Mastercard’s Zero-Fee Crypto Card Shakes Up $253B Payments War—Visa Left Scrambling

Game on. Mastercard just dropped a nuclear option in the payments arms race—a zero-fee crypto card that could rewrite the rules of the $253 billion digital transactions battlefield.

Why it matters: No more nickel-and-diming users with hidden spreads or conversion fees. This is a direct assault on Visa’s dominance—and a calculated bet that crypto adoption just hit its tipping point.

The fine print: Banks will still take their pound of flesh elsewhere (old habits die hard). But for once, the finance giants aren’t just talking about blockchain—they’re weaponizing it.

Bottom line: When elephants fight, the grass gets trampled. Today it’s Visa’s margins—tomorrow? Your neighborhood bank’s ‘innovation’ department sweating over their PowerPoint decks.

Mastercard & Visa’s Strategic Moves in the $253 Billion Crypto Market

The stablecoin crypto threat has reached a tipping point, and it’s forcing both payment giants to adapt their strategies. Mastercard’s partnership with Bitget Wallet launched a zero fee crypto card that allows users to spend cryptocurrencies at over 150 million merchants worldwide, eliminating traditional barriers that have protected card networks from crypto competition.

Meanwhile, Visa has responded to the stablecoin crypto threat by launching its own stablecoin pilot program across six Latin American countries including Argentina, Colombia, Ecuador, Mexico, Peru, and Chile. The Visa & Mastercard competition has intensified as both companies recognize that US businesses paid $187 billion in swipe fees last year, and this revenue that zero fee crypto card solutions could potentially eliminate.

Jamie Elkaleh, CMO of Bitget Wallet, stated:

The rise of stablecoin crypto threats highlights this demand.

Jack Forestell, Visa’s Chief Product and Strategy Officer, had this to say:

Visa is aware of the threat posed by the stablecoin crypto sector.

Visa’s Stablecoin Strategy Against Mastercard

Visa’s approach to the stablecoin crypto threat involves allowing customers to transact in stablecoins using existing balances, with plans to expand to Europe, Asia, and Africa. This stablecoin payment system strategy positions Visa as an enabler rather than a disruptor, and it’s designed to preserve their existing infrastructure while embracing cross-border stablecoins.

The $253 Billion Market Battle

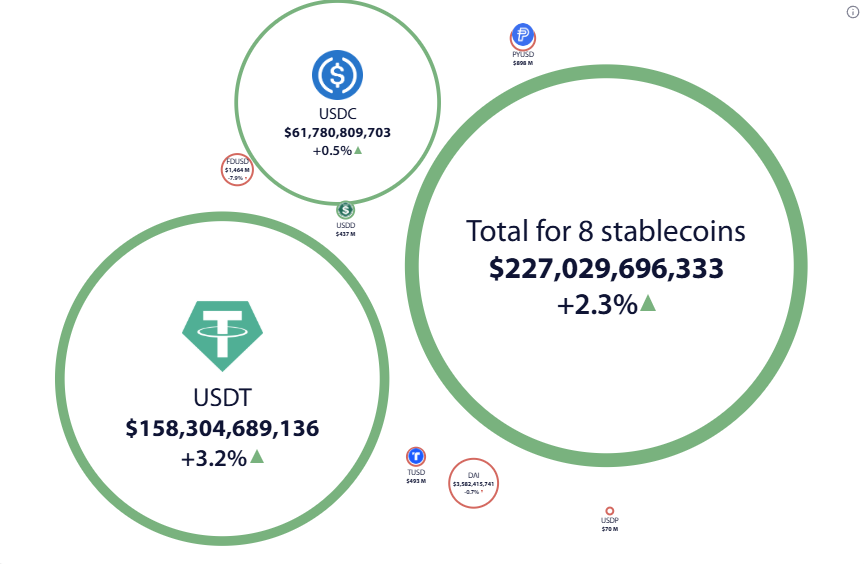

The stablecoin crypto threat has materialized into a $253 billion market that Treasury Secretary Scott Bessent projects could also reach $2 trillion within years. This explosive growth in cross-border stablecoins has created pressure on traditional payment networks, as stablecoin transfers reached $27.6 trillion in 2024, and this actually surpassed Visa and Mastercard’s combined volume.

Both companies are positioning themselves differently in this Visa Mastercard competition. Mastercard’s zero fee crypto card eliminates annual and top-up fees, while Visa focuses on integrating stablecoin payment system capabilities into their existing network infrastructure.

The zero fee crypto card initiative demonstrates how the stablecoin crypto threat reshapes the payments industry, and both Mastercard and Visa position themselves to benefit from rather than let the growing cross-border stablecoins market displace them.