Digital Yuan Gobbles Up 38% of Global Trade—And Traders Are Nervous

China’s CBDC just ate the competition’s lunch. Again.

The quiet takeover

No press releases. No fanfare. Just a creeping dominance in cross-border settlements—now accounting for over a third of global trade volume. SWIFT never saw it coming.

How?

Compulsory usage for commodity deals. Backdoor BRI adoption. And let’s be honest—when the PBOC ’suggests’ you use their rails, you use their rails.

The fallout

Western banks are scrambling to retrofit systems. Crypto exchanges are adding CNY pairs faster than you can say ’capital controls.’ And Bitcoin maximalists? Suddenly very interested in monetary sovereignty.

One hedge fund manager quipped: ’Turns out fiat works great... when it’s backed by 1.4 billion people and a surveillance state.’ Ouch.

The Start Of

The Start Of

De-dollarization –

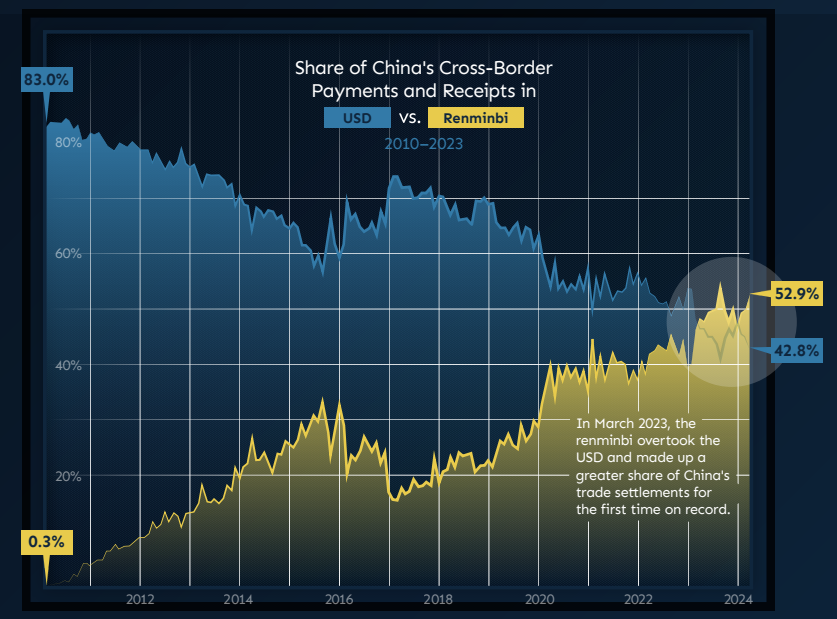

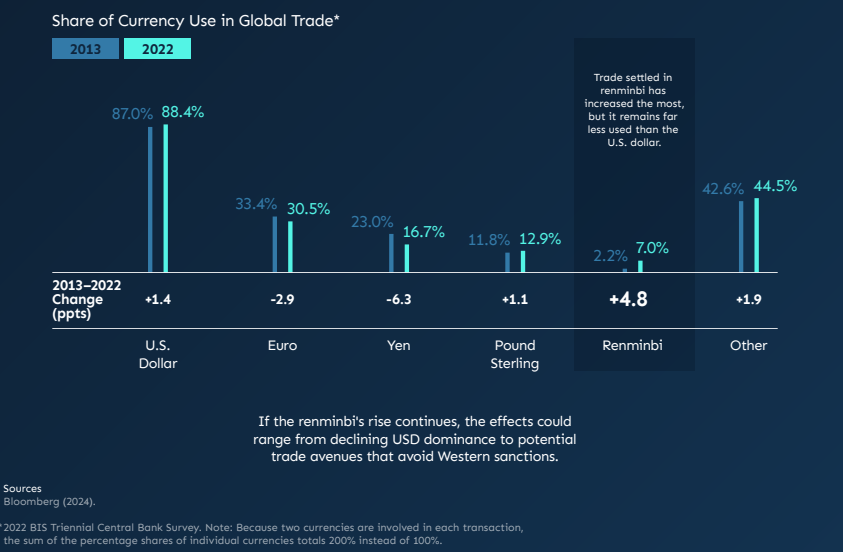

China’s Gradual MOVE Away From the U.S. Dollar – Source: hinrichfoundation

BRICS Alliance and SWIFT Shift Accelerate De-dollarization Push

The digital yuan has been connected with ASEAN member states and also six Middle East countries through China’s CBDC cross-border payment system. This expansion leverages the mBridge project technology, which was originally developed with the Bank for International Settlements, to create alternatives to SWIFT messaging systems that have dominated international finance for decades now.

Technology Drives Financial Revolution

De-dollarization –

China’s Gradual Move Away From the U.S. Dollar – Source: hinrichfoundation

The digital yuan is not only more secure than traditional banking, but it is also less expensive. Cross-border digital currencies make payments in minutes and they are cheaper than SWIFT by about three quarters. At present, CIPS manages $60 billion each day, helping Yuan benefit from technology, though US-based CHIPS has a much higher daily processing rate.

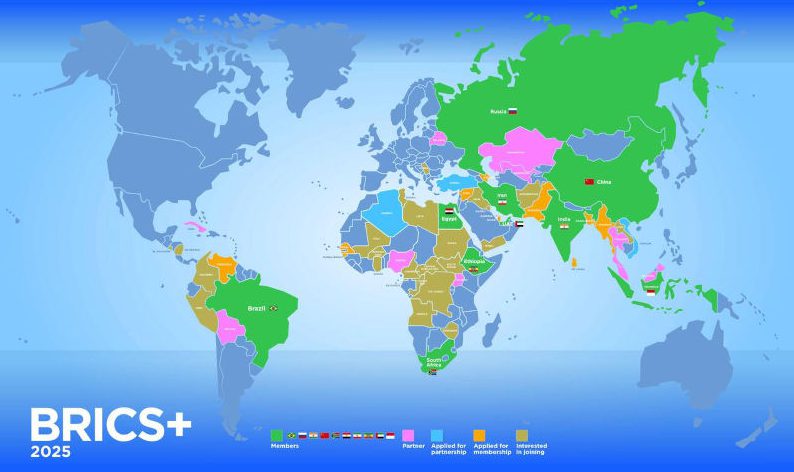

The leading BRICS countries have also joined in by making digital plans to reduce dependence on the dollar. Having the digital yuan means member countries can trade with each other without needing the US dollar or SWIFT which matters now more than ever.

Geopolitical Implications

China’s digital yuan strategy centers on achievingand also reducing dependence on US financial systems. The Chinese Yuan’s internationalization through digital technology allows trading partners to avoid potential sanctions while maintaining economic autonomy., which makes alternatives like the digital yuan increasingly attractive to BRICS alliance members seeking de-dollarization options.

The Bank for International Settlements withdrew from the mBridge project after it reachedstage, and this coincided with BRICS Summit discussions about creating abased on similar technology. This timing suggests growing momentum for SWIFT alternatives powered by digital yuan infrastructure.

Because of capital controls, many countries are still unable to loan in Chinese Yuan. However, right now, low interest rates in China encourage international borrowing. The digital yuan’s technology helps to chip away at the U.S. dollar’s global dominance, especially as BRICS countries consider other ways to cooperate.