Corporate Giants Bet Big: $26.2 Billion Bitcoin Splurge by Stock Exchange-Listed Firms in 2025

Wall Street’s latest addiction? Bitcoin—and they’re buying it by the billion.

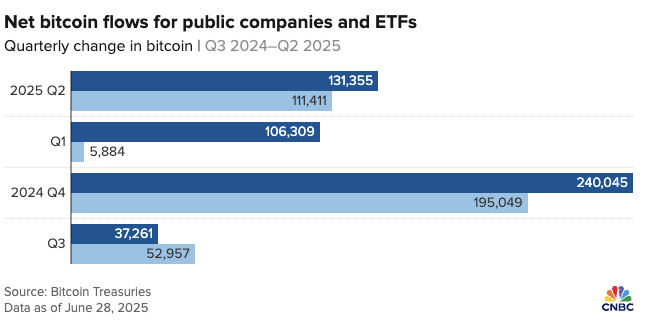

In a move that’d make Satoshi smirk, publicly traded companies just dropped $26.2 billion on BTC this year alone. Forget treasury bonds—this is corporate hedging 2.0, with more volatility and way better cocktail-party talking points.

The institutional floodgates are wide open. What started as Tesla’s side hustle in 2021 has become a full-blown corporate arms race. CFOs who once scoffed at ‘internet money’ now scramble to allocate portions of their balance sheets to digital gold—right before explaining to shareholders why Q2 earnings are ‘unexpectedly dynamic.’

Meanwhile, Bitcoin maximalists nod sagely while traditional finance scrambles to retrofit legacy systems for a asset that never sleeps. The irony? These same institutions spent a decade dismissing crypto as a bubble—now they’re inflating it themselves.

One hedge fund manager quipped (off the record, naturally): ‘We’re not FOMOing—we’re strategically aligning with the future of finance.’ Sure. And that $26.2 billion buy-in? Just a coincidence it happened right before the next halving.

Source: CNBC

Source: CNBC

Public Companies Going All-In On Bitcoin?

BTC seems to be the new obsession among public companies. Many are following Michael Saylor’s Strategy. Strategy is currently the most significant BTC holder among public companies. The firm recently purchased an additional $531 million worth of BTC.

According to Nick Marie, head of research at Ecoinometrics, ““

Public companies may be following a different strategy altogether. They don’t seem to be waiting for a dip. The pro-Bitcoin firms seem to be in a hoarding phase. Marie added, ““

The surge in BTC interest among public companies could be due to President Trump signing an executive order to set up a US bitcoin reserve. Many believe they will be left out of the digital asset race if they do not participate in the accumulation.

May experts anticipate BTC’s price to breach the seven-digit mark this cycle. Binance founder Changpeng Zhao (CZ) is one of the experts who believe BTC will hit somewhere between $500,000 to $1 million this cycle.

The original crypto is currently facing a consolidation phase. We could see another big upswing over the coming weeks.