Congressional Traders Crush Buffett With 149% Phone Stock Bonanza

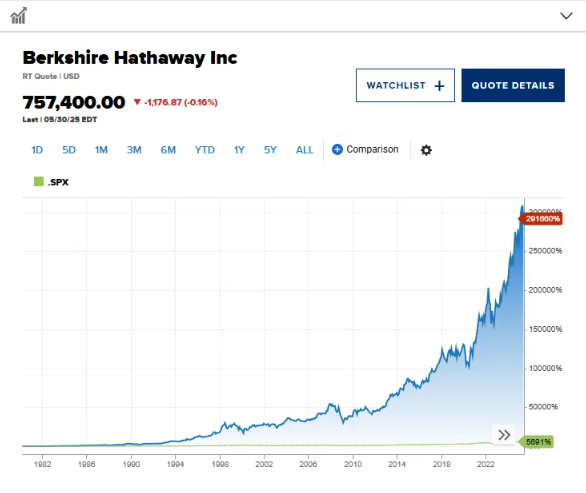

Move over, Oracle of Omaha—Washington’s insiders just schooled Wall Street.

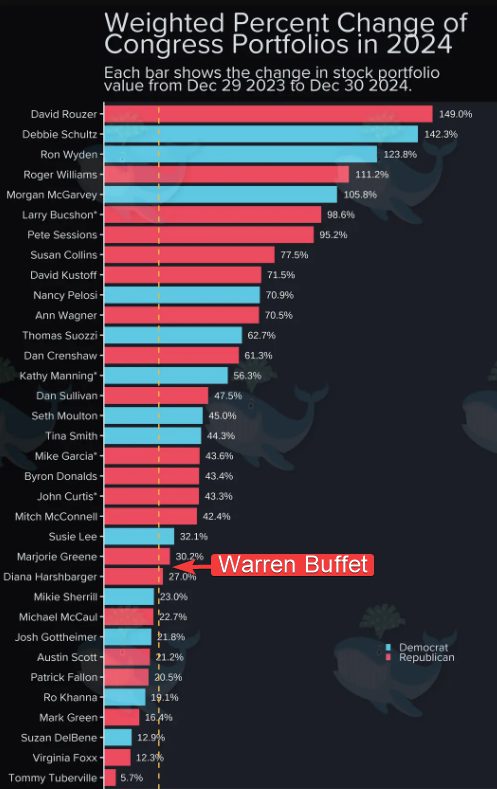

While retail investors chase meme stocks, Capitol Hill’s trading club quietly racked up phone-sector gains that’d make hedge funds blush. The 149% returns? Just another Tuesday when you’ve got front-row seats to legislation.

Funny how those ’public service’ portfolios keep outperforming the S&P 500. Must be all that bipartisan... market research.

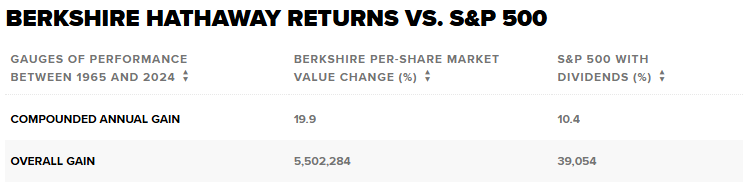

Berkshire Hathaway returns vs S&P 500 chart – Source: Berkshire Hathaway

Berkshire Hathaway returns vs S&P 500 chart – Source: Berkshire Hathaway

How Congress Beat Buffett With Phone Trades in Nvidia and Coinbase

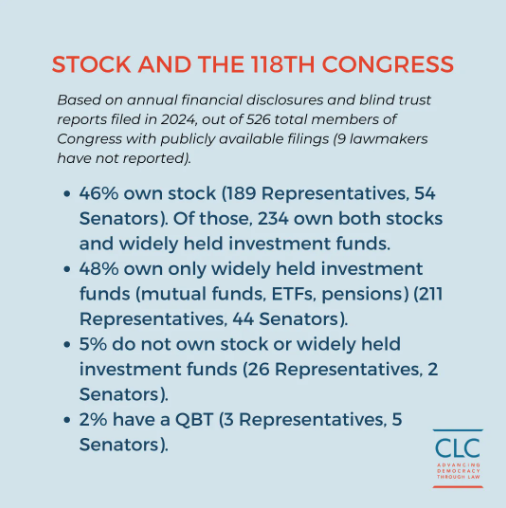

Based on the 118th Congress data, 46% of lawmakers own individual stocks, with 189 Representatives and 54 Senators actively trading. These congress stock trades have generated exceptional returns that outpace even professional investors. The trading activity shows a clear concentration in technology stocks, particularly Nvidia stock and also Coinbase positions.

The most profitable congress stock trades occurred through quick “phone trades” executed via brokers ahead of major policy announcements. At the time of writing, several members hold between $750,000 and $2 million in crypto assets, with Representative Shri Thanedar holding $365,003 to $800,000 in cryptocurrency investments.

Record-Breaking Congressional Holdings

According to the congressional disclosure data, Representative Nicholas Begich holds $250,001 to $500,000 in crypto assets, while Representative Michael Collins holds $58,016 to $345,000. These congress stock trades and crypto holdings often coincide with committee assignments related to financial services and also technology regulation.

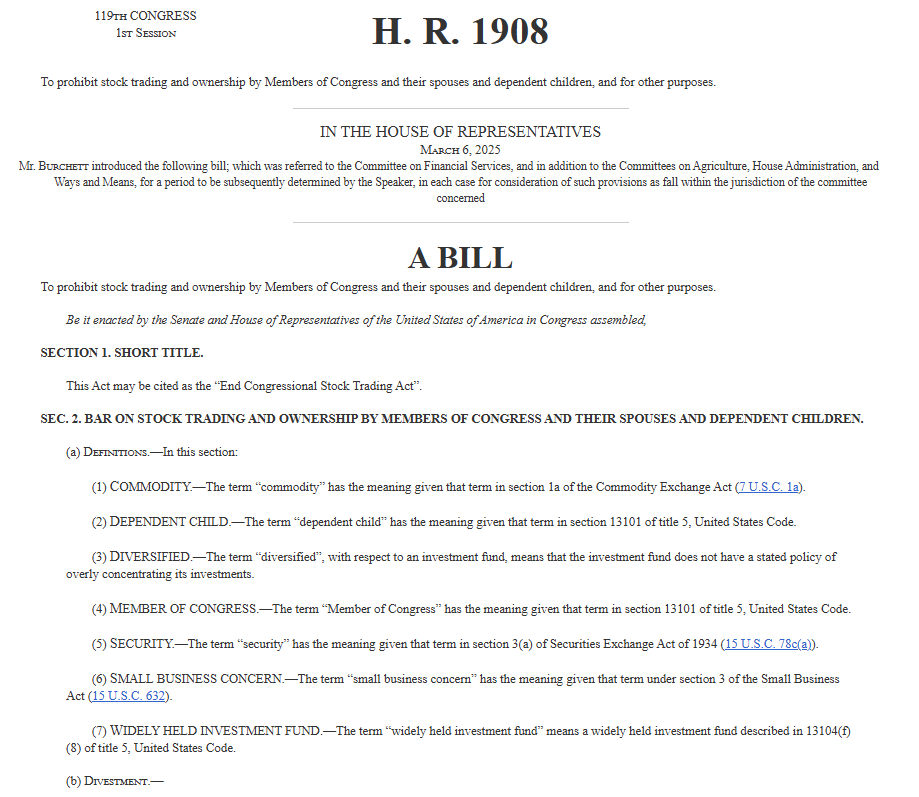

The STOCK Act had three principal objectives related to congressional stock trading: increase public trust in Congress, increase transparency with new filings required within 30 days of member trades, and also penalize members for insider trading by clarifying that securities laws apply to Congress.

Technology and Energy Stock Focus

The most profitable congress stock trades concentrated on Nvidia stock, Coinbase, and also NGL Energy Partners. The data shows that cryptocurrency assets in Congress are becoming increasingly significant, with ten members holding substantial digital asset portfolios right now.

The weighted percent change data reveals dramatic portfolio performance variations among lawmakers in 2024, with some achieving returns that WOULD be considered exceptional for professional fund managers at the time of writing.

The Insider Trading Question

The Campaign Legal Center reported Gavin Kliger to the ethics office for not removing himself from stocks in seven companies which had a value of up to $715,000. This story highlights that there are still concerns about government officials breaking insider trading rules.

Because of the impressive gains in congress stock, calls for far-reaching changes have increased. It is clear from how congress performs compared to Buffett’s success that important issues in the system must be identified and resolved right away by regulators as well as reformers. It appears from the weighted percent change in Congress portfolios in 2024 that traders in these portfolios are likely profiting far more than they should, leading many to doubt if current rules are fair.