Nvidia (NVDA) Primed for 14% Surge: Why This AI Powerhouse Is a Must-Buy Now

Nvidia’s stock is flashing bullish signals—again. With a projected 14% upside, the AI chip giant remains Wall Street’s favorite rocket fuel.

The AI Engine Isn’t Cooling Off

Demand for Nvidia’s GPUs keeps outstripping supply, and the company’s stranglehold on the AI hardware race shows no signs of loosening. Forget 'overbought'—this is a structural play.

Short-Term Pain, Long-Term Gain

Volatility? Sure. But every dip gets bought aggressively. The Street’s price targets keep creeping higher, and the smart money’s betting on another leg up.

The Cynical Take

Of course, analysts love it now—just wait for the first earnings miss and watch those downgrades pour in. But until then, ride the wave.

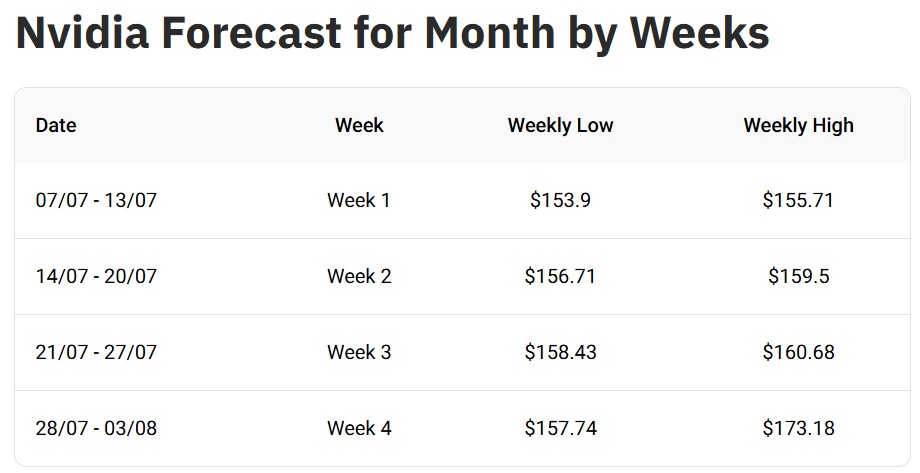

July 2025 Price Target For Nvidia Shares (NVDA): Potential 14% Profits

The latest price prediction for Nvidia shares indicates that it could deliver double-digit profits in July 2025. The recent forecast from the Traders Union indicates that NVDA could reach a high of $173 to $174 by the end of the month. That’s an uptick and return on investment (ROI) of approximately 14% from its current price of $153.

Therefore, an investment of $1,000 could turn into $1,140 if the price prediction turns out to be accurate. That’s Stellar returns in just a month and not every asset can generate double-digit returns in a month. Nvidia shares can be on your must-watch list as the equity is primed for another leg up.

However, the markets need to gear up on July 9 and Trump’s 90-day pause on tariffs comes to an end. If the President decides to continue with the tariffs, Nvidia shares could begin to dip as they did in April. Even if it dips below the $100 mark again, taking an entry position there WOULD be beneficial to your portfolio.