Buffett’s Blue-Chip Bets: 2 Rock-Solid Stocks Even Crypto Bulls Can Respect

While Wall Street obsesses over meme stocks and algorithmic trading, Warren Buffett’s old-school picks keep printing money. Here are two cash-generating machines that survive market cycles—unlike your cousin’s NFT portfolio.

The Oracle of Omaha’s playbook remains simple: buy boring businesses with unshakeable moats. These picks won’t moon overnight, but they’ll still be here after the next crypto winter.

Fun fact: Both stocks outperformed Bitcoin during 2022’s crash. But who’s counting? (Besides every hedge fund manager quietly rebalancing into value stocks.)

2 Warren Buffett-Approved Stocks to Hold On To for Major Gains

1. Coca-Cola (KO)

Coca-Cola is a multinational corporation headquartered in Atlanta, Georgia, United States. The company was founded in 1892 by Asa Griggs Candler and is responsible for manufacturing and selling a variety of soft drinks, including the famous Coke. The company has recently renewed its marketing partnership with WPP Open X, amping up procedures to popularize the brand across the globe.

Coca-Cola accounts for nearly 10% of the total Berkshire Hathaway portfolio, with the firm being the largest shareholder of the beverage company.

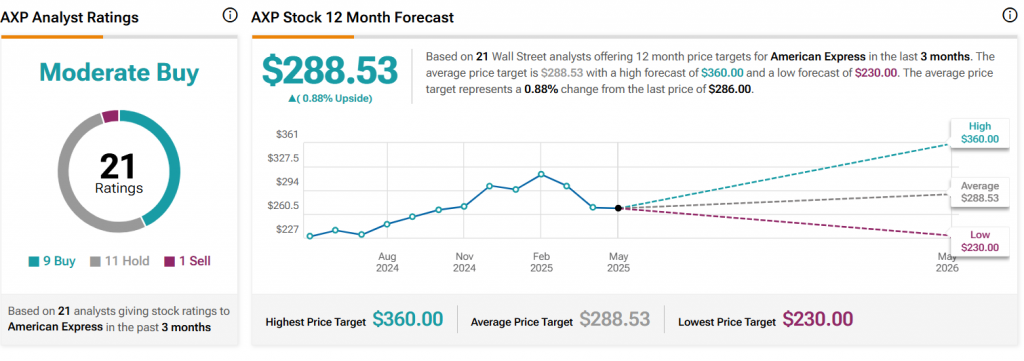

Per TipRanks, Coca-Cola is currently sitting at $71, eyeing a mild price uptick of $79 in the coming months. At the same time, the stock is also eyeing a high of $86, which it can achieve anytime in the next 12 months.

2. American Express (AXP)

American Express is another profitable stock that Berkshire Hathaway proudly owns. The firm holds nearly a 21% stake in American Express, showcasing the undue trust that Warren Buffett has projected for more than 30 years. Buffett purchased the American stocks in 1994 in exchange for warrants from a $300 million preferred stock investment. The firm since then has been expanding its stake in the company.

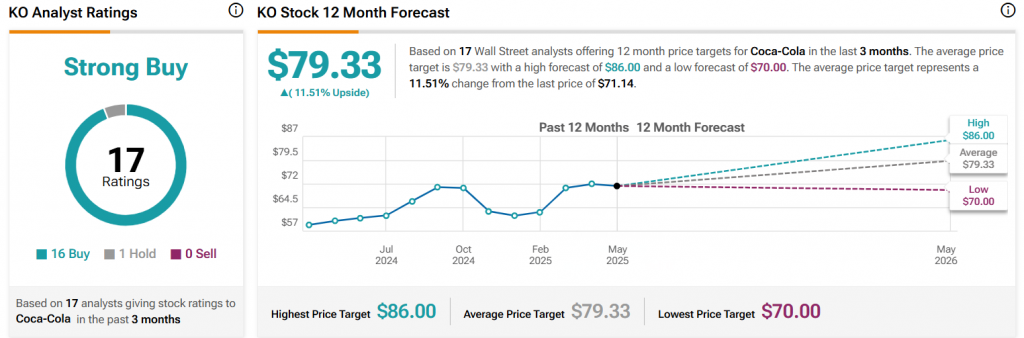

Per TipRanks, American Express stock is currently sitting at $287, eyeing the $288 short-term target. Per the portal, the stock is eyeing a new high of $360 in the next 12 months.