From $620 to $5.13M: How One Ethereum Early Investor Struck Crypto Gold

Talk about a moonshot—this Ethereum whale turned lunch money into generational wealth.

Back when gas fees were measured in cents rather than mortgage payments, an anonymous investor dropped $620 into ETH. Fast-forward to today: that stack ballooned to $5.13 million. Not bad for ''magic internet money.''

While Wall Street hedgies were busy shorting GameStop, crypto''s quiet early adopters were building fortunes in plain sight. The ultimate flex? Watching traditional finance scramble to explain 82,900% returns while still charging 2% management fees.

Of course, for every diamond-handed HODLer, there are a thousand paper-handed traders who sold their ETH for a used Tesla. Timing beats timing the market—if you''ve got the stomach to ignore the FUD.

Will Ethereum Face A Correction?

There is a probability that ETH will face a correction if the whale wallet dumps the 2000 coins on the market. The crypto market still faces considerable volatility. An additional 2000 coins in the market could lead to a spike in investor uncertainty.

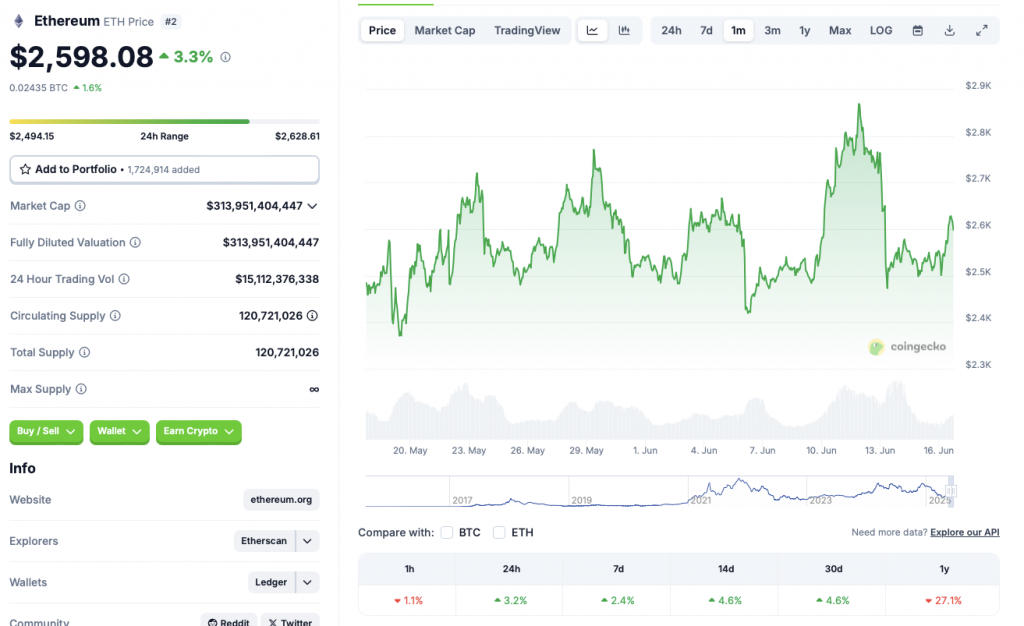

Ethereum (ETH) seems to be making a recovery after the recent market dip. ETH’s price is up 3.2% in the daily charts, 2.4% in the weekly charts, 4.6% in the 14-day charts, and 4.6% over the previous month. Despite the rebound, ETH is still down by 27.1% since June 2024.

ETH experienced quite a big price surge in early May following the highly anticipated Pectra upgrade. Despite the bullish developments, ETH has failed to breach the $3000 price level. The asset last traded above the $3000 mark in early February. ETH breached the $4000 point in December of last year. This is another price level the asset has struggled to hit over the last few years.

Ethereum (ETH) is among the most popular cryptocurrencies in the market. The ETH network is also home to a majority of decentralized applications. Despite the project’s incredible success, the coin has failed to generate steam since the 2021 bull run. How the cryptocurrency performs over the coming weeks is yet to be seen.