$1 Billion Mega-Merger: US Investor Unleashes Bitcoin Treasury Juggernaut

Wall Street meets blockchain in a seismic power play.

The New Whale in the Room

A $1 billion merger just birthed a Bitcoin treasury heavyweight—one that could shake corporate balance sheets and ETF markets alike. The deal combines deep-pocketed institutional firepower with laser focus on BTC as a reserve asset.

Why It Breaks the Mold

Forget MicroStrategy’s slow accumulation—this is a shock-and-awe deployment of capital. The move signals institutional players are done dipping toes in crypto; they’re now diving in headfirst.

The Cynic’s Corner

Because nothing says ‘mature asset class’ like nine-figure bets that still give traditional CFOs night sweats. Happy volatility, folks.

Bitcoin treasury merger announcement – Source: GlobalNewsWire

Bitcoin treasury merger announcement – Source: GlobalNewsWire

Bitcoin Treasury Merger Sparks Institutional Crypto Adoption Boom

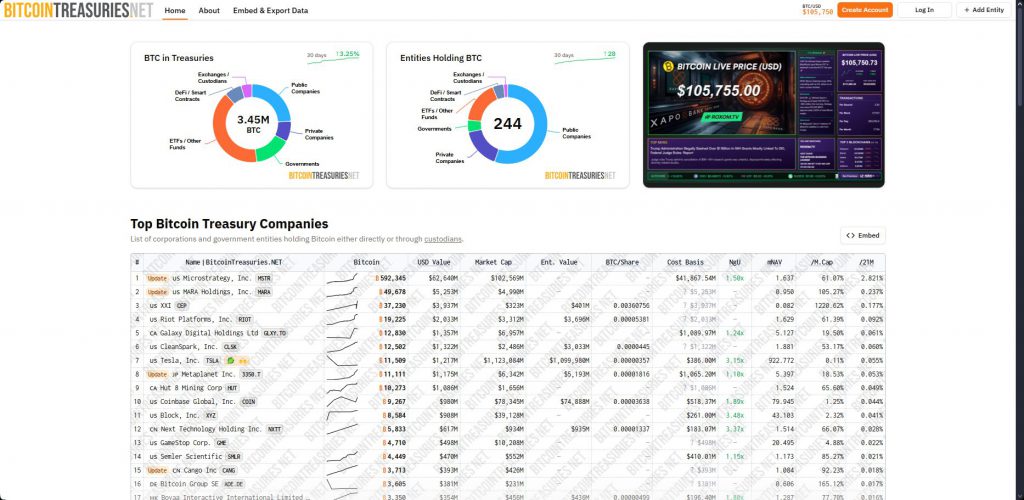

The Bitcoin treasury merger follows MicroStrategy’s successful model, which holds over $63 billion in bitcoin right now. This institutional crypto adoption trend demonstrates how companies are implementing Bitcoin investment strategy approaches tothat continue to persist.

Pompliano stated:

Today I am announcing a $1 BILLION merger to create ProCap Financial, a bitcoin-native financial services.

The company will be a publicly traded entity on Nasdaq at the conclusion of the proposed business combination between my private company ProCap BTC, LLC and Columbus Circle…

![]()

Revolutionary Revenue Generation Model

As opposed to other traditional bitcoin treasury companies,as well. The crypto treasury management model is a valuable consideration in that it manages the challenge of market volatility by generating opportunities to generate multiple revenue streams that are not merely due to an appreciation in the value of bitcoin.

Pompliano had this to say:

Major Institutional Backing

, including commitments from. Crypto-focused firms such asalso participated in this bitcoin treasury merger, signaling strong institutional crypto adoption confidence at the time of writing.

Strategic Market Timing

This Bitcoin investment strategy emerges as President Trump seeks cryptocurrency policy reforms, including establishing a strategic bitcoin reserve. The timing supports growing crypto treasury management acceptance among traditional financial institutions, and it addresses previous regulatory uncertainty concerns that have been persistent.

The bitcoin treasury merger could accelerate similar deals, with ProCap Financial’s active management model demonstrating sustainable revenue generation from bitcoin holdings. This institutional crypto adoption milestone may encourage more corporations to explore Bitcoin investment strategy options, particularly as inflation concerns persist and continue to influence decision-making.

This one billion dollar crypto transaction is an upward movement towards the wider acceptance of crypto treasury management procedures and it possibly establishes new principles in bitcoin treasury merger transactions in the current cryptocurrency market today.