BlackRock Dumps Bitcoin for Ethereum—Time to Follow the Smart Money?

Wall Street's trillion-dollar whale just made a seismic crypto shift. BlackRock—the asset manager that moves markets with a sneeze—quietly swapped Bitcoin for Ethereum in its latest portfolio rebalance. Cue the frantic retail trader FOMO.

But before you ape into ETH like a degens chasing the next shiny thing, let's break it down.

The play: Institutional giants are rotating into Ethereum's programmable ecosystem—DeFi, NFTs, tokenized RWAs—while Bitcoin's 'digital gold' narrative gathers dust. BlackRock didn't become a $10T behemoth by YOLO-ing into memecoins.

The catch: This could just be another case of suits 'diversifying' after missing the bottom. Remember when they bought the 2021 BTC top at $69K? Yeah, that worked out great.

Bottom line: Don't let BlackRock's chess move turn into your checkers game. ETH's tech stack looks juicy, but the real smart money? Probably already pricing in the next pivot.

Bitcoin Slides As Ethereum Gains Amid BlackRock’s Shuffle

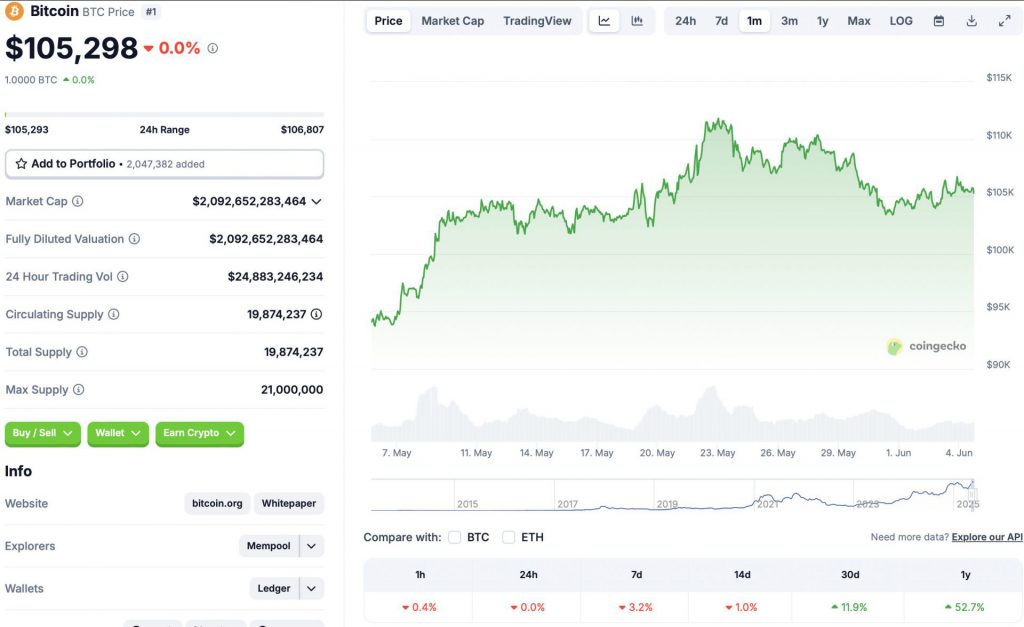

BTC hit an all-time high of $111,814 on May 22. BTC’s upswing triggered a market-wide rally. Many crypto assets saw increased inflows following BTC’s price surge. The rally was likely due to a spike in institutional investments. BlackRock alone purchased more than $3 billion worth of BTC in May.

BTC has seen a 0% change in the last 24 hours. The asset is down by 3.2% over the last week and 1% in the 14-day charts. Despite the downtrend, the original crypto is up 11.9% in the monthly charts and 52.7% since June 2024.

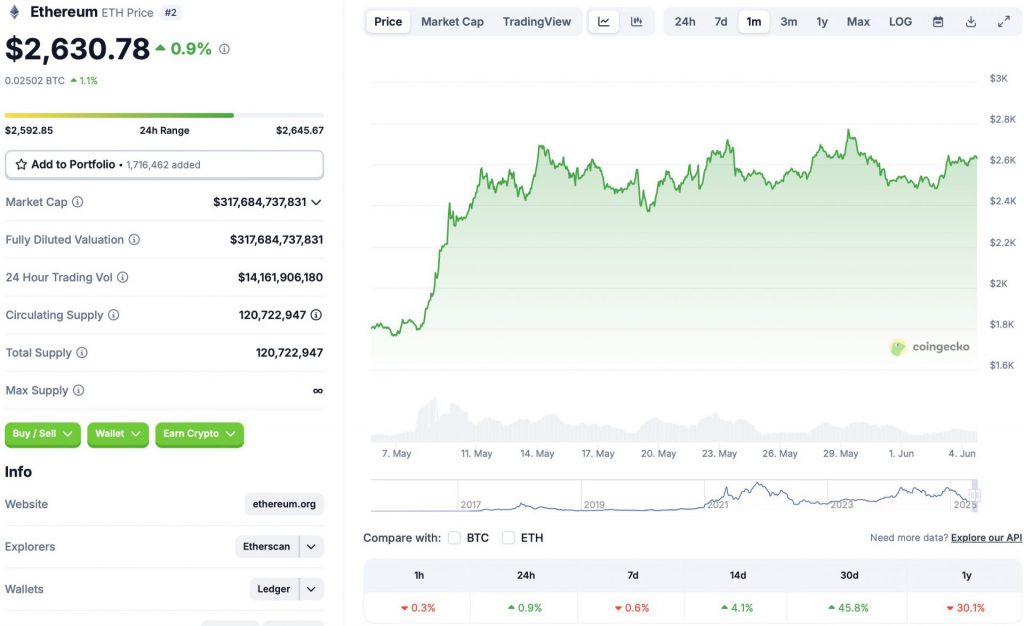

Ethereum (ETH) seems to be fairing better than BTC right now. The second-largest crypto by market cap is up 0.9% in the daily charts, 4.1% in the 14-day charts, and 45.8% over the previous month. ETH’s price continues to glow red in the weekly and yearly time frames, falling 0.8% and 30.1%, respectively.

ETH began to rally in early May after the commencement of the Pectra update. The upgrade may have triggered a spike in investor confidence. ETH registered double-digit percentage growth in the daily charts at one point. It is possible that BlackRock anticipates ETH’s price to rally over the coming weeks.

BlackRock’s purchase may also be due to a rise in client demand. The approval of spot ETH ETFs by the SEC last year did not have the same effect as the approval of BTC ETFs. Bitcoin (BTC) hit multiple all-time highs after the SEC’s ETF approval. ETH, on the other hand, has struggled to breach the $3000 mark.