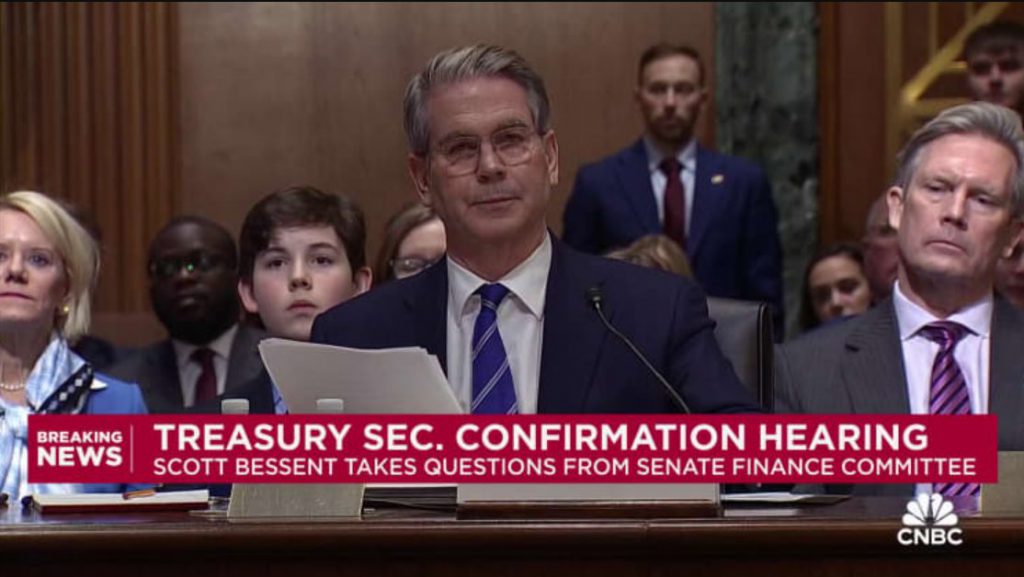

Trump’s Treasury Nominee Rejects Digital Dollar: What It Means for Crypto

Treasury nominee Scott Bessent took a firm stance against CBDCs. This happened at Thursday’s Senate hearing. He said that he can seefor a U.S. digital dollar. This matches President-elect Trump’s promises and points to changes in U.S. crypto policy.

CBDC (Digital Money): What It Means for Crypto Investors

Breaking with Current Policy

Federal plans support CBDCs. The treasury nominee CBDC stance goes against this support. The Federal Reserve started looking at digital dollar plans in 2021. Treasury Secretary Janet Yellen supports this research. But Bessent has some different thoughts.

” he told the Senate.

Global Context and U.S. Situation

134 out of the countries of the world make up roughly 98% of global GDP and are exploring multiple CBDC options. Some analysts suggest Bessent’s stance hints at a U.S. policy shift.

While China tested its digital yuan at the 2022 Olympics, Federal Reserve Chair Jerome Powell noted in August that the U.S. has “nothing new” on CBDCs.

Crypto Community Response

Various experts note the treasury nominee CBDC rejection matches certain crypto industry concerns about surveillance. Ethereum co-founder Vitalik Buterin changed his view, saying he” Several observers indicate this reflects wider concerns about government control through digital currencies.

Legislative Momentum

Many Republicans opposed CBDCs by passing the Anti-Surveillance State Act in May 2024. This law limits quite a few Federal Reserve banks from issuing digital currencies. Sources say the digital dollar debate grew after Biden’s March 2022 order called forCBDCs.

What’s Next?

Multiple analysts suggest that if approved as Treasury Secretary, Bessent’s central bank digital currency views could reshape U.S. crypto policy. The treasury nominee CBDC position follows Trump’s November 2024 promise toa U.S. digital dollar, indicating a potential new direction in the federal cryptocurrency approach.