Cardone Capital Doubles Down: $101M Bitcoin Bet Paves Way for 3,000 BTC Acquisition Spree

Wall Street's latest love affair with Bitcoin just got hotter. Cardone Capital—the investment firm that once scoffed at crypto—just dropped a $101 million bombshell purchase, signaling a potential 3,000 BTC shopping spree. Guess even boomer funds need FOMO therapy.

Why the sudden appetite? While traditional finance still debates Bitcoin's 'tulip status,' Cardone's move screams institutional FOMO. The firm's pivot from real estate to digital gold mirrors BlackRock's ETF rush—except with fewer compliance headaches and more alpha potential.

Market whales smell blood. With this buy-in, Cardone joins the ranks of corporate treasuries hedging against dollar decay. Their next 3,000 BTC target? A drop in the ocean compared to MicroStrategy's hoard—but enough to make retail bagholders weep into their Coinbase apps.

Cynical take: Nothing cures a bear market like suit-and-tie money finally reading the Satoshi whitepaper. Welcome to the party, Wall Street—the volatility's brutal, but the exit liquidity's delicious.

Cardone Capital’s Bitcoin Growth Plan Amid Market Volatility And Accumulation Strategy

Historic Bitcoin Integration Strategy

Cardone Capital’s Bitcoin holdings now include 1,000 BTC worth approximately $101 million, making it the first real estate/BTC company to achieve full Bitcoin strategy integration. This institutional Bitcoin buying decision combines traditional property investments with digital assets in an unprecedented way.

Grant Cardone stated:

The company’s large bitcoin purchase reflects growing confidence in cryptocurrency’s role within traditional investment portfolios, despite ongoing Bitcoin market volatility concerns.

Ambitious Expansion Plans

The Cardone Capital Bitcoin strategy extends far beyond the initial investment. The company has announced plans for significant growth across both digital and physical assets.

Grant Cardone had this to say:

This Bitcoin stacking strategy shows that the company is ready to increase its stock of cryptocurrencies and still concentrating on real estates development. This institutional bitcoin purchasing method makes Cardone Capital one of the Gold standards of a hybrid investment strategy.

Market Impact and Future Outlook

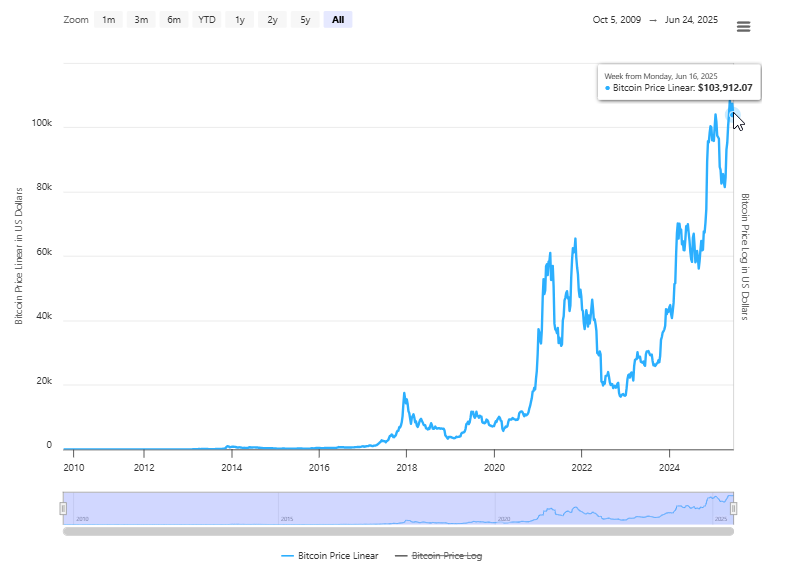

The Cardone Capital Bitcoin announcement has generated significant attention within both real estate and cryptocurrency sectors. This large Bitcoin purchase comes at a time when Bitcoin market volatility has created both opportunities and challenges for institutional investors.

The Bitcoin accumulation strategy carried by the company is not simply a diversification strategy rather it is a radical change in terms of the traditional business position to the digital asset integration context. Cardone Capital is bringing together a new institutional model of purchasing Bitcoin by integrating real estate knowledge and cryptocurrency investments.

The success of this Cardone Capital Bitcoin strategy could influence other real estate companies to consider similar moves, potentially accelerating institutional Bitcoin buying across the sector despite Bitcoin market volatility concerns.