BlackRock, Vanguard & State Street Under Fire: The $27T Antitrust Battle Shaking Finance

The trillion-dollar trio faces regulatory reckoning as antitrust scrutiny hits nuclear levels.

How three funds built a financial oligarchy—and why governments are finally pushing back.

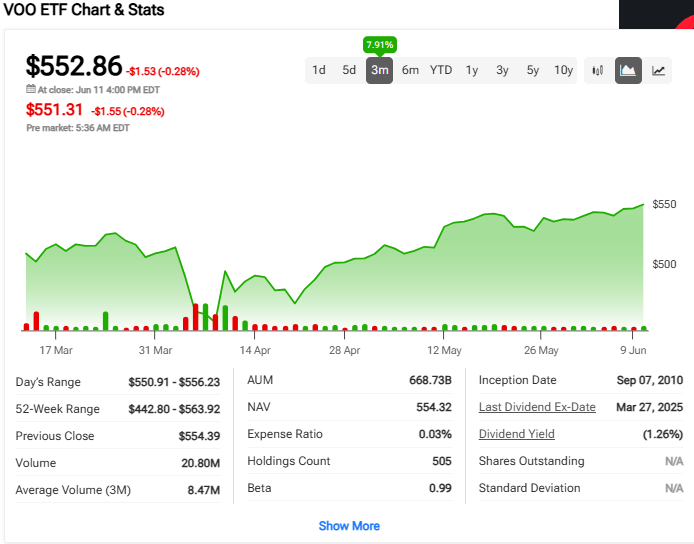

BlackRock, Vanguard, and State Street now control enough assets to buy Earth twice—if planets were for sale (and let’s be honest, they’d find a way).

Regulators are sweating over the $27 trillion question: When does market dominance become a systemic risk?

Behind the scenes: Pension funds and 401(k)s quietly feed the beast—while retail investors get the crumbs.

The irony? These ‘passive’ funds now actively dictate corporate America’s future.

One hedge fund manager whispers: ‘They’re the Federal Reserve’s shadow committee—just without the transparency.’

Will antitrust action actually change anything? Or just force the giants to hire more lobbyists?

Meanwhile in crypto-land: Decentralized protocols laugh as TradFi rediscovers the perils of centralization.

FTC official statement document – Source: FTC

FTC official statement document – Source: FTC

Regulatory Uncertainty Grows as BlackRock, Vanguard & State Street Face Collusion Claims

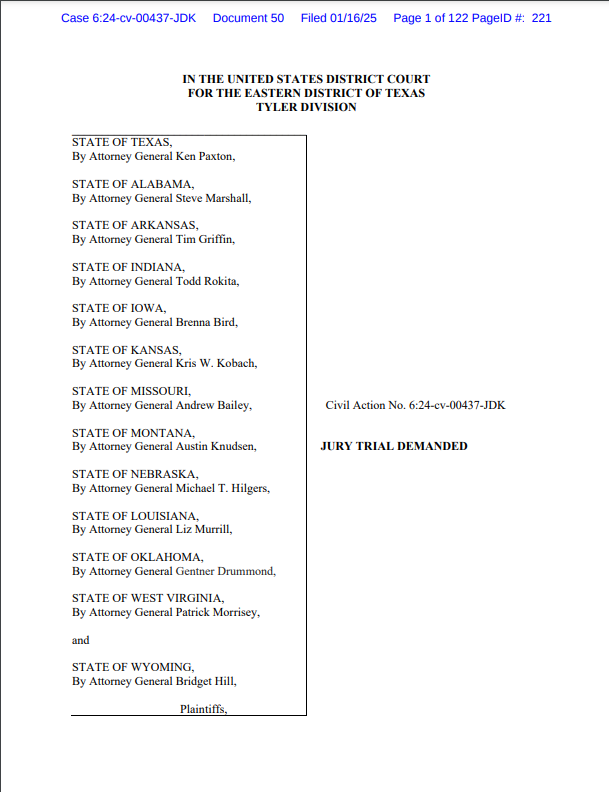

The BlackRock & Vanguard antitrust case reached the Federal Court as lawyers argued for dismissal of claims that the firms coordinated to suppress coal production. State Street collusion allegations center on whether the asset managers used their massive holdings to influence corporate decisions, and this is creating unprecedented regulatory uncertainty across financial markets.

Gregg Costa, representing BlackRock, stated:

Coal Industry at Center of Legal Battle

Texas Attorney General Ken Paxton’s lawsuit alleges that the three firms coordinated to pressure coal producers to reduce output while also profiting from soaring energy prices. The BlackRock Vanguard antitrust case claims environmental goals provided cover for anticompetitive behavior affecting American consumers, and at the time of writing, this remains a contentious point.

Brian Barnes, representing the states, argued:

The regulatory uncertainty extends beyond energy markets, and it could potentially affect how passive funds interact with companies across all sectors, including the rapidly growing cryptocurrency investments.

Federal Support Strengthens State Case

The Justice Department and Federal Trade Commission backed the lawsuit, signaling that State Street collusion claims have federal support right now. DOJ lawyer David Lawrence participated in court arguments, emphasizing that asset management firms should not be exempt from antitrust scrutiny, and also highlighting the government’s commitment to this case.

Robert Wick, representing Vanguard, initially clarified his firm’s approach:

However, after a brief recess, Wick returned and said:

Broader Market Implications

The BlackRock Vanguard antitrust case highlights an emerging “common ownership” theory, where institutional shareholders own large stakes across competing companies. This regulatory uncertainty could reshape how asset managers approach investments in cryptocurrency and also traditional markets alike.

The three firms control about $25 trillion in combined assets and hold top positions in almost every S&P 500 company. Their influence extends into emerging sectors like cryptocurrency, where similar State Street collusion concerns could arise as digital asset adoption grows, and also as these firms expand their crypto offerings.

US District Judge Jeremy Kernodle disclosed owning shares in three Vanguard index funds and one BlackRock fund but indicated he doesn’t plan to recuse himself. This transparency adds another LAYER to the regulatory uncertainty surrounding the case, and also raises questions about potential conflicts of interest.