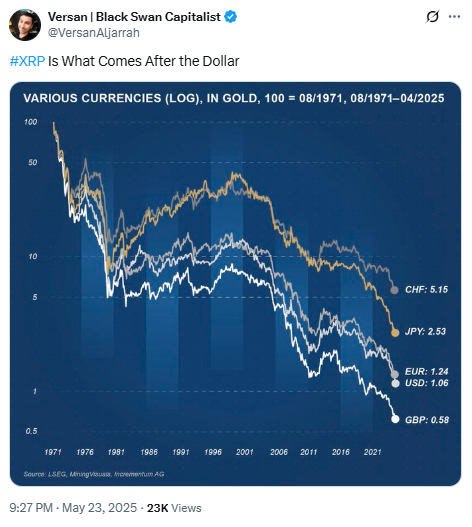

Black Swan Capitalist Declares: ‘XRP Will Replace the Dollar’

Move over, greenback—there’s a new sheriff in town. Or so claims one bold investor betting against the almighty dollar.

XRP, the crypto often tangled in regulatory fistfights, just got a surprise endorsement as the ’post-dollar’ future. Because nothing says ’stable reserve currency’ like an asset that moonwalks 20% in a week.

Wall Street’s response? Probably another latte sip and a muttered ’Sure, just after we audit those Tether reserves.’

Source: Black Swan Capitalist Versan AlJarrah on X

Source: Black Swan Capitalist Versan AlJarrah on X

Ripple Price Forecast And XRP’s Role Amid Regulatory Risks And Volatility

Corporate Giants Embrace The Post-Dollar Vision

A large MOVE toward XRP as a strategic reserve asset occurred when three big companies all announced their treasury plans in one day and this didn’t happen randomly. Ault Capital Group revealed it will purchase $10 million in XRP by the end of the year, whereas VivoPower International raised an impressive $121 million, with Prince Abdulaziz bin Turki Abdulaziz Al Saud of Saudi Arabia at the helm of the private placement.

Likewise, in 2013, WeBus International said they would invest $300 million in non-equity funds to form an XRP reserve designed to support global payments. It shows that British companies are adding XRP to their treasury strategies after the dollar as the risks linked to crypto regulations become clearer and manageable.

Technical Analysis Points To Breakout Potential

Ripple’s price forecast shows XRP consolidating around $2.20 at the time of writing, and it’s forming what appears to be a bullish pennant pattern that could signal significant moves ahead. Technical indicators suggest the crypto market volatility that swept through markets over the weekend has been creating consolidation rather than reversal patterns, which is actually quite encouraging for bulls.

XRP faces confluence resistance at $2.25-$2.26, established by both the 4-hour 50-period EMA and the 100-day EMA, and a break above this level could trigger a projected 14.2% move to $2.72. This technical setup supports the broader XRP after the dollar thesis with price action that validates institutional confidence in the asset’s long-term potential.

The Moving Average Convergence Divergence indicator has been showing potential buy signals, while derivatives market Open Interest increased 2% to $4.74 billion. Trading volume also jumped 10% to $2.97 billion, suggesting growing interest despite XRP recording its largest weekly outflow of $37.2 million in history, which ended an 80-week inflow streak.

Market Dynamics Support Post-Dollar Vision

Despite crypto market volatility affecting weekend trading sessions, XRP’s utility in cross-border payments provides fundamental value that extends beyond pure speculation. The long-to-short ratio of 3.0371 on Binance suggests traders remain bullish overall, even as cryptocurrency regulatory risks continue shaping market sentiment and investor behavior.

The Ripple price forecast becomes increasingly compelling when considering institutional adoption alongside these technical patterns. The fact that XRP as a strategic reserve asset adoption happened across multiple corporations within 24 hours demonstrates real-world utility that supports the XRP after the dollar narrative promoted by Black Swan Capitalist and other market observers.

Higher long position liquidations of $2.6 million compared to $1.43 million in shorts indicate some market caution, yet the underlying trend toward corporate XRP adoption suggests growing institutional confidence in the asset’s role within evolving monetary systems and the potential transition away from traditional fiat currencies.

The parallels between XRP’s institutional adoption and the US dollar’s historical rise to global reserve status are becoming increasingly apparent. Just as the US dollar gained prominence through widespread corporate and government adoption in the mid-20th century, XRP coming after the dollar appears to be following a similar trajectory through strategic corporate treasury adoption and cross-border payment utility that could eventually challenge the dollar’s dominance in international settlements.