Ripple Lands in Zurich: Webus Doubles Down with $100M XRP Bet as Crypto Adoption Soars

Zurich Airport just became the latest battleground in crypto's real-world expansion—Ripple's payment rails touchdown as Webus throws a nine-figure vote of confidence.

While traditional banks still debate blockchain, the $100M wager screams institutional FOMO. Another 'unbanked' corridor falls as XRP's liquidity play outflanks SWIFT.

Cynics' note: That's 100 million reasons why 'useless casino money' now handles more cross-border volume than some mid-tier banks.

XRP Treasury Strategy: Webus’ $100M Equity Line and Airport Campaign Unveiled

Webus Secures Major XRP Investment Framework

![]() BREAKING:

BREAKING:

NASDAQ-LISTED WEBUS SECURES $100M EQUITY LINE FOR #XRP TREASURY EXPANSION!![]() https://t.co/IfYecZI3Um pic.twitter.com/wKc29jQUju

https://t.co/IfYecZI3Um pic.twitter.com/wKc29jQUju

Webus International has established an XRP $100m equity line specifically designed for treasury expansion purposes, and this arrangement provides the company with flexible access to funds for building their XRP treasury strategy over time. Rather than requiring immediate full capital deployment, companies can now draw funds as needed.

The equity line structure enables Webus International XRP treasury operations to scale systematically while also managing market volatility risks. At the time of writing, this approach allows businesses to time their cryptocurrency purchases strategically rather than making large single transactions all at once.

Ripple Strategy Holdings Gain Airport Visibility

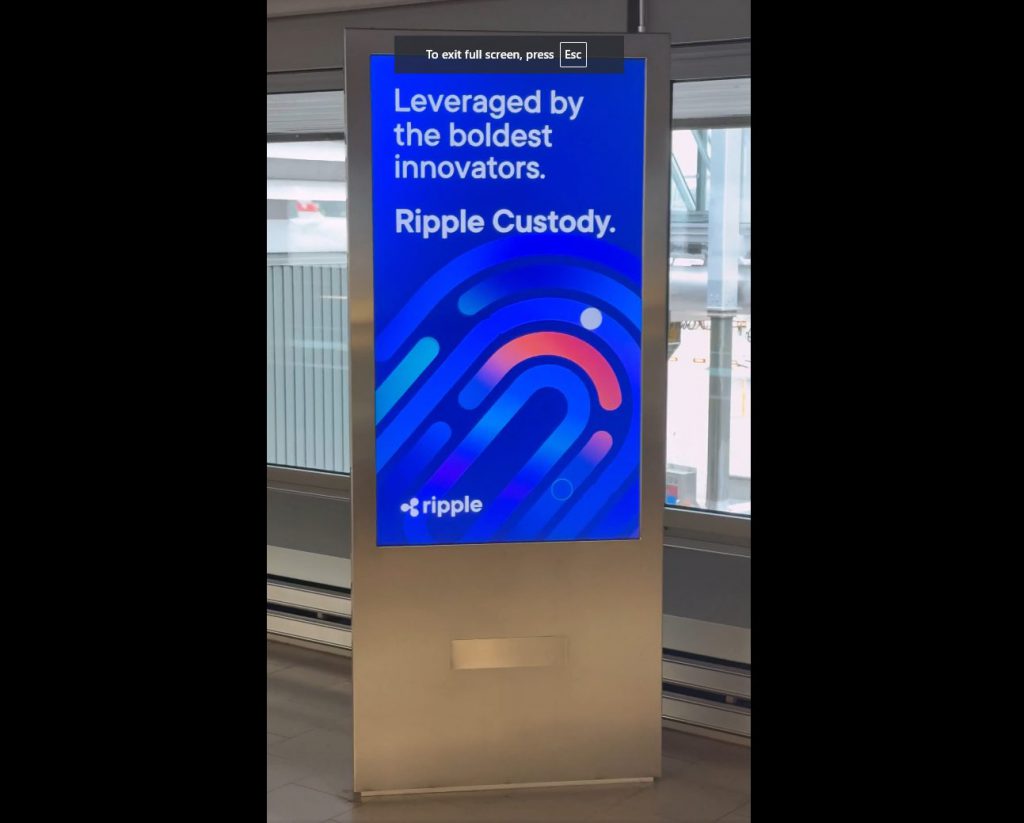

Ripple’s advertising campaign at Zurich Airport targets international business travelers with institutional messaging right now. Thedisplays emphasize enterprise-grade security and also professional services for Ripple strategy holdings.

WOW!![]()

NEW RIPPLE ADVERTISEMENT AT ZURICH AIRPORT!![]()

RIPPLE IS TAKING OVER GLOBALLY!![]() #XRP pic.twitter.com/1QIl7mK2Pa

#XRP pic.twitter.com/1QIl7mK2Pa

Cross-Border Payments Drive Corporate Interest

XRP cross-border payments technology has attracted companies seeking efficient international transaction solutions, and traditional methods often involve high fees and lengthy settlement times. This makes XRP cross-border payments an attractive alternative for businesses like Webus right now.

The combination of Webus International’s XRP treasury strategy and Ripple’s marketing push signals broader corporate adoption of digital assets at the time of writing. This coordinated approach also demonstrates how companies are integrating cryptocurrency infrastructure into their Core financial operations.

Webus International’s $100 million commitment represents one of the largest corporate XRP treasury strategy implementations announced in 2025, and it positions the company to leverage both investment potential and also operational efficiency through XRP cross-border payments capabilities right now.