Ripple and BlackRock Deepen Ties as Deutsche Bank Throws Weight Behind $75 XRP Target

Wall Street's unlikely crypto love affair gets hotter—Deutsche Bank just placed a big bet on Ripple's XRP hitting $75, cementing its alliance with BlackRock. Because nothing says 'institutional adoption' like traditional finance scrambling to catch the blockchain train.

Behind the headlines: The marriage of old-money giants and crypto's rebel tech just got more interesting. Forget 'partnerships'—this is a full-scale arms race for legitimacy.

The punchline? Watch legacy finance institutions suddenly discover their inner crypto enthusiasm—right as the price targets get juicy. How very... predictable.

Ripple “ex”-employee is the head of digital assets at BlackRock

Ripple “ex”-employee is the head of digital assets at BlackRock

Ladies and Gentlemen Do NOT forget:

1) Ripple “ex”-employee Robert Mitchnick is the head of digital assets at BlackRock

2) Larry Fink (BlackRock), Trump and Ripple were all in the Middle East together… pic.twitter.com/SFjK4Hzv8g — The Real Remi Relief

Ripple’s BlackRock Alliance Drives XRP Price Prediction to $75

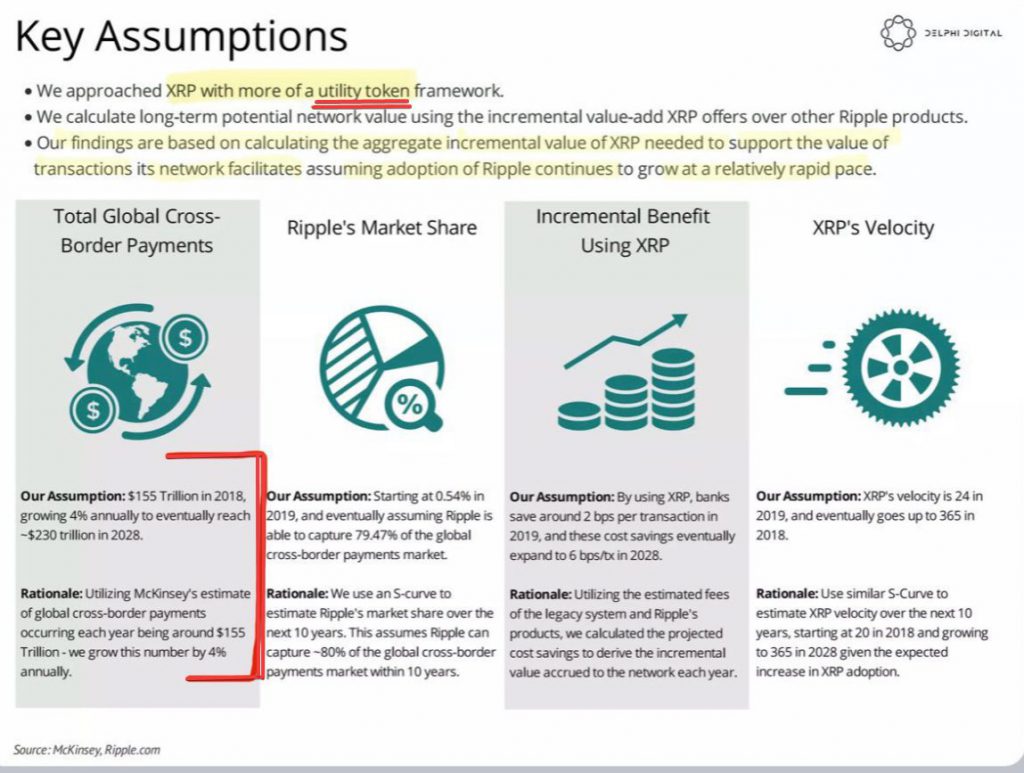

The Ripple BlackRock alliance centers around Robert Mitchnick, who is a former Ripple employee and now heads BlackRock’s digital assets strategy. XRP advocate The Real Remi Relief has highlighted this connection, and he’s projecting xrp price prediction targets between $25-$75 by June-July 2025.

The Real Remi Relief stated:

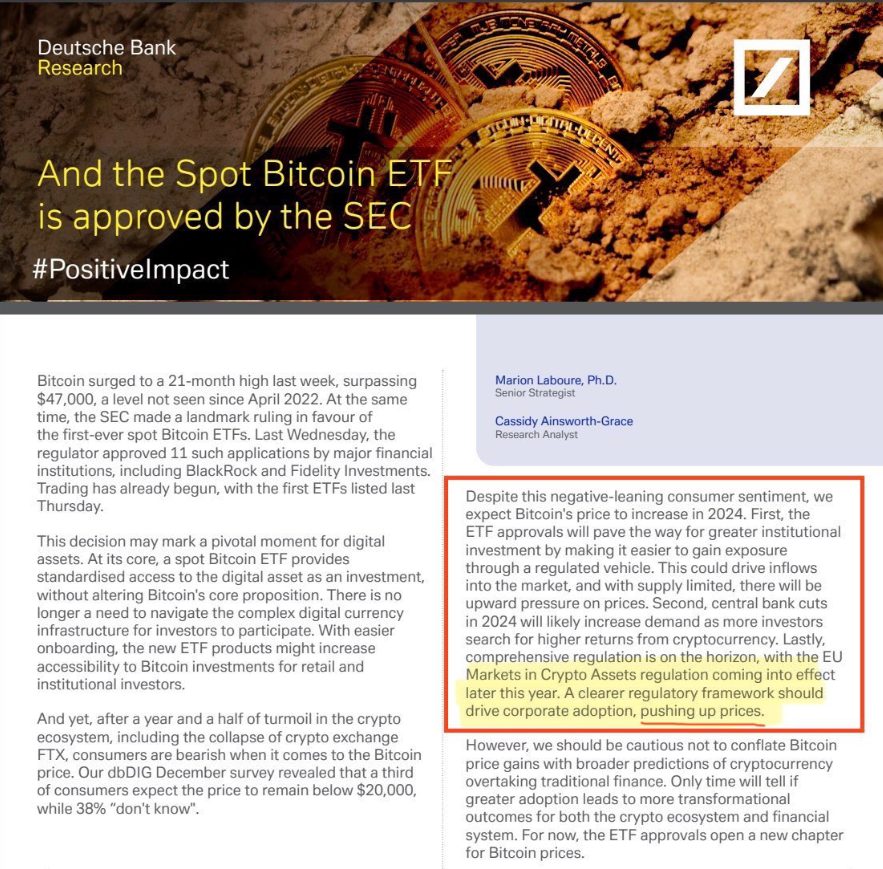

Deutsche Bank Validates an Upcoming Cryptocurrency Price Surge

The Deutsche Bank’s latest Ripple news confirms institutional optimism for cryptocurrency adoption, and it validates the Ripple BlackRock alliance potential. The bank’s research demonstrates how regulatory frameworks drive XRP price prediction growth across European markets.

Marion Laboure and Cassidy Ainsworth-Grace from Deutsche Bank stated:

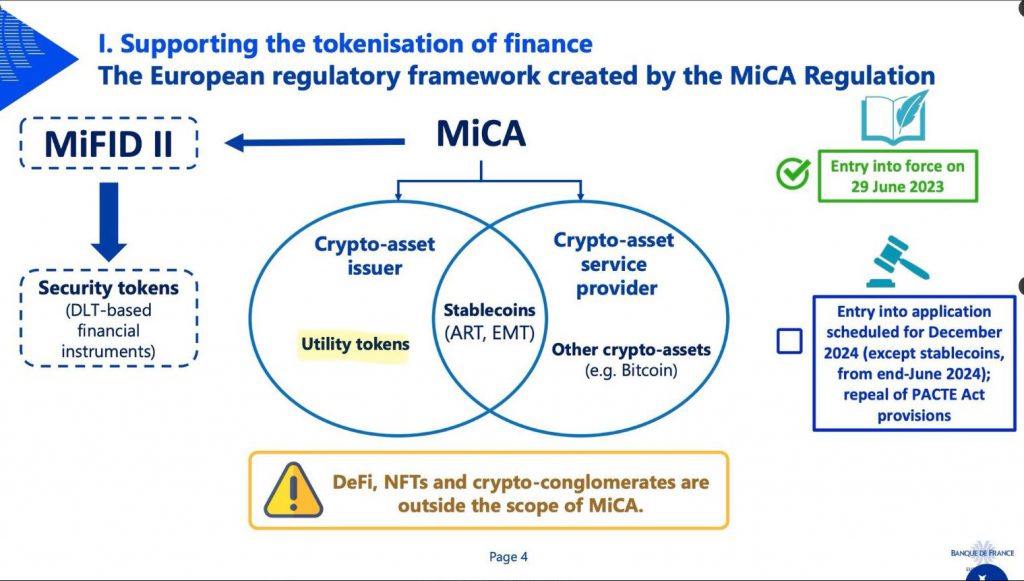

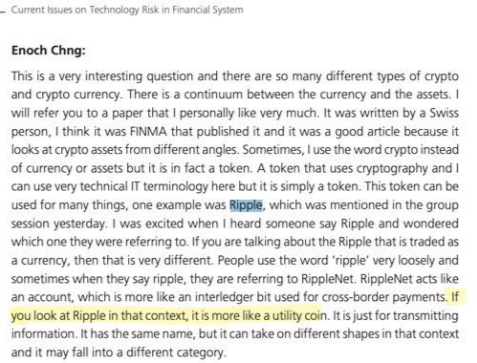

XRP Ledger Gains an Important MiCA Recognition

The XRP Ledger has achieved utility token classification under the EU’s MiCA regulation, and this provides legal certainty that Bitcoin and ethereum lack right now. This Ripple news strengthens the Ripple BlackRock alliance foundation by offering institutional investors regulatory compliance for cryptocurrency integration.

SMQKE emphasized:

Major Confirmation from Deutsche Bank.

“Clearer regulatory frameworks like MICA WILL PUSH UP CRYPTOCURRENCY PRICES.”

Documented.

https://t.co/UJzZdZhXKx pic.twitter.com/i3DFLulVxt

https://t.co/UJzZdZhXKx pic.twitter.com/i3DFLulVxt

Institutional ETF Interest Accelerates at This Time

The Ripple BlackRock alliance potential extends to ETF products, with 18 XRP applications under SEC review right now. BlackRock’s successful iShares Bitcoin Trust demonstrates how institutional products can drive XRP price prediction fulfillment through massive capital inflows and supply constraints.

The Real Remi Relief warned:

Strategic Timeline Points to an Important June-July 2025 Window

The Ripple BlackRock alliance timeline also suggests coordinated institutional adoption throughout 2025. This Ripple news, combined with Deutsche Bank’s regulatory endorsement and also the XRP Ledger utility recognition, creates conditions supporting ambitious XRP price prediction targets in the cryptocurrency sector.

The Real Remi Relief projected:

The convergence of the Ripple BlackRock alliance, regulatory clarity, and institutional infrastructure positions XRP for significant price appreciation as traditional finance embraces cryptocurrency solutions for global payments and also asset management.