US Dollar in Crisis? 6-Month Forecast Reveals Make-or-Break Levels After Hitting 3-Year Low

The greenback''s looking greener than ever—and not in a good way. Fresh off a 3-year low, the USD''s next moves could redefine global markets. Here''s what traders are scrambling to watch.

The floor is lava

Key support levels evaporated faster than a DeFi rug pull. If bulls can''t defend these next technical zones, we might witness a dollar dump that''d make emerging markets cheer (while Wall Street bankers ''reassess their positions'' over martinis).

Inflation''s hangover hits hard

The Fed''s ''transitory'' narrative now looks as outdated as a 2017 ICO whitepaper. With real yields sinking and debt ceilings looming, the dollar''s becoming the ultimate contrarian bet—just as crypto maximalists predicted.

The cynical take

Watch institutional analysts suddenly discover ''the benefits of diversification'' when their USD-denominated bonuses start shrinking. Meanwhile, Bitcoin''s sitting pretty at 20% monthly gains—but hey, fiat''s totally stable, right?

Source: Bank of International Settlements

Source: Bank of International Settlements

How Slowing Growth, Inflation & Rates Impact USD Outlook

Critical Support Levels Define US Dollar Forecast Next 6 Months

There are two major levels according to the technicals that have the potential of giving the US dollar forecast next 6 months track and where traders are watching worldwide. A significant test can be seen when it reaches the level of 95 as there WOULD be a lot of support achieved.

Prior to that, though, a more severe decrease to 90 could be the next step in case this is not sustainable, which would be the no-man land that had been witnessed at the times of pandemic. It shows a fact that there is an overlying resistance of 101 and 107 to any recovery efforts by the USD index. The dollar bulls will face massive difficulties in duelling above the levels and the sell pressure will become strong at the areas. Here is where the technical view of the US greenback is getting bleaker and bleaker.

Fed Rate Cuts 2025 Reshape Currency Outlook

The stand adopted by the Federal Reserve has become even weaker since expectations among market players regarding Fed rate cuts are growing as quick as 2025. Arguably, recent policy indecisiveness and the continuing tussle between Israel and Iran constitute other reasons why the monetary standstill should continue to be extended at a number of succeeding meetings.

The pricing of the market derivatives suggests that there is a lot of easing that will take place in March-June 2026, and this is when Jerome Powell will be leaving his term. The inflation outlook is quite volatile as the rise in oil prices can put upward the gasoline prices by 17 percent and the US inflation gained speed of 3.2 percent till June. These inflationary forces are limiting the choices of the Fed at the point of writing and seeing it unable to take action as aggressively.

Major Banks Sound Alarm on Dollar Weakness

Wall Street consensus has turned decidedly bearish on the US dollar forecast next 6 months, and the warnings are becoming more frequent. Morgan Stanley strategists stated:

The bank projects a 9% decline to 91 by mid-2026, which would extend the current weakness significantly. JPMorgan strategists noted concerning divergence trends:

This divergence is creating structural headwinds for the dollar, and the USD index prediction from these major institutions suggests more pain ahead.

De-Dollarization Trends Accelerate Global Shift

The de-dollarization trend continues gaining momentum as currency realignment accelerates globally, and this shift is becoming more pronounced. The euro could rise to 1.25 by 2026 from current 1.13 levels, while the yen may strengthen from 143 to 130 per dollar. These moves would represent significant shifts in global currency dynamics.

Economic policy analysis reveals structural challenges ahead for the US dollar forecast next 6 months.

The administration in the US has planned to raise the proportion of exports to the GDP, which is now between 10-12 %. This will be with an aim of narrowing the trade deficit. But with the decline of US dollar, this has contributed to various concerns that has made Fed have a second thought of the future.

The persistent 4.2% GDP trade deficit creates ongoing pressure that could overwhelm shorter-term supports. Technical indicators suggest the de-dollarization trend will continue pressuring the greenback through 2025, and right now, there’s little sign of this trend reversing.

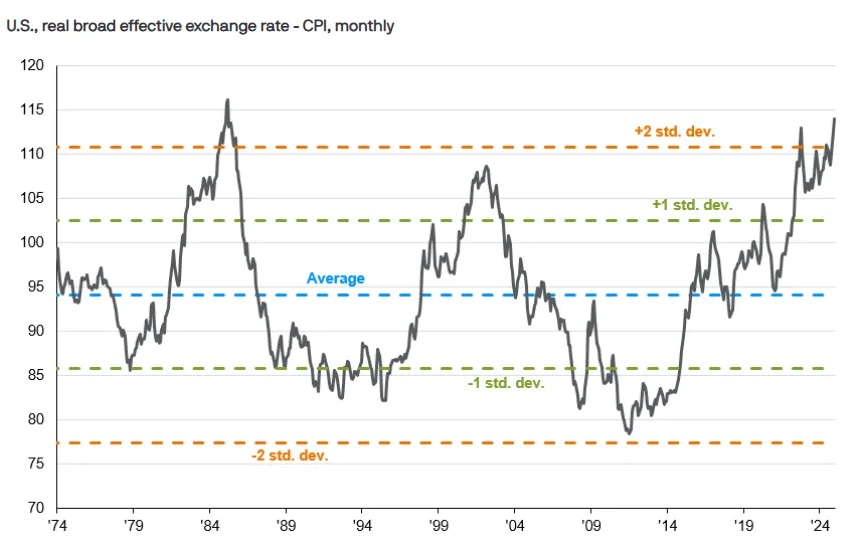

The US dollar forecast for the next 6 months points toward continued weakness as fundamental and technical factors align bearishly. With the currency already two standard deviations above its 50-year average, limited upside potential remains while downside risks multiply. The Fed rate cuts 2025 cycle, combined with persistent de-dollarization trends and uncertain inflation outlook, suggests the USD index prediction of 95 and potentially 90 could materialize sooner than many expect. At the time of writing, the technical breakdown from the bearish flag pattern suggests more selling pressure lies ahead for the world’s reserve currency.