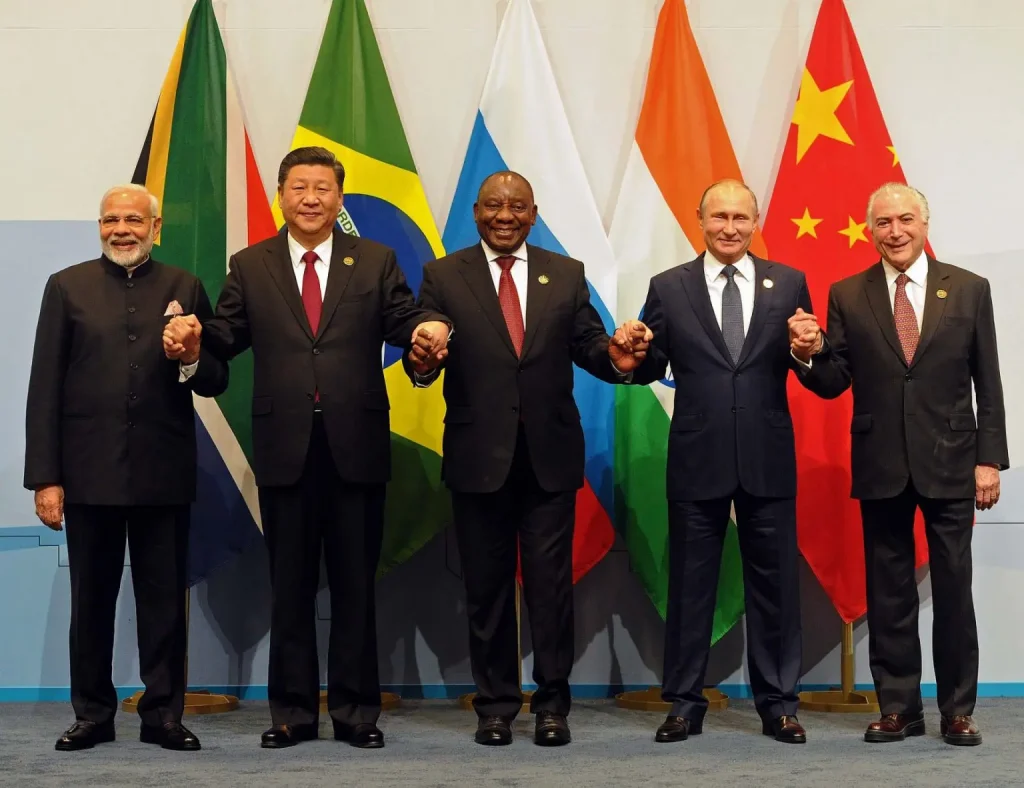

BRICS’ De-Dollarization Push: Overhyped or Underdelivered?

The BRICS bloc's grand plan to dethrone the dollar? More smoke than fire.

Goldbugs and geopoliticians take note

Five nations controlling 40% of global GDP should've moved the needle by now. Instead, dollar-denominated trade volumes actually grew 3% last quarter—despite all the 'alternative payment system' press releases.

Petroyuan? More like petty yuan

China's much-touted oil contracts in yuan account for less than 6% of global crude trades. Even Putin's forced ruble payments for gas evaporated faster than a shitcoin rug pull.

The cold hard truth

Until BRICS members stop hoarding USD reserves (still 65% of their combined war chest) and actually settle trades in local currencies, this 'revolt' looks like another hedge fund manager's empty promise—loud at conferences, quiet in the vault.

De-Dollarization Is Heavily Exaggerated by BRICS: Here’s Why

Around 88% of all global forex transactions involve the US dollar and that’s a huge number to be replaced or brought down. The dollar also accounts for 58–60% of global reserves, which is far ahead of any BRICS member’s local currency. 50% of global trade is settled in the USD, even between countries outside America and the West as a whole. Therefore, BRICS claiming that it has penetrated its hegemony through de-dollarization is nothing but a farce.

But that’s an average day in the developing world as a smokescreen FORM of politics is the norm. People are unable to differentiate between reality and exaggeration as the quest to come out on top is immeasurable. While BRICS has made several symbolic moves to take on the US dollar, the de-dollarization agenda will not cause a dent in the greenback’s prospects. Even if it does, there is no viable alternative currency available in the market to replace the US dollar.