BREAKING: Every U.S. Bank Rushes to Launch Stablecoins Post-GENIUS Act Frenzy – Alchemy CTO Drops Bombshell

Wall Street's latest gold rush? Turning vaults into blockchain nodes. The GENIUS Act just flipped traditional finance on its head—and banks are scrambling to mint their own digital dollars before the music stops.

Here's why your neighborhood bank teller might soon be a DeFi wizard.

• No more 'innovation theater'—legacy institutions are finally being forced to put real skin in the crypto game

• The great stablecoin land grab begins (with FDIC insurance as the ultimate rug pull)

• How Jamie Dimon's worst nightmare became his board's mandatory KPIs

One cynical prediction? These bank-issued stablecoins will have more fine print than a subprime mortgage—but hey, at least the APY beats your 0.01% savings account.

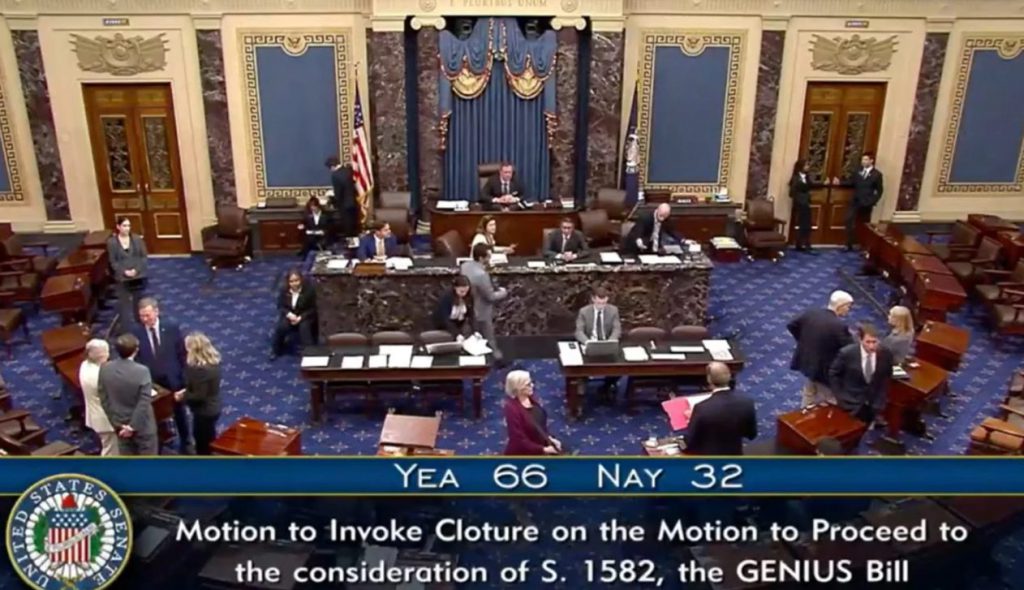

GENIUS Act Senate voting – Source: CryptoBriefing

GENIUS Act Senate voting – Source: CryptoBriefing

Bank‑Issued Stablecoin Trends & Blockchain Adoption Post‑Genius Act

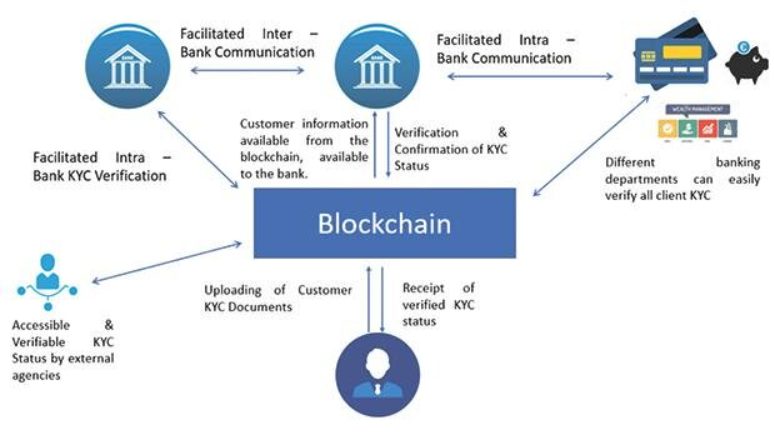

Until now, major banks held back from entering the stablecoin market, waiting for clear GENIUS Act stablecoin regulation that the new bill addresses. Alchemy CTO insight reveals significant revenue opportunities for financial institutions entering this space.

Poncin stated:

The stablecoin regulation senate framework enables banks to offer clients instant settlement, 24/7 availability, and programmable money backed by traditional banking trust. Bank blockchain adoption will accelerate as institutions recognize these competitive advantages.

Market Competition and Infrastructure Choices

Existing stablecoin issuers like Circle and Tether won’t be displaced by bank-issued stablecoin competition, according to Alchemy CTO insight. Different market segments will emerge for specialized players.

Poncin explained:

Bank blockchain adoption will favor layer-2 networks for retail applications due to cost efficiency, while layer-1 networks suit large-scale B2B transactions requiring maximum security.

The GENIUS Act stablecoin regulation creates unprecedented opportunities for traditional finance to integrate blockchain technology seamlessly. With regulatory clarity clearily established right now, banks are ready to start their shifting from asking “” to “” regarding stablecoin implementation.