Breaking: Judge Slams Door on Ripple and SEC’s Bid to Fast-Track XRP Lawsuit Resolution

A federal judge just threw cold water on Ripple Labs and the SEC’s joint plea to wrap up their marathon legal battle over XRP’s regulatory status. The courtroom showdown continues—much to the delight of crypto drama addicts.

No quick exits here. Both parties must now grind through the full legal process, proving once again that when regulators and crypto clash, the only winners are the lawyers billing by the hour.

XRP holders left hanging. With no early resolution in sight, the token’s fate remains tethered to a case that’s become the legal equivalent of a proof-of-work blockchain—slow, expensive, and environmentally unfriendly.

Final thought: Maybe next time, the SEC should try settling during a bull run—it’d be cheaper than paying attorneys through a multi-year crypto winter.

Crypto Markets React As Torres Blocks Settlement In Historic Ruling

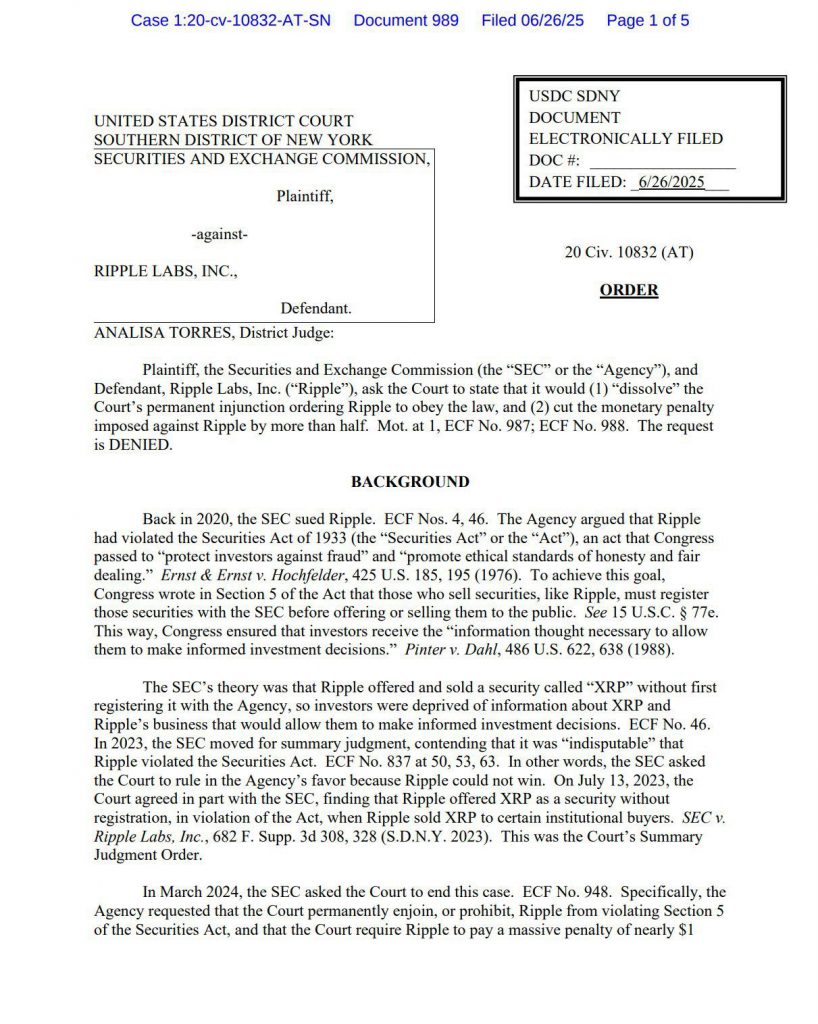

The judge denies Ripple SEC motion through an official court order dated June 26, 2025. Both SEC and Ripple Labs had filed a joint motion asking the court to provide guidance on dissolving the permanent injunction, and also reducing monetary penalties.

Torres’ Official Ruling Details

Judge denies Ripple SEC request in a straightforward order that closes the door on early resolution. The court’s decision means the lawsuit will proceed through standard legal channels rather than expedited procedures.

The court document states in its conclusion section:

This Ripple settlement rejected outcome was filed at ECF No. 987, and the court has officially terminated this particular motion from the case docket at the time of writing.

Background of the Legal Battle

The SEC sued Ripple back in 2020, claiming the company violated securities laws by selling XRP tokens without proper registration. The agency argued that Ripple offered XRP as an unregistered security, which deprived investors of information needed for informed decisions.

The case reached a significant point when the court previously ruled that Ripple’s institutional XRP sales violated securities laws, while programmatic sales to retail investors through exchanges didn’t constitute securities offerings. This Torres court ruling XRP partial victory was seen as important for cryptocurrency regulation.

What This Means Moving Forward

This crypto regulation news development extends the regulatory uncertainty period that has characterized the digital asset sector. The judge denies Ripple SEC motion for expedited resolution, and this means both parties must continue preparing for potential trial proceedings.

With this XRP lawsuit update 2025 decision, questions about permanent injunctions and monetary penalties remain unresolved. The Ripple settlement rejected ruling shows the court’s preference for thorough legal procedures over fast-tracked resolutions.

The Torres court ruling XRP approach ensures comprehensive consideration of all arguments before final determinations. This methodical process may provide clearer guidance for the cryptocurrency industry, though it extends the timeline for resolving this landmark case.

Right now, digital asset markets continue monitoring these proceedings as they influence how cryptocurrencies are classified and regulated. The case has already provided some clarity regarding different token sale types, but significant questions about compliance requirements and remedies remain unanswered.