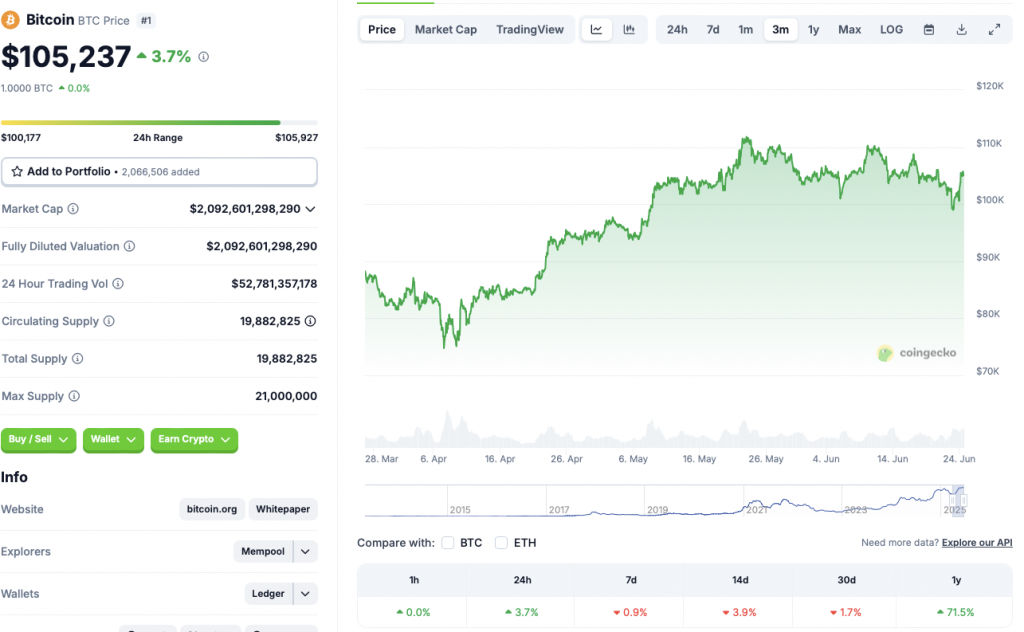

Fidelity’s $105M Bitcoin Bet Ignites 3.7% Price Rally—Institutional Bulls Are Back

Wall Street's crypto winter just got a surprise heatwave.

Fidelity drops $105 million into Bitcoin—and the market responds with a 3.7% surge. Traders scramble as the OG cryptocurrency shakes off its sideways slump.

Institutional whales making moves? Check. Price action? Check. The only thing missing? Your average hedge fund manager pretending they saw this coming all along.

Source: CoinGecko

Source: CoinGecko

Cryptocurrencies Recover Amid Potential Peace Talks

The cryptocurrency market faced a big correction after the US launched its attack on three Iranian nuclear sites. Many feared an all-out war between the two countries. Iran already faces Western sanctions. A potential war with the US may cause severe strain on the global economy. Bitcoin (BTC) and other crypto assets saw big liquidations as investors lowered exposure to risky assets.

The crypto market is showing signs of a recovery after President Trump hinted at possible peace talks between the two countries. BTC could see a continued rally if the talks are successful.

The market dip may have also been triggered by the Federal Reserve deciding to keep interest rates unchanged. A rate cut may have led to more investments in risky assets.

Will Bitcoin Keep Rallying?

There has been an increase in institutional inflows into BTC over the last few weeks. BTC-based ETFs have seen continued inflows despite global geopolitical tensions. Retail investors are likely sitting the rally out.

If peace is brokered in the Middle East, retail investors may display a surge in sentiment. The move could lead to increased retail money flowing into the crypto market. Such a scenario could lead to Bitcoin (BTC) breaching its previous peak of $111,814.