine

That grand you tossed at XRP last year? It's now sitting pretty at $5,500—assuming you didn't paper-hand during the SEC's annual 'regulation theater.'

The institutional wink-and-nod effect

While Bitcoin maximalists were busy arguing about pizza purchases, XRP quietly became the backroom handshake of cross-border payments. No blockchain purity tests, just ruthless efficiency.

Warning: past performance ≠ future gains (but it's fun to look)

Let's be real—if traditional finance worked this well, your savings account wouldn't still pay 0.5% interest. XRP's run proves one thing: in crypto, the 'impossible' keeps happening... until it doesn't.

XRP Trading In The Green Zone As Bitcoin Approaches Peak

Ripple’s XRP token is experiencing a bullish rebound amid a larger crypto market rally. Bitcoin (BTC) is half a percentage point away from its peak. Most other assets are also showing healthy rallies.

XRP is currently up by 4.3% in the daily charts, 7.6% in the weekly charts, 10.6% in the 14-day charts, and 5.7% over the previous month.

XRP’s rally could be fueled by the recent announcement that Ripple will use BNY Mellon as custodian of its new stablecoin, RLUSD.

The larger market rally could be due to BTC on the verge of hitting a new all-time high. The crypto market had struggled to gain much momentum over the last few months. Retail players were stagnant. The rallies over the last few weeks were likely due to consistent institutional inflows from crypto-based ETFs.

There is a chance that XRP will continue its rally over the coming weeks. Ripple has seen a substantial growth in global adoption over the last few years. Many anticipate a similar pattern in the US once clear regulations are in place.

XRP also has a few ETF applications awaiting approval with the SEC. An ETF approval will likely lead to further price spikes for the asset. The SEC has taken a pro-crypto stance after the appointment of Paul Atkins as the new head. Atkins is a pro-crypto candidate, and many anticipate him to be more lenient on the crypto industry than Gary Gensler.