Buffett Bets Big: $330B Portfolio Leans Hard on 4 Stocks

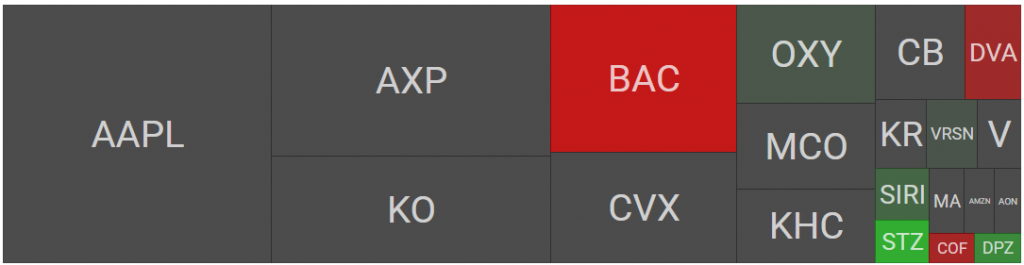

Warren Buffett’s Berkshire Hathaway isn’t playing the diversification game—58% of its $330B war chest is parked in just four equities. So much for ’don’t put all your eggs in one basket’... unless that basket prints money.

The Oracle of Omaha’s concentrated playbook defies modern portfolio theory—and, frankly, most financial advisors’ sweaty-palmed recommendations. But when you’re sitting on a third of a trillion dollars, maybe you get to rewrite the rules.

Funny how ’too big to fail’ applies to banks but not to stock picks—especially when the guy picking them still thinks Bitcoin is ’rat poison squared.’

How Buffett’s Top 4 Stocks Drive the $330B Berkshire Portfolio

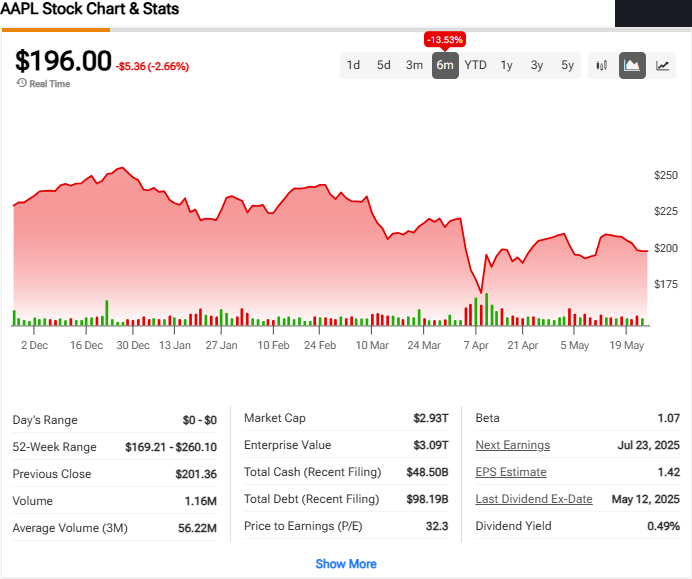

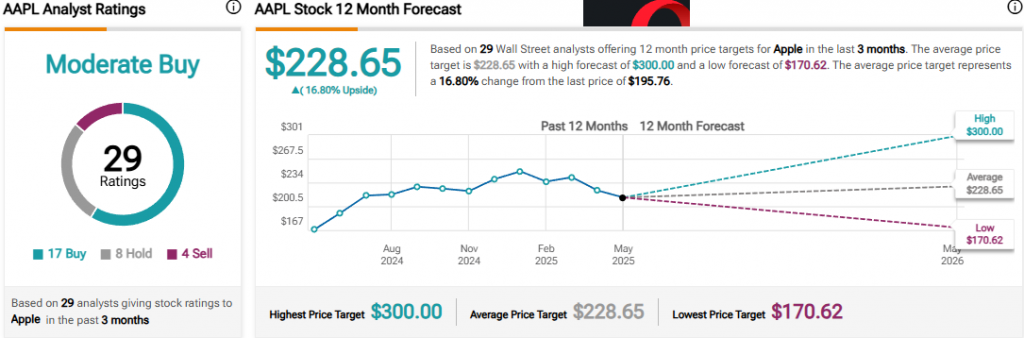

1. Apple Stock Dominates Warren Buffett Portfolio

Apple stock represents $63.4 billion of the Warren Buffett portfolio at 22.1%. Despite reducing from 915 million to 300 million shares, Apple stock remains Berkshire’s largest holding. Customer loyalty and premium pricing attracted Buffett to this long-term investing play. The tech giant’s $775 billion buyback program since 2013 helps grow Berkshire’s stake without additional Warren Buffett portfolio purchases.

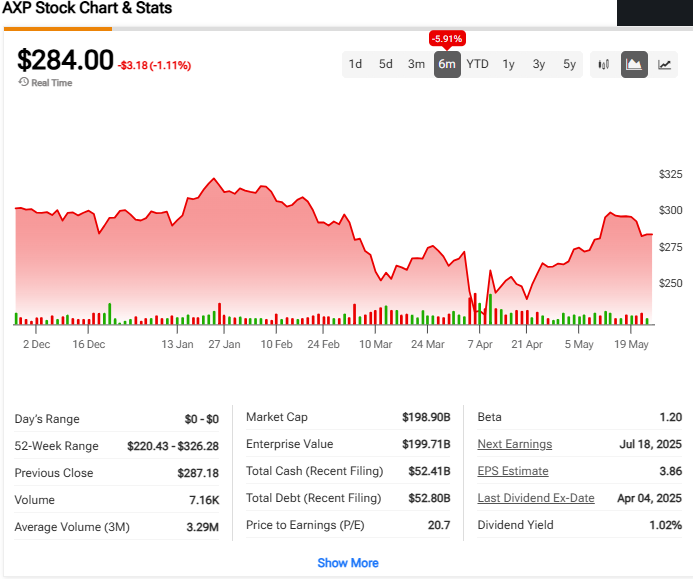

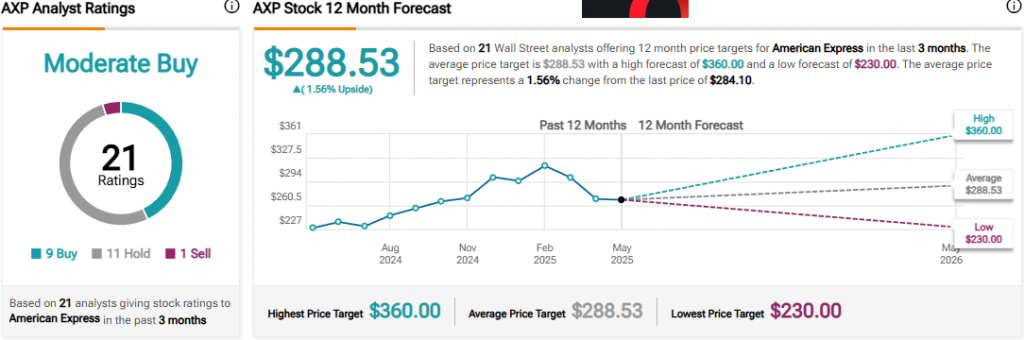

2. American Express Powers Returns

American Express commands $45.4 billion of the Warren Buffett portfolio as an “indefinite” holding since 1991. This financial sector stock benefits from merchant fees and cardholder interest income streams. American Express delivers 38.6% yield on cost with $3.28 dividends on $8.49 basis, showcasing dividend stocks performance.

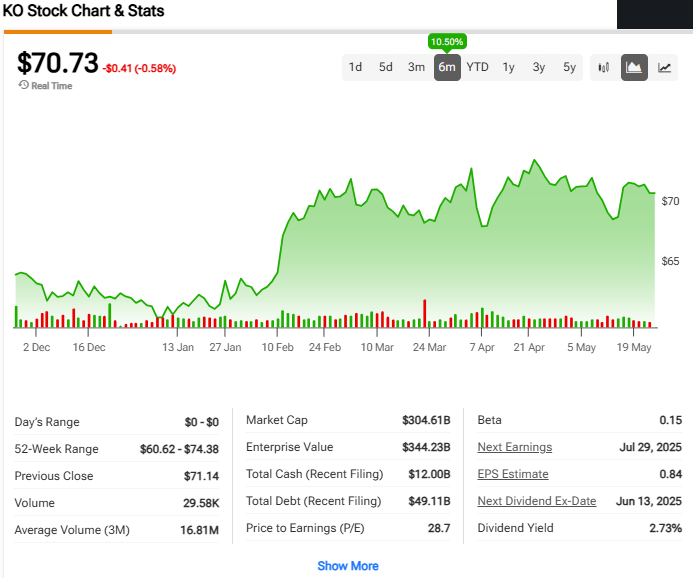

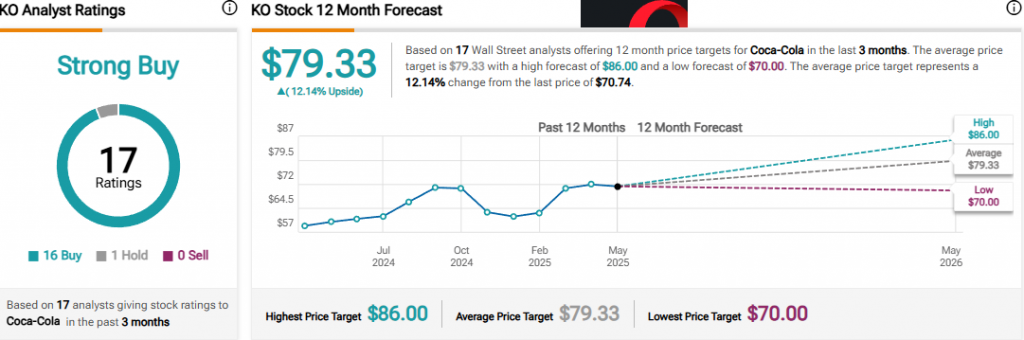

3. Coca-Cola Stock Anchors Dividend Strategy

Coca-Cola stock worth $28.8 billion anchors the Warren Buffett portfolio since 1988. This dividend stocks champion increased payouts 63 consecutive years across global operations. Berkshire’s Coca-Cola stock generates 62.8% yield on cost through $2.04 dividends on 400 million shares at $3.2475 basis.

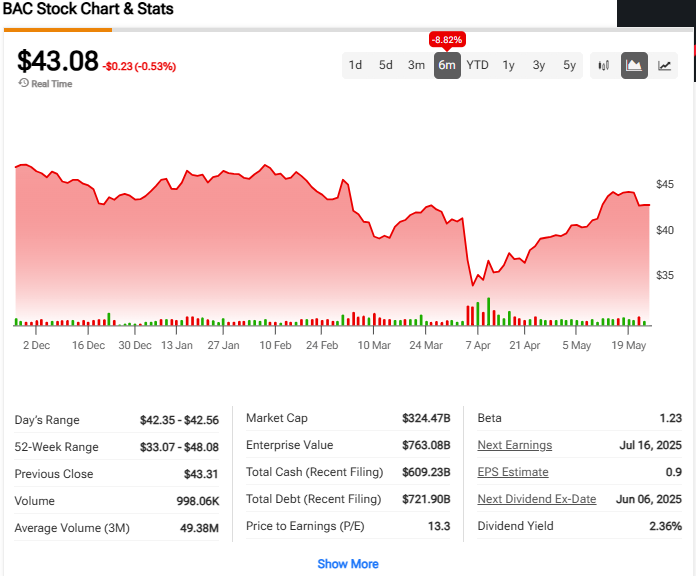

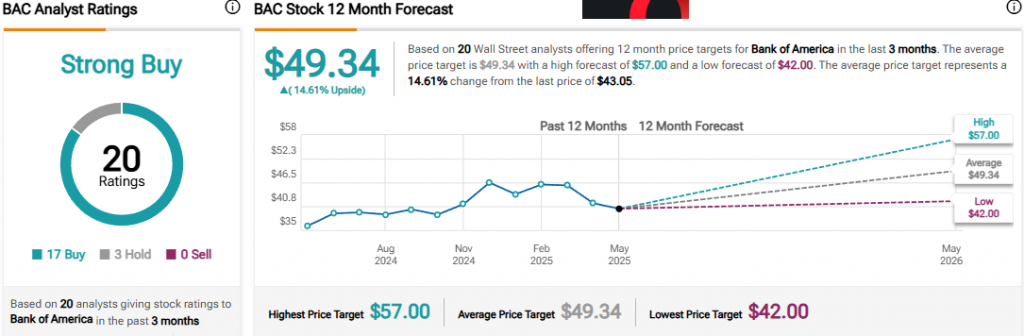

4. Bank of America Completes Core Holdings

Warren Buffett still owns around $28.2 billion of Bank of America stock. He sold 48.6 million shares but kept most of it. Bank of America does really well when interest rates go up – better than other big banks. The bank gives shareholders $1.04 per share each year. They also bought back a bunch of their own stock – about 29% since 2017. This means fewer shares are out there, so each share is worth more.

Conclusion

The Buffett portfolio concentration in these four power stocks proves focused investing in Apple stock, American Express, Coca-Cola stock, and Bank of America generates superior returns through patient blue-chip stocks allocation and disciplined long-term investing approach.