From $1K to $16M: How Binance Coin (BNB) Became Crypto’s Ultimate Rags-to-Riches Story

In 2017, $1000 worth of BNB could barely buy you a decent laptop. Today? That same stack would make you a crypto millionaire—16 times over.

The numbers don't lie

While traditional investors were obsessing over blue-chip stocks, Binance Coin quietly delivered a 16,000x return in just eight years. Try finding that in your S&P 500 index fund.

Exchange token supremacy

BNB's relentless climb mirrors crypto's shift from speculative asset to infrastructure backbone—with Binance's ecosystem fueling everything from DeFi to real-world payments. Who needs banks when your exchange token moonwalks past Visa's market cap?

The cynical take

Of course, Wall Street will claim they 'saw it coming'—right after they finish downgrading their BNB price targets for the 47th time.

Source: CoinGecko

Source: CoinGecko

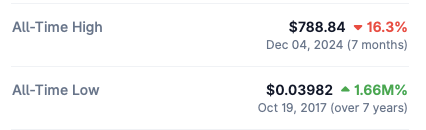

The value of 25,118.14 BNB coins today is nearly $16.5 million. The asset hit an all-time high of $788.84 in December of last year. If you had sold the 25,118.14 BNB coins when the asset was at its peak, you would have made nearly $20 million.

Is BNB Primed For Another Bullish Run?

Binance‘s BNB coin’s rallies have aligned with a larger market movement. The asset has, in particular, followed Bitcoin’s (BTC) trajectory. BTC was nearing a new high when BNB hit its $788.84 peak. While BTC has hit multiple new all-time highs since its December 2024 rally, BNB has failed to climb to a new high. The asset is down by 16.3% since its December 2024 high.

BNB could rally under favorable market conditions. BTC is facing considerable resistance at the $108,000 level. A BTC breakout could lead to a surge in BNB’s price.

While a BTC rally may trigger a BNB and a wider market-wide resurgence, there are a few things to consider. The current market most likely lacks retail participation. BTC has surged mostly due to institutional inflows. Institutional money continued to flow into the original crypto despite global uncertainties. Retail players are yet to recover from trade war blows.

The current crypto market tone is highly uncertain. With no sign of an interest rate cut in sight, we may be in for a prolonged consolidation phase. There is also a high possibility of a correction very soon. Glassnode data shows that BTC unrealized profits have hit $1.2 trillion. A sudden change in sentiment could lead to an increase in selling pressure. BNB and other cryptocurrencies could suffer under such conditions.