SCO Nations Slash Dollar Dependence—92% of Trade Now in Alternative Currencies

The U.S. dollar’s grip weakens as Shanghai Cooperation Organization members pivot hard—92% of cross-border trade now bypasses the greenback. A seismic shift or just geopolitical posturing? Either way, Wall Street’s favorite monopoly is looking shaky.

Local currencies, digital assets, and barter systems eat the dollar’s lunch. No surprise—when sanctions become a weapon, even central bankers start hedging bets. Gold? Crypto? Yuan? Anything but the petrodollar’s baggage.

One cynic’s take: Maybe the Fed should’ve thought twice before weaponizing SWIFT. Now the world’s building financial firewalls—and Uncle Sam’s exorbitant privilege is on clearance.

How SCO Nations, BRICS, and Currency Substitution Are Driving De-dollarization Trends

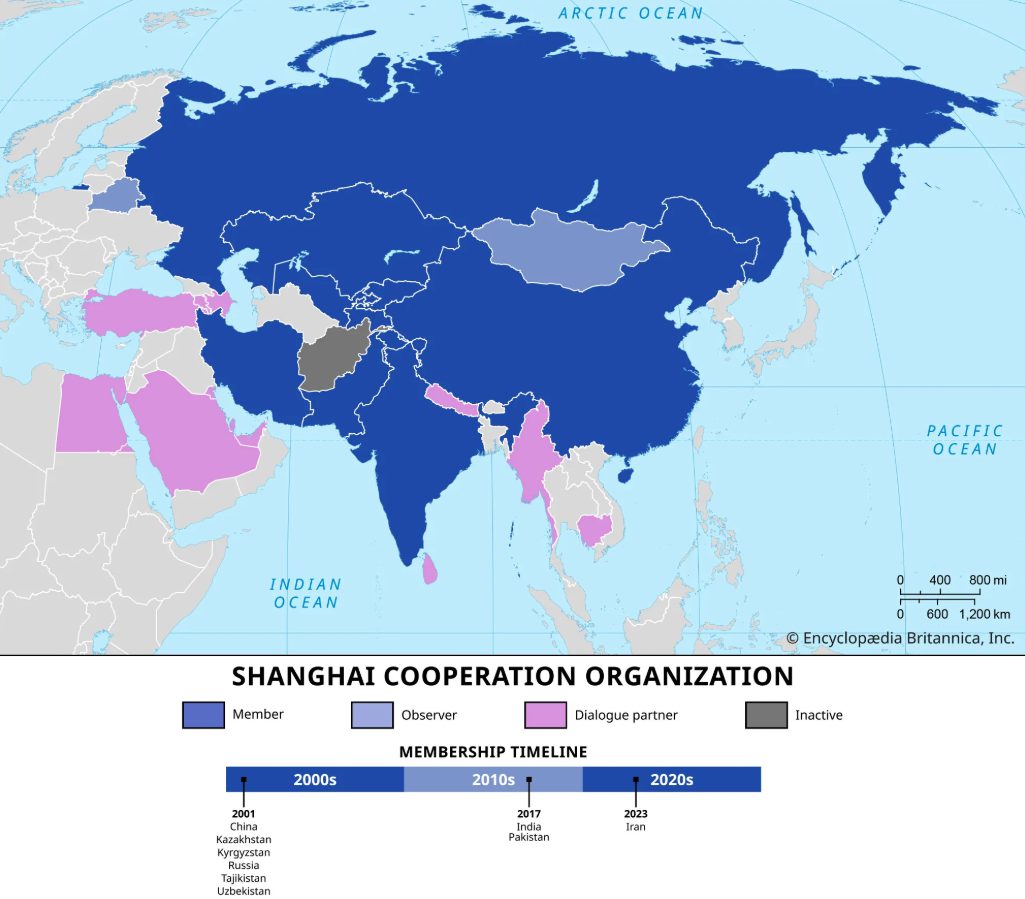

The Shanghai Cooperation Organization’s coordinated approach to de-dollarization represents a fundamental shift in global financial architecture right now. This massive economic bloc, which encompasses China, Russia, India, Pakistan, Iran, Kazakhstan, Kyrgyzstan, Tajikistan, and also Uzbekistan, controls approximately 42% of the world’s population and represents significant economic power that’s driving currency substitution initiatives across the region.

Putin also noted the broader economic success of SCO nations:

SCO’s Strategic De-dollarization Implementation

The de-dollarization movement within SCO represents more than just statistical changes—it also reflects systematic policy coordination among member nations at the time of writing. Putin emphasized Russia’s commitment to expanding non-dollar payment mechanisms, and he’s proposing an independent SCO settlement system that WOULD further reduce United States dollar dependency.

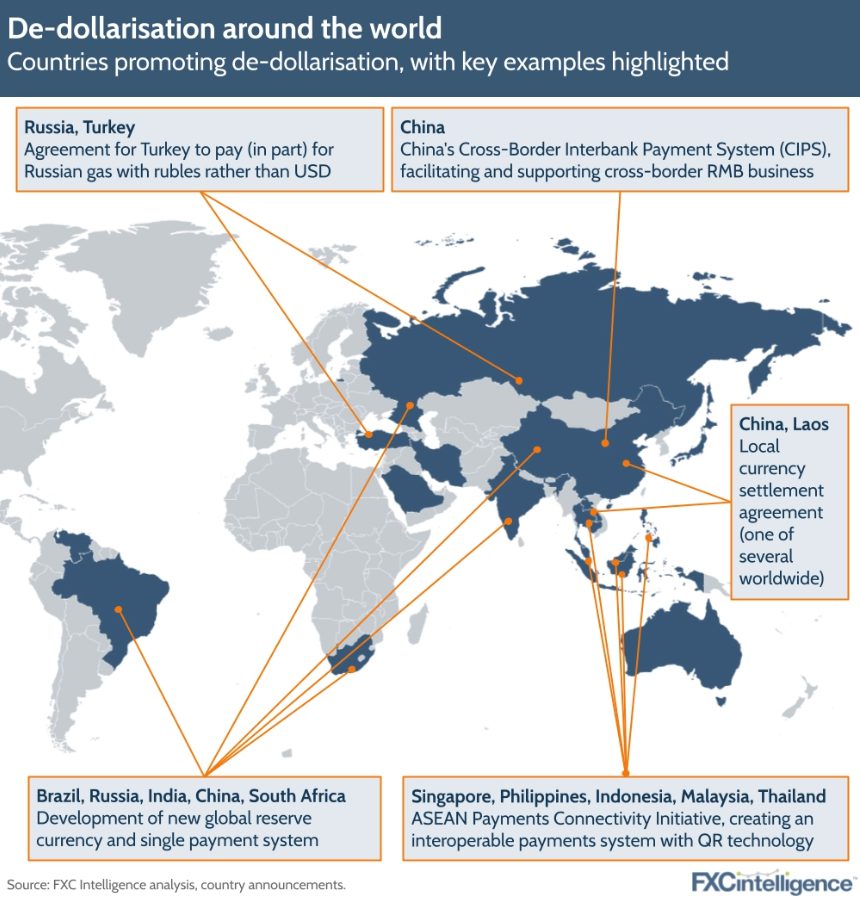

BRICS nations are working closely with SCO countries to implement currency substitution across multiple economic sectors right now. China’s yuan has emerged as a primary alternative currency, while bilateral trade agreements are increasingly favoring national currencies over traditional dollar-denominated transactions, and this trend is gaining momentum.

BRICS and Currency Substitution Drive Global Change

The coordination between SCO nations and also BRICS members amplifies de-dollarization effects globally. These interconnected economic blocs represent countries that are seeking financial sovereignty through currency substitution, and they’re reducing exposure to United States dollar volatility and potential sanctions.

Putin highlighted the strategic importance of this transition:

Oil-producing nations that were traditionally tied to petrodollar systems are now exploring alternatives. Saudi Arabia’s openness to yuan-denominated oil transactions with China exemplifies how even traditional dollar allies are considering currency substitution options right now.

Since almost all of the trade settlements within the SCO avoid the dollar, this achievement shows that large-scale de-dollarization works well. This action by leading economies is now challenging the United States dollar’s long-standing place in global trade and it may play a major role in reshaping financial systems over the next few decades.