Palantir Lands Whopping $795M Army Contract—Analyst Says ’Buy’ (PLTR)

Defense tech just got a bullish signal. Palantir’s latest $795 million deal with the US Army has analysts—like Wedbush’s Daniel Ives—urging investors to grab shares before the next surge.

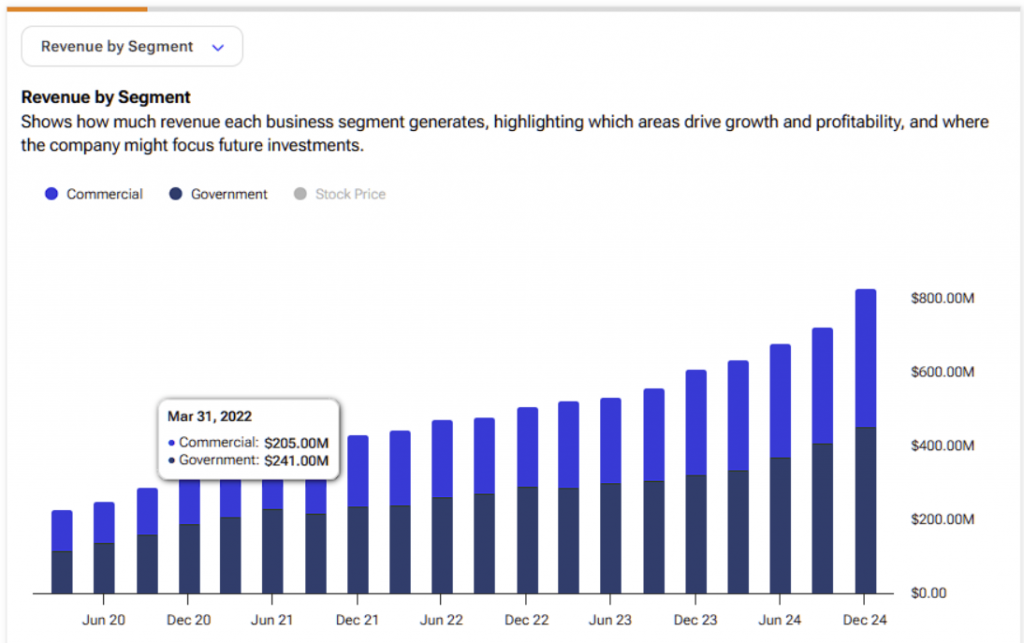

Big contracts, bigger bets. The data-mining firm’s government work continues to print money, though skeptics whisper about valuation multiples that’d make a Silicon Valley founder blush.

Active verbs, passive risks. While PLTR’s tech ’cuts’ through bureaucracy and ’bypasses’ legacy systems, Wall Street still wonders if the stock can dodge its history of wild swings. One thing’s certain: the military keeps writing checks.

Unlock Palantir Stock Price Prediction And Market Volatility Amid Regulatory Risks

Palantir Stock Surges on Historic Army Deal

Palantir stock jumped 8.2% to $25.67 per share on May 21, 2025, and this came after securing the $795 million contract modification for Maven Smart System software. Trading volume also spiked to 42.3 million shares compared to the 30-day average of 29.5 million, which is reflecting strong investor confidence in Palantir stock’s defense positioning at the time of writing.

Daniel Ives from Wedbush stated:

Golden Dome Project Fuels Palantir Stock Rally

President Trump’s $175 billion Golden Dome missile defense initiative is also adding momentum to the Palantir stock surge right now. The project includes $25 billion earmarked for 2026, and Palantir is positioned to provide AI analytics for the satellite-based defense system, which further supports PLTR assets upward trajectory.

Ives had this to say:

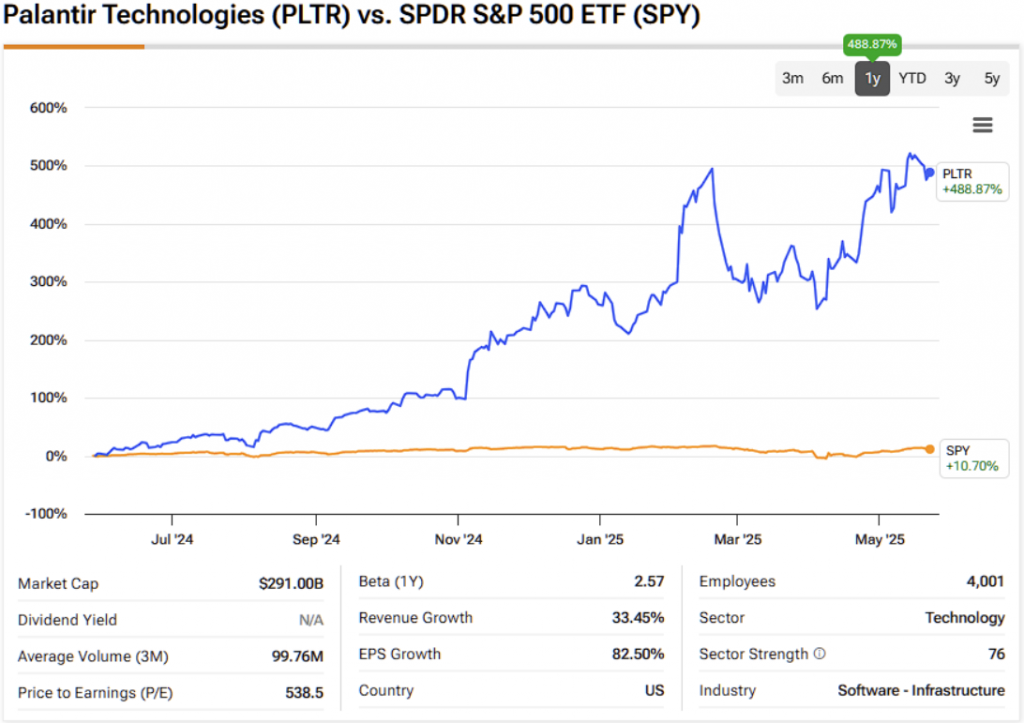

Market Volatility Can’t Stop PLTR Stock Momentum

Despite broader market volatility affecting tech stocks, Palantir stock has also rallied 60% year-to-date, and it’s significantly outperforming indices. The company’s government-focused AI approach helps it navigate market volatility while also benefiting from increased federal AI spending, with PLTR stock maintaining its upward momentum right now.

Market volatility concerns haven’t dampened Palantir stock performance, and the recent Army deal is providing concrete validation of its growth strategy. While Nasdaq: NVDA along with other AI stocks face market volatility headwinds, PLTR stock benefits from stable government contract revenue streams.

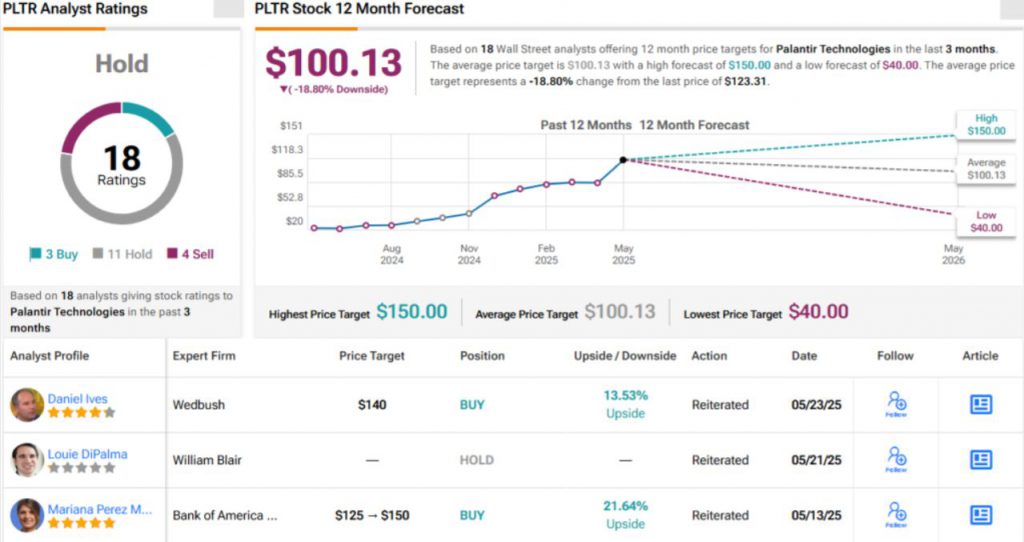

Bullish Price Prediction Despite Mixed Sentiment

Wedbush maintains its aggressive $140 PLTR price prediction, which represents upside from current levels following the stock surge. However, broader Wall Street shows mixed sentiment, and the average Palantir price prediction of $100.13 suggests more conservative expectations despite recent Palantir stock gains at the time of writing.

Ives stated:

The subscription-based defense model also supports bullish Palantir price prediction targets, providing recurring revenue stability that justifies premium valuations despite ongoing market volatility challenges.