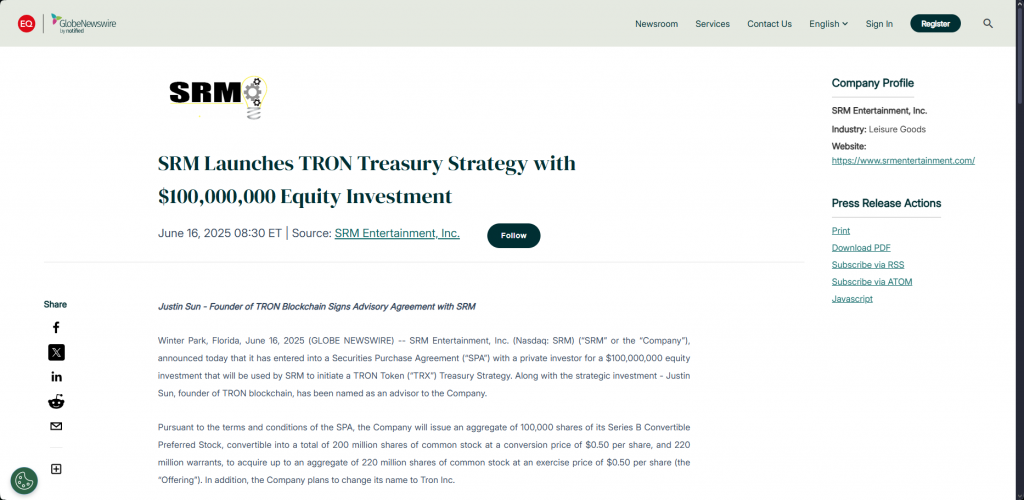

TRON Rockets $100M on Nasdaq Debut Through SEC-Blessed Reverse Merger

TRON just pulled off a Wall Street heist—legally. The crypto project blasted onto Nasdaq via a slick SEC-approved reverse merger, sending shares soaring by $100M in a single trading session. Who said blockchain and traditional finance can''t play nice?

Behind the numbers: The market clearly voted with its wallet—approving TRON''s backdoor listing with a nine-figure endorsement. Not bad for an asset class regulators still side-eye at cocktail parties.

The cynical take: Another day, another crypto project dressing up in suits to impress institutional investors. At least this one brought the receipts—$100M worth.

Financial Times headline about crypto group TRON going public – Source: Financial Times

Financial Times headline about crypto group TRON going public – Source: Financial Times

Tron Nasdaq Debut Fuels $210M Treasury Surge Amid SEC Pause Probe

., which will hold substantial TRX tokens similar to MicroStrategy’s Bitcoin strategy.following the Tron Nasdaq debut announcement, lifting the company’s market cap to approximately $140 million.

Strategic Partnership Details

to purchase TRON tokens, with thewhen warrants are exercised. The SEC pause probe removal cleared the path for this Justin SUN Nasdaq venture to proceed.

Political and Financial Backing

The deal reflects the shifting regulatory environment favoring digital assets., strengthening his political connections ahead of this Tron reverse merger.

Market Impact and Future

The $210M TRX treasury strategy positions Tron Inc. to benefit from token price appreciation while providing traditional investors exposure to cryptocurrency markets.

The SEC pause probe demonstrates changing regulatory attitudes, making this Tron Nasdaq debut possible. TRX price surged following the announcement, validating investor interest in crypto companies accessing public markets through established financial channels.