Wall Street Flees Dollar Dominance: $59B Exodus as FMAS:25 & Russia Reshape Global Finance

Another day, another tectonic shift in the currency wars. Wall Street just pulled a $59 billion reverse uno card on the greenback—because nothing says 'confidence' like institutional capital sprinting for the exits.

The triggers? FMAS:25's regulatory gambits and Russia's latest end-run around SWIFT. Guess those 'petrodollar forever' PowerPoints need updating.

Funny how 'safe haven' currencies become exit liquidity when BRICS start playing monetary chess with actual gold reserves. But hey—at least someone's profiting from the dollar's slow-motion retirement party.

European vs US stock market performance comparison chart – Source: LSEG

European vs US stock market performance comparison chart – Source: LSEG

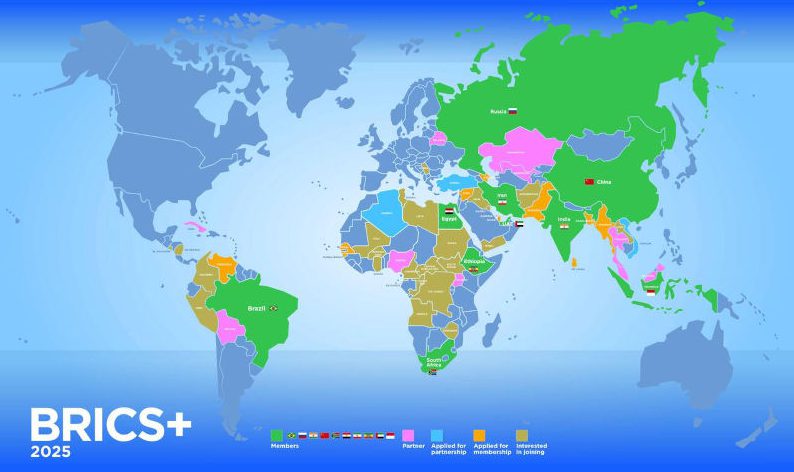

BRICS Nations Challenge US Dollar Dominance Amid Global Currency Shift

Wall Street Faces Historic Dollar Asset Exodus

Foreign central banks reduced their holdings of dollar-denominated securities by $59 billion last year, marking a significant shift away from United States dollar dependence. With de-dollarization efforts, currency substitution has become a key strategy as dollars now represent just 57.8 percent of global reserves, the lowest level since 1994. This represents a substantial 7.3 percent decline over the past decade, down from approximately 72 percent in 2002.

George Saravelos, Deutsche Bank’s global head of FX research, said:

The CFO of an Australian pension company said:

BRICS Payment Systems Reshape Global Finance

The BRICS coalition has been developing sophisticated alternatives to dollar-centric financial infrastructure, with particular focus on reducing currency substitution costs and risks. Their de-dollarization objectives were discussed at the recent FMAS:25 conference in Cape Town, where financial leaders explored innovative cross-border payment mechanisms that operate independently of United States dollar clearing systems.

Kenneth Lamont from Morningstar told industry experts that he’s convinced about the fact that:

Russia Accelerates De-Dollarization Strategy

Russia has introduced entire systems to reduce its use of US dollars in transactions with other countries. Increasing local currency usage with important trading partners, mainly China and India, is a main objective for the nation’s central bank to cut down on ties controlled by US sanctions.

The government of Russia has established direct payment routes to enable energy purchases without involving the dollar, advancing its strategic plans to de-dollarize. The oil sector is a leading example, since several major producers now exchange their goods and services for payment in alternative currencies.

Market Implications and Investor Response

BofA surveys have shown that fund managers are holding less than normal in U.S. equities, the lowest level ever, with 36 percent considering American stocks to be underweight. There were €2.5 billion of outflows from Europe-based ETFs specializing in U.S. investments last month, the highest amount since the beginning of the year.

Wellington Management analyst John Butler asked the following question:

The dollar has declined by 7 percent so far in the year, while the euro has risen and bonds from the German government are in high demand, suggesting that investors are seeking assets other than U.S. dollar-based ones. The increased worry suggests that financial networks could be exploited and that having a huge amount of U.S. dollars in one place could be dangerous to the global economy.

Moves by the BRICS indicate a significant challenge to the present global financial order and may affect future trends in trade and stability. These alternatives are rapidly gaining appeal and advancing, putting strong pressure on the US dollar to lose its position as the main currency in global trade.