Moscow Exchange’s Bitcoin Futures Surge to 7B Rubles – New Index Fuels Expansion

Russia's financial heavyweights just doubled down on crypto—whether regulators like it or not.

Moscow Exchange's Bitcoin futures market smashed 7 billion rubles in volume, proving institutional demand survives even under economic sanctions. The kicker? A freshly launched index expands access while dodging Western scrutiny.

Behind the numbers: Traders are bypassing traditional finance's roadblocks with Kremlin-approved instruments. The new index bundles crypto prices from 'friendly' jurisdictions—because nothing screams decentralization like geopolitical arbitrage.

One cynical take: When your fiat currency loses 30% annually, a volatile asset starts looking stable. Ruble-denominated Bitcoin futures? Now that's a hedge even Soviet-era central planners couldn't invent.

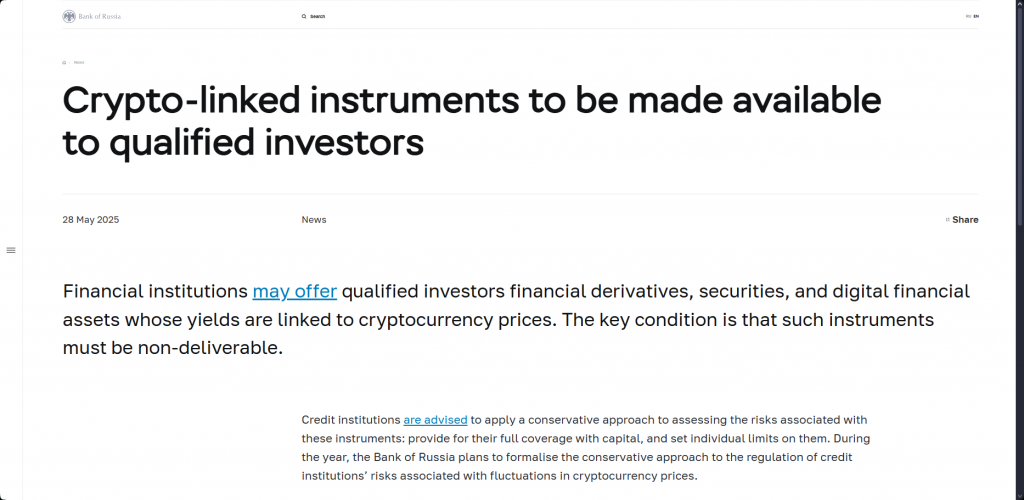

Bank of Russia crypto regulation announcement – Source: CBR.ru

Bank of Russia crypto regulation announcement – Source: CBR.ru

Moscow Exchange Crypto Futures Surge Amid Index Launch, New Rules

The Moscow Exchange Bitcoin futures contracts, which were launched on June 4, also generated 420 million rubles on their first trading day alone. Managing Director Vladimir Krekoten had this to say:

Bitcoin Index Trading Powers New Growth

The Moscow Exchange bitcoin futures utilize the platform’s new Moscow Exchange PFI Bitcoin Index (MOEXBTC), which has been calculated since June 10. This Bitcoin index trading system underlies the second crypto offering from MOEX, and it follows their BlackRock Bitcoin ETF futures launch. The crypto futures Russia market expansion demonstrates strong institutional demand for regulated digital asset exposure right now.

Regulatory Framework Shapes Moscow Exchange Crypto Access

The Bank of Russia will allow limited cryptocurrency purchases for investors! This decision could signal a shift in the country's stance on crypto. #Crypto #Bitcoin

Regulations are still in progress, but this move could have a global impact on the cryptocurrency market. pic.twitter.com/vKjhUKF1Mh

Access to Moscow Exchange Bitcoin futures remains limited to highly qualified investors under Russian crypto regulation at this time. The Bank of Russia’s experimental legal regime requires 100 million rubles in securities or deposits, and also 50 million rubles annual income. This framework ensures Bitcoin index trading occurs within controlled parameters while expanding crypto futures Russia opportunities for institutional participants.

The success of Moscow Exchange in the trading of Bitcoin futures with the volume of 7 billion rubles makes Russia a key non-retrospective player in the trading of regulated cryptocurrency derivatives at the moment. The Bitcoin index trading platform on the exchange and its growing crypto futures Russia products indicate how Russian crypto regulation can liberalize institutional exposure to digital assets over time, but with severe control of Moscow exchange crypto, as at the time of writing.