From $5,459 to $55M: How an Early Ethereum Bet Became a Crypto Jackpot

Talk about hitting the crypto lottery. One early Ethereum investor turned a modest $5,459 gamble into a staggering $55 million windfall—proof that sometimes, the dumbest bets pay off the most.

How? By doing what Wall Street hates most: ignoring 'sensible' investments and backing an unproven blockchain when gas fees were still measured in pennies.

Timing beats talent. While hedge funds were busy overengineering portfolios, this anonymous degen spotted Ethereum's potential during its 2015 infancy—back when even Bitcoin maximalists dismissed it as 'altcoin nonsense.'

Fast-forward a decade, and that 'nonsense' now underpins DeFi, NFTs, and half the speculative garbage clogging your Twitter feed. The ultimate irony? This life-changing ROI came not from some complex trading strategy, but from the one thing finance bros fear most—patiently holding through every crash, scam, and 'Ethereum killer' hype cycle.

So next time your financial advisor scoffs at crypto, remember: the biggest gains go to those who ignore them.

They originally bought 16,800 ETH for ~$5K during Genesis and added another 804 ETH at $459. They have a total profit of over $55M – a 149x return while still… pic.twitter.com/GdBSqOU1IV — Cointelegraph (@Cointelegraph) July 2, 2025

Why is The Investor Selling?

The ETH ICO participant may have been booking profits over the last few years. Turning $5k into more than $55 million is no ordinary feeling. The investor may have thought to liquidate their holdings and live the dream life. In all honesty, what is the point of having all that money if you don’t live a little?

It is also possible that the ETH ICP investor has diversified their portfolio. They may have purchased other assets after selling more than $50 million worth of Ethereum (ETH).

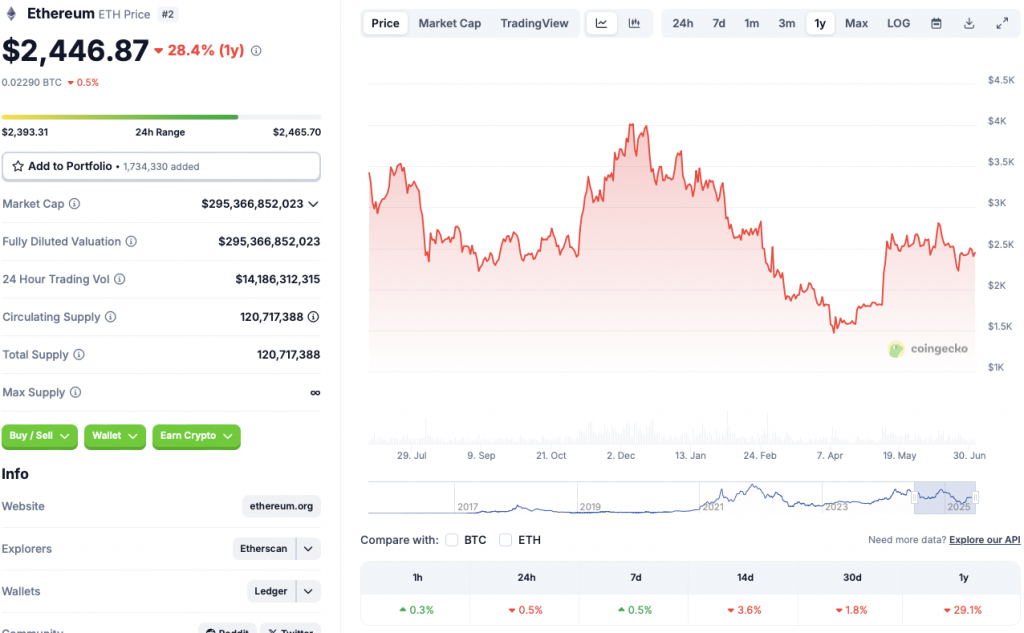

Ethereum Continues To Slump

ETH has struggled to generate momentum over the last few months. The asset last traded above the $3000 mark in early February of this year. ETH currently faces substantial resistance at the $2500 level.

ETH’s price has dipped 0.5% in the last 24 hours, 3.6% in the 14-day charts, 1.8% over the previous month, and 29.1% since July 2024. The second-largest cryptocurrency by market cap has maintained a 0.5% gain over the last week.

ETH has seen consistent institutional inflows for its spot ETF. The inflows have not been enough to propel the asset’s price north of $2500. Bitcoin (BTC) has also seen weeks of consecutive institutional inflows. BTC, on the other hand, has been more successful with a price rally.

The crypto market seems to be consolidating at the moment. BTC is facing resistance at $108,000. BTC’s consolidation may have caused the market to slow down.