VeChain’s Silent Ascent: Why VET Might Dominate Crypto by 2030

Beneath the radar of meme coin mania and ETF hype, VeChain’s enterprise blockchain play is stacking real-world partnerships—while speculators chase the next vaporware moonshot.

The enterprise adoption engine

Walmart China. BMW. PwC. VeChain’s client roster reads like a Fortune 500 wishlist, with supply chain tracking that actually cuts costs instead of just mining fees.

2030: The tipping point?

Mainstream blockchain integration moves at glacial speeds—until it doesn’t. When multinationals flip the switch on full-scale deployment, VET’s tokenomics could trigger a perfect storm of scarcity and utility.

Wall Street still dismisses utility tokens as ’toys,’ but then again, they said the same about Bitcoin in 2015—right before missing the decade’s best-performing asset.

Why VeChain Could Become A Top Player By 2030

VET utilizes a Proof-of-Authority (PoA) consensus method. This FORM of reaching a consensus is a more energy-efficient alternative to others. The network’s speed, reliability, and low transaction costs are catered to better the needs of growing enterprises. The high transaction volumes and speed make VET an easy choice for large-scale business operations.

VeChain (VET) is most known for its supply chain-related initiatives. Walmart China utilizes the VET blockchain to track supplies for safety and authenticity. BMW is another global brand that uses the blockchain for supply-chain management. VET’s collaboration with top global brands has made it a solid contender to become a global powerhouse by the end of the decade.

VET’s smart contract capabilities are also less complex than Ethereum’s (ETH). The simplicity makes VET smart contracts a top choice for growing businesses. The world is slowly transitioning into Web3. VET could become a central figure within a global transition phase.

VeChain (VET) also has a lot of environment-related initiatives. Climate change has taken center stage in global discussions. More and more companies will aim to offset their carbon footprint over the coming years. VET could fill the necessary gaps that companies may need. This is another aspect that makes VET a solid choice for future growth.

Cryptocurrencies To Skyrocket

While VET’s utilities are many, the general market sentiment may also impact the asset’s price. The cryptocurrency sector has entered mainstream finance after years of being pushed around. The US SEC approved Bitcoin (BTC) and Ethereum (ETH) spot ETFs in 2024. The move enabled large financial institutions to open their doors to the budding asset class.

VeChain (VET) currently does not have an ETF application with the SEC. This may soon change. The SEC recently welcomed a pro-Bitcoin (BTC) head, Paul Atkins. Many anticipate that Atkins will take a more lenient approach to the crypto sector. There is a possibility that we will see a spot VET ETF application very soon.

The cryptocurrency market is expected to skyrocket over the coming years. Many expect Bitcoin (BTC) to breach the $1 million mark by the end of this decade. BTC hitting $1 million will likely trigger a massive market-wide rally. VET’s price could surge to $5 under such conditions.

VET Price Prediction For 2030

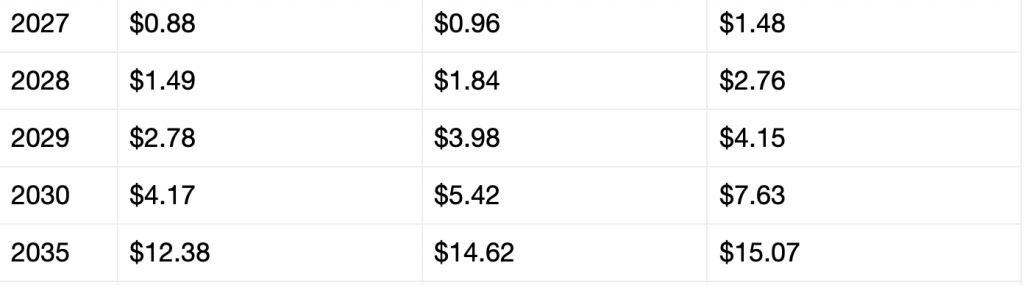

Telegaon analysts are quite bullish on VeChain (VET). The platform anticipates the asset to trade at a maximum price of $7.76 in 2030. VET’s price will face a 32,233% price rally if it hits the $7.76 target. The platform further anticipates the asset to hit a potential maximum price of $15.07 by 2035. The asset’s price will rally by about 62,691% if it reaches the $15.07 target from current price levels.

There is also a possibility that VeChain (VET) will not rally as predicted by Telegaon. The cryptocurrency market is plagued with high volatility. The market has faced numerous big crashes in its 15-year history. One of the most significant market crashes came right after the 2021 bull run. While the chances are high that VET will hit new peaks in the future, there will most likely be many dips along the way. How the asset performs by the end of this decade is yet to be seen.