Metaplanet Doubles Down: $208M Bond Raise to Fuel Bitcoin Buying Spree

Tokyo-listed Metaplanet just made its boldest bet yet on Bitcoin—issuing a staggering $208 million in bonds to load up on more BTC. Because when traditional finance crumbles, why not pivot to digital gold?

The move signals a radical corporate treasury shift as companies worldwide flirt with crypto reserves. Metaplanet’s play? Swap yen for Satoshis while Japan’s negative rates make borrowing cheaper than a konbini coffee.

Critics call it reckless. Bulls see genius—leveraging debt to chase an asset that’s outperformed every central bank currency this decade. Either way, the market’s watching: will this trigger a wave of copycats, or end up as another cautionary tale in crypto’s volatile lore?

One thing’s certain: in a world where ‘trustless’ beats ‘too big to fail,’ Metaplanet just wrote the playbook for corporate Bitcoin maximalism. Now we wait to see if the balance sheet bleeds… or moons.

Metaplanet Goes All In On Bitcoin

Institutions around the world seem to be hoarding BTC. BTC-based ETFs saw inflows of $2.22 billion from June 23 to June 27. The consistent purchases by institutions are a testament to the growing demand for BTC products.

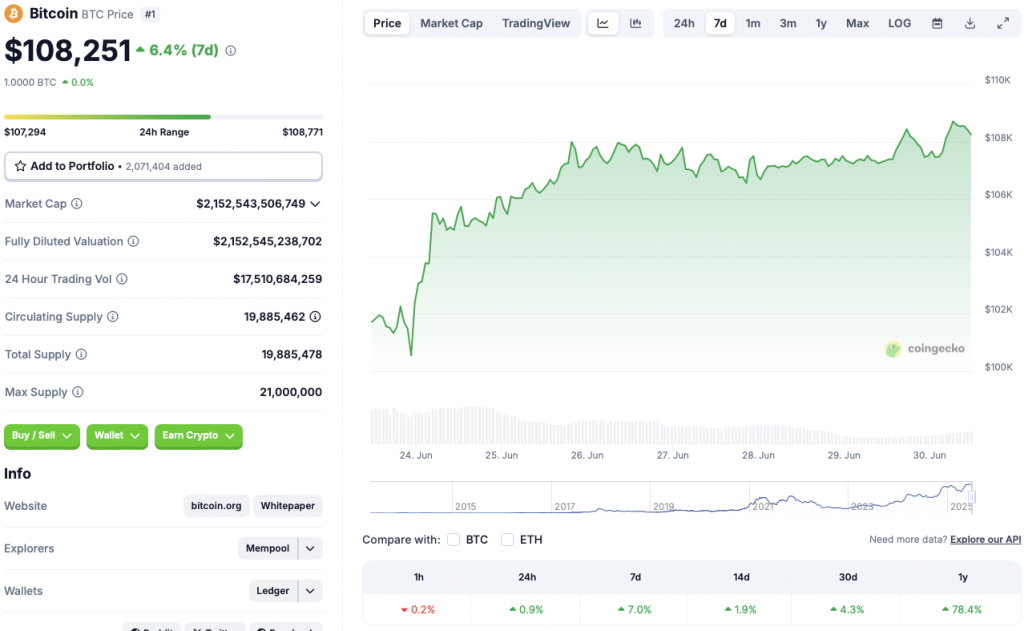

The growing bitcoin (BTC) purchases align with the asset’s recent resurgence. BTC has reclaimed the $108,000 price level after the recent crash. BTC is trading in the green zone across all time frames. The asset is up 0.9% in the daily charts, 7% in the weekly charts, 1.9% in the 14-day charts, 4.3% over the previous month, and 78.4% since late June 2024.

New All-Time High Around The Corner?

The original crypto is currently down by just 3.2% from its all-time high of $111,814. If BTC continues its current growth pattern, it could hit a new peak very soon.

The crypto market faced considerable volatility in June due to trade wars and global geopolitical tensions. Both factors seem to be easing off. The European Union has said it is open to a new trade deal with the US. The Iran-Israel conflict has also seen rapid de-escalation. The developments could help BTC rise to a new high.

One bearish factor is the Federal Reserve’s decision to keep interest rates unchanged. President TRUMP has pushed for a rate cut from the Fed. However, we may not see a dip in interest rates anytime soon.