Standard Chartered Calls De-Dollarization Hype—Predicts 10% USD Drop by 2026

The dollar's dominance isn't crumbling—it's just taking a haircut. Standard Chartered slams the panic button on de-dollarization chatter, forecasting a mere 10% decline by 2026.

Wall Street's favorite scare tactic—currency collapse—gets a reality check. Turns out, even a 'weakened' dollar still buys plenty of overpriced espresso.

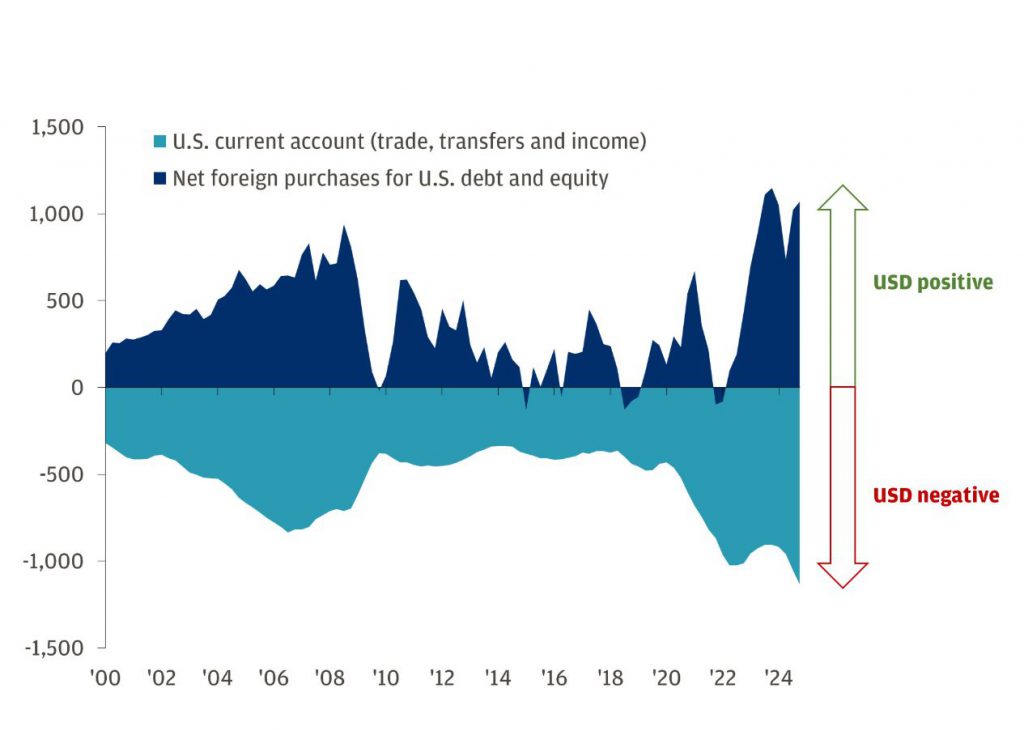

US current account and foreign debt purchases chart – Source: JP Morgan Analysis

US current account and foreign debt purchases chart – Source: JP Morgan Analysis

How De-Dollarization, Currency Substitution, And Crypto Impact The Dollar’s Future

Standard Chartered’s De-Dollarization Assessment

Standard Chartered’s research dismisses extreme de-dollarization scenarios while also acknowledging real pressures on dollar dominance at the time of writing. The bank stated:

It will still be an uphill challenge to replace the dollar as the global reserve currency, but there is no room for complacency given that regime shifts can occur over a relatively short time frame.

Currency Substitution and Cyclical Risks

Currency substitution efforts face obstacles, particularly regarding alternatives like the Euro and the Chinese yuan. Standard Chartered emphasized:

The bank also notes that dedollarisation efforts remain challenging despite growing momentum.

Cryptocurrency Impact on De-Dollarization

Cryptocurrency adoption influences global currency dynamics, though technical challenges and security risks limit implementation right now. The bank noted:

Standard Chartered’s probability assessment indicates:

The United States dollar maintains its world dominance despite any de-dollarization concerns there might exist, and currency substitution trends included, with Standard Chartered also recognizing both dollar resilience and its potential for some cyclical weakness caused gradual dedollarisation pressures.