Nvidia Surpasses Microsoft as AI Frenzy Fuels 48.5% Rally Toward $210 Target

Nvidia just dethroned Microsoft—turns out selling shovels in a gold rush beats selling office software. The chipmaker's stock rockets toward $210 as AI demand hits ludicrous speed.

Wall Street analysts scramble to upgrade targets (as usual) while retail traders YOLO into weekly calls. Meanwhile, Microsoft quietly rebrands its AI chatbot for the third time this year.

Funny how 'paradigm shifts' always seem to benefit the same semiconductor giants—but hey, this time it's different, right?

Market rankings showing top companies by market cap – Source: TradingView

Market rankings showing top companies by market cap – Source: TradingView

Nvidia Stock Surges Amid Soaring AI Chip Demand and Market Volatility Concerns

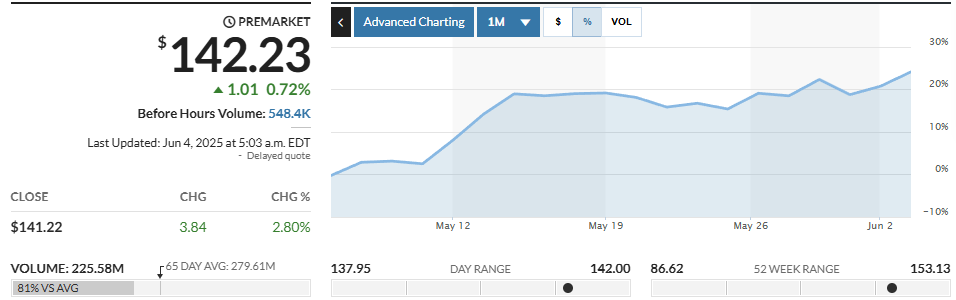

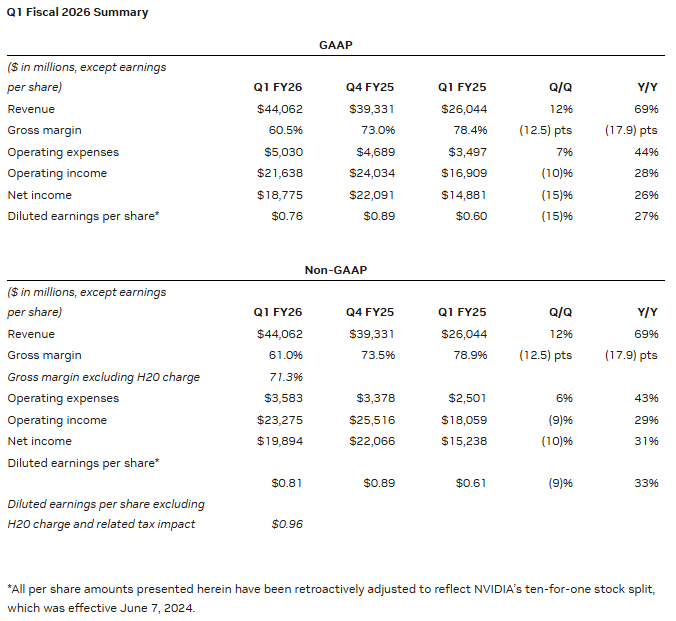

showing the company’s ability to maintain rapid growth at massive scale. The chipmaker reported 96 cents in adjusted earnings per share on $44.06 billion in sales, which represented 69% growth from the year-ago period.

AI Infrastructure Drives Record Revenue Growth

Nvidia tops Microsoft in market value as major tech companies purchase AI accelerators in massive quantities. Companies including Microsoft, Meta, Google, Amazon, Oracle, and also xAI are building ever-larger computer clusters for advanced AI work. This surge in demand has positioned Nvidia stock as a primary beneficiary of the AI revolution right now.

The company’s transformation from gaming chip manufacturer to AI infrastructure leader showcases strategic execution. Founded in 1993 for 3D gaming chips, researchers discovered that Nvidia’s graphics designs were ideal for the parallel processing needed in artificial intelligence applications.

Market Position and Trading Dynamics

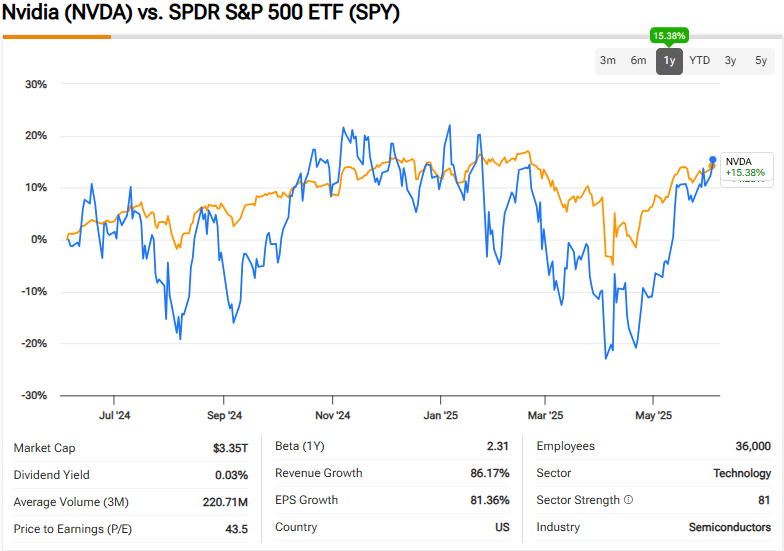

Nvidia share price volatility reflects intense competition among mega-cap technology stocks, with the company trading places with Apple and also Microsoft at the top since last June. Tuesday marked the first time Nvidia held the most valuable position since January 24th, highlighting how market volatility affects even dominant players.

Recent insider activity shows director Robert Burgess sold 50,000 shares valued at $6.74 million on May 30th. While insider selling can signal concerns, transactions like these often represent routine portfolio management given the stock’s substantial appreciation.

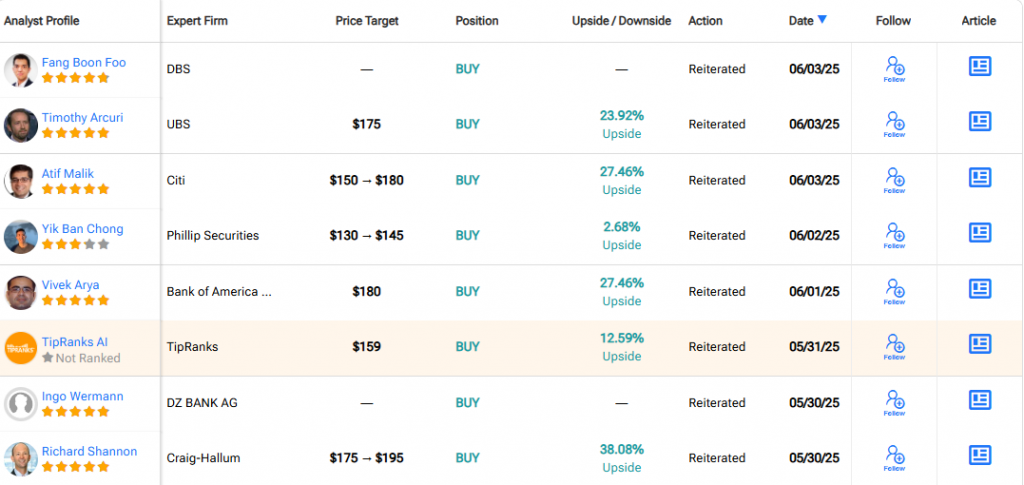

Future Outlook and Price Targets

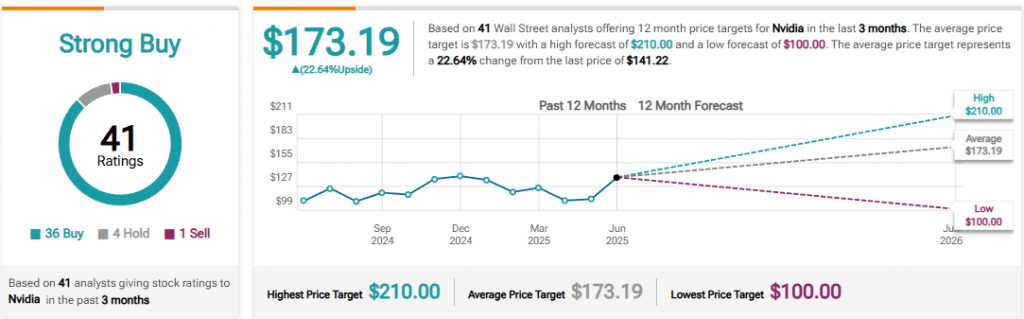

Wall Street analysts maintain bullish forecasts for NVDA stock, with some price targets reaching $210, representing 48.5% upside from current levels. The consensus suggests AI infrastructure spending will accelerate as companies build competitive advantages in artificial intelligence.

Nvidia tops Microsoft not just in current valuation but also in growth trajectory, as the Nasdaq: NVDA listing continues attracting institutional investment at the time of writing. The company’s technological moat in AI processing also helps mitigate regulatory uncertainty around chip exports and trade restrictions affecting the semiconductor industry.

Scientists and researchers are still discovering new ways to use Nvidia’s parallel processing and they believe the need for AI accelerators could be more than what is currently forecasted. The combination of self-driving cars, robots and improved data analysis helps Nvidia win new business and supports its rising stock price over 2025 and beyond.