BREAKING: White House Confirms US Govt Bitcoin Accumulation Strategy – Here’s What You Need to Know

The US government is quietly stacking sats—and they’re not hiding it anymore.

The Backroom Bitcoin Play

A senior White House official just tipped their hand: Washington’s got a deliberate BTC accumulation plan. No vague statements—just cold, hard hodl strategy from the world’s most powerful treasury.

Why This Changes Everything

When the issuer of the global reserve currency starts treating Bitcoin like a strategic asset, the ‘magic internet money’ narrative dies. This is institutional adoption on steroids—with the printing press operator buying the antidote.

The Cynic’s Corner

Of course they’re accumulating. After inflating away 30% of the dollar’s purchasing power since 2020, they need something that can’t be CTRL+P’d into oblivion. How’s that for financial irony?

One thing’s clear: the game changed today. The only question left—how many zeros get added before Wall Street’s dinosaurs finish their coffee?

Bitcoin Gains Momentum Amid Market Rebound

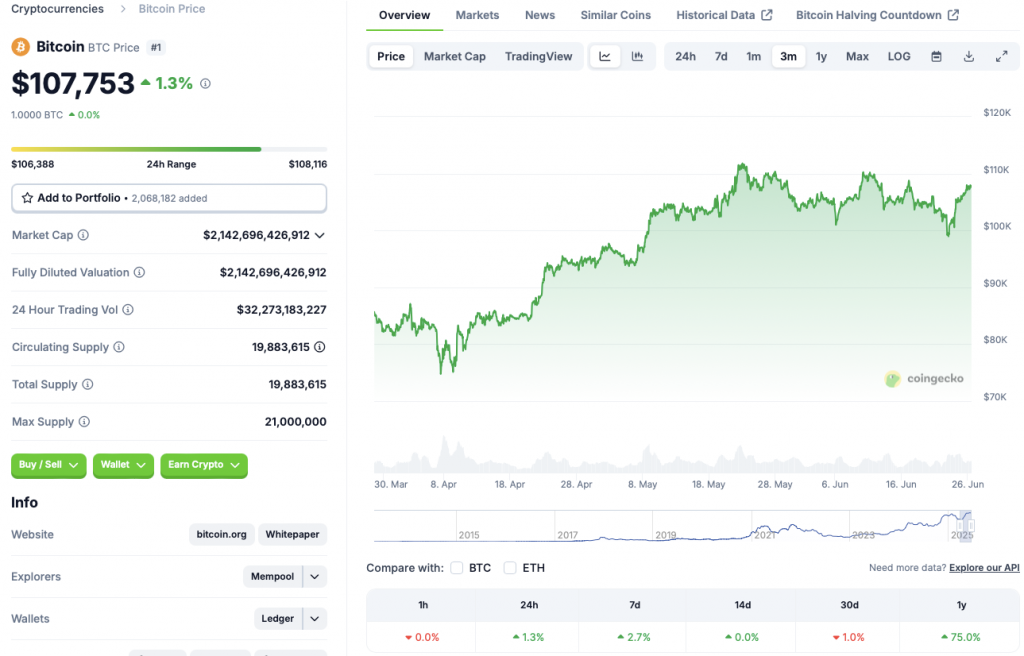

The cryptocurrency market faced a steep correction last week after an escalation in the Israel-Iran conflict. BTC’s price fell to below $99,000 on June 23 for the first time since early May. The Federal Reserve keeping interest rates the same may have also added to the dip in investor sentiment.

Bitcoin (BTC) has since made significant gains. The original crypto has reclaimed the $107,000 mark and is inching closer to $108,000. The asset is up 1.3% in the daily charts, 2.7% in the weekly charts, and 75% since June 2024. BTC is still down by 1% over the last month. The number one crypto project by market cap is down by just 3.6% from its all-time high of $111,814.

The market resurgence is likely due to the de-escalation in the Middle East conflict. The possibility of peace talks has led to a substantial rise in investor confidence. The WHITE House’s bullish comment may further elevate investor sentiment.

Bitcoin (BTC) has seen continuous inflows from financial institutions. BTC-based ETFs have seen consistent buys despite the recent volatility. Retail investors have played a smaller role in this cycle so far. A surge in retail money could lead to another bullish outbreak.

If the inflows continue, BTC could easily rise to a new all-time high. BTC hitting a new peak will likely trigger a market-wide rally. The scenario could bring much-needed fresh air to the crypto industry.

There is also a possibility that BTC will face a correction if market conditions slump. Global geopolitical tensions and trade wars could prevent a market-wide rally.