Circle Goes Public at $31 a Pop—Can the USDC Giant Justify Its $1B+ Market Debut?

Wall Street meets stablecoin: Circle—the powerhouse behind $1.05 billion in USDC circulation—just slapped a $31 price tag on its NYSE debut. Traders, grab your popcorn.

The big question? Whether a firm tethered to crypto's volatile underbelly can charm traditional investors. Spoiler: the SEC won't be sending congratulatory flowers.

One cynical take: Nothing says 'financial innovation' like another IPO cashing in on blockchain hype while dodging actual profitability debates. Classic.

How Circle’s IPO and USDC Issuer Move Impact Cryptocurrency Regulation & Market Volatility

The Circle IPO represents a pivotal moment for cryptocurrency regulation, as the USDC issuer successfully navigates traditional financial markets. Circle and its shareholders sold 34 million shares at the revised $31 per share price, also valuing the company at roughly $8 billion and marking one of 2025’s largest public offerings.

Strong Financial Performance Drives Circle IPO Success

Circle’s financial trajectory supports its successful market entry as the USDC issuer. The company reported $1.68 billion in revenue and reserve income in 2024, up from $1.45 billion in 2023 and also $772 million in 2022. Net income reached approximately $156 million last year, though it was down from $268 million the previous year.

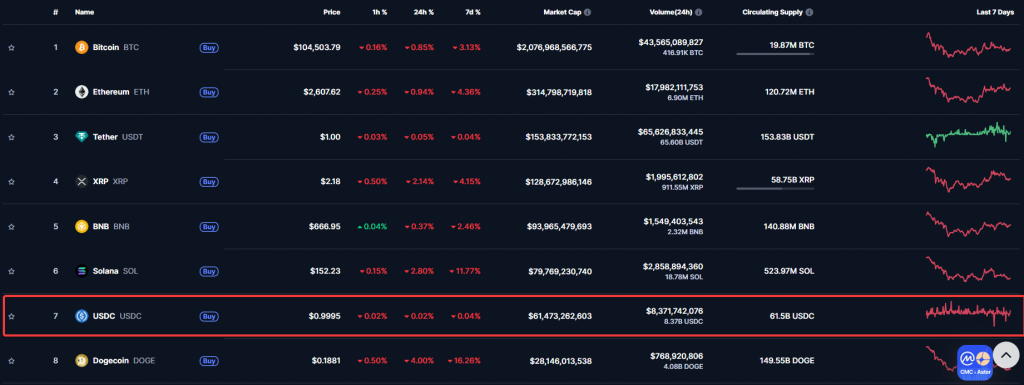

USD Coin maintains its position as the second most popular stablecoin by market capitalization and also ranks as the seventh most popular cryptocurrency overall. This market strength helped drive investor interest in the Circle IPO despite ongoing market volatility in the broader cryptocurrency sector right now.

Regulatory Environment Supports Circle IPO Launch

The timing of Circle’s IPO benefits from improved cryptocurrency regulation under the current administration. U.S. banking regulators, including the Federal Deposit Insurance Corporation and also Federal Reserve, have withdrawn previous restrictive statements on crypto assets, giving banks more freedom to engage without prior approval.

This regulatory shift addresses long-standing concerns about market volatility and also security risks that previously hindered institutional investment. The USDC issuer’s successful debut on the New York stock exchange demonstrates how clearer regulatory frameworks can support cryptocurrency companies’ transition to public markets at the time of writing.

Circle’s Services Address Market Adoption Challenges

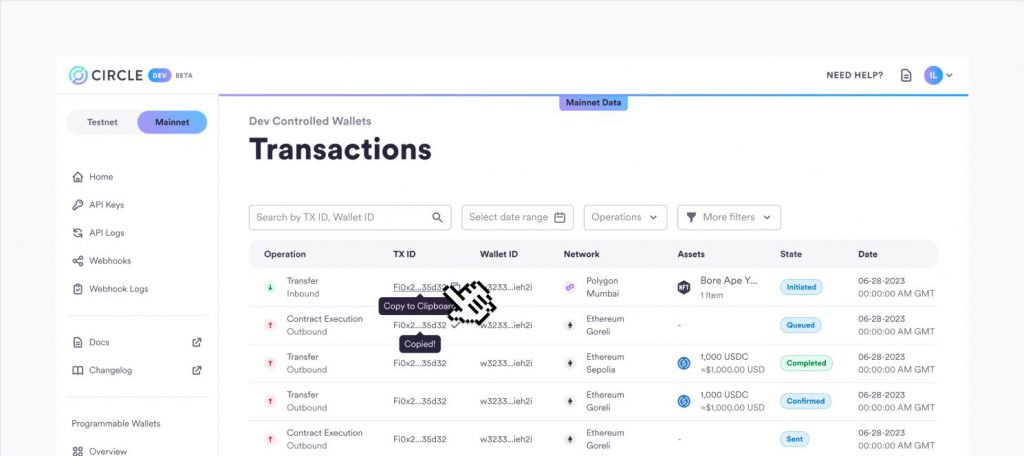

Beyond the Circle IPO success, the USDC issuer offers comprehensive digital currency services that tackle industry adoption barriers. The company provides application programming interfaces for payments supporting USDC transactions and also infrastructure solutions for digital asset management.

Circle’s programmable Web3 wallet platform enhances decentralized finance adoption by simplifying blockchain interactions. These services help reduce technical challenges while also addressing security risks that often concern potential cryptocurrency users and investors right now.

The Circle IPO positions the USDC issuer among major 2025 public debuts, and also joining companies like SailPoint Technologies which raised $1.38 billion. The successful pricing above initial expectations signals growing institutional comfort with cryptocurrency investments, particularly those backed by stable regulatory frameworks and also established market positions like Circle’s.