Vanadi Coffee Stock Skyrockets 242% Following Bold €1.1B Bitcoin Treasury Move

Talk about a caffeine kick—Vanadi Coffee just jolted the market with a Bitcoin-backed adrenaline shot.

When traditional finance meets crypto chaos

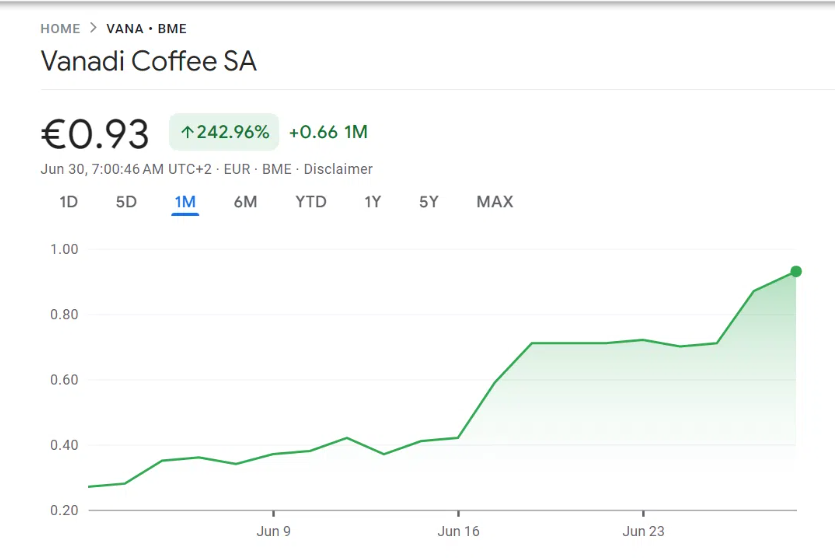

The specialty coffee chain saw shares surge 242% after announcing plans to allocate €1.1 billion—roughly half its market cap—to Bitcoin treasury reserves. Wall Street analysts scrambled to adjust price targets while crypto Twitter erupted in memes about 'decaf vs. decentralized finance.'

Risk-on flavor profile

The aggressive move mirrors MicroStrategy's playbook, swapping conservative cash management for volatile digital assets. 'Either they've discovered the holy grail of corporate treasury management,' quipped one fund manager, 'or this is the most expensive marketing stunt since WeWork's IPO.'

Market mechanics brewing

Short sellers got steamrolled as the announcement triggered a gamma squeeze—proving once again that in 2025's market, fundamentals take a backseat to crypto narrative alchemy. The stock now trades at 38 times revenue, making even Tesla's valuation look sober.

Wake up and smell the volatility—this is what happens when companies chase the crypto premium while traditional investors still can't spell 'Satoshi.'

Vanadi Coffee official company document – Source: bmegrowth.es

Vanadi Coffee official company document – Source: bmegrowth.es

Vanadi Coffee Bitcoin Treasury Plan Drives Stock Surge Amid Market Volatility

The Vanadi Coffee bitcoin treasury plan was unanimously approved by shareholders on June 29, 2025, and it authorized the board to pursue Bitcoin investment risks worth up to €1 billion. This ambitious strategy aims to transform the struggling Alicante-based coffee chain into Spain’s largest Bitcoin-holding company, despite reporting €3.3 million in losses during 2024, which represents an increase of 15.8% from the previous year.

The company has already purchased 54 BTC valued at approximately €5.8 million, with assets held in custody by Bit2Me exchange. The Vanadi Coffee stock surge demonstrates how cryptocurrency market volatility can create dramatic price movements when companies announce Bitcoin treasury strategies, and also shows investor appetite for such moves.

Financial Strategy Shift Drives Bitcoin Investment

Chairman Salvador Martí leads this transformation of the Vanadi Coffee Bitcoin treasury approach, and he seeks to replicate successful models from companies like Strategy and also Metaplanet. The Bitcoin treasury plan represents a calculated response to mounting financial pressures and rising operational costs that have been affecting the business.

The company stated:

Andrew Bailey, senior fellow at the Bitcoin Policy Institute, expressed skepticism about the strategy and had this to say:

The Vanadi Coffee stock surge reflects broader market enthusiasm for Bitcoin investment risks, though critics warn about the scale of ambition relative to the company’s six-location operations. Directors received authorization to increase capital by 50% and also negotiate convertible debt financing, which could potentially dilute existing shareholders while pursuing the ambitious cryptocurrency market volatility strategy.

Despite financial struggles, the Vanadi Coffee Bitcoin treasury plan positions the company at the forefront of corporate cryptocurrency adoption in Spain right now, though success remains uncertain given the inherent Bitcoin investment risks and also ongoing cryptocurrency market volatility challenges facing the digital asset space at the time of writing.