Tesla (TSLA) Nears ATH as Bulls Charge—Wall Street Scrambles to Justify Valuations

Elon Musk’s EV juggernaut Tesla is revving up for a potential breakout—again. After weathering supply-chain chaos, Twitter drama, and the occasional ’production hell,’ TSLA’s chart looks primed for a moonshot.

Key drivers? Cybertruck hype bleeding into margins, energy storage deployments doubling down, and that sweet, sweet AI narrative. Short sellers? Still getting squeezed.

Meanwhile, analysts flip-flop between ’overvalued’ and ’must-own’ faster than a crypto trader chasing memecoins. Bonus cynicism: If TSLA hits $1T again, expect another round of ’this time it’s different’ PowerPoints from the same banks that called it a bubble at $200.

Source: Business Insider

Source: Business Insider

Tesla Stock Poised to Surge: Why a New Record Price May Be Nearing

After a rebound took place early in the week, the US stock market fell yet again on Wednesday. The Dow Jones Index dropped 750 points as the Nasdaq also slid. Although Tesla fell more than 1.6% alongside the market drop, it is still in a strong position in recent weeks. Specifically, the company is up more than 48% over the last 30 days.

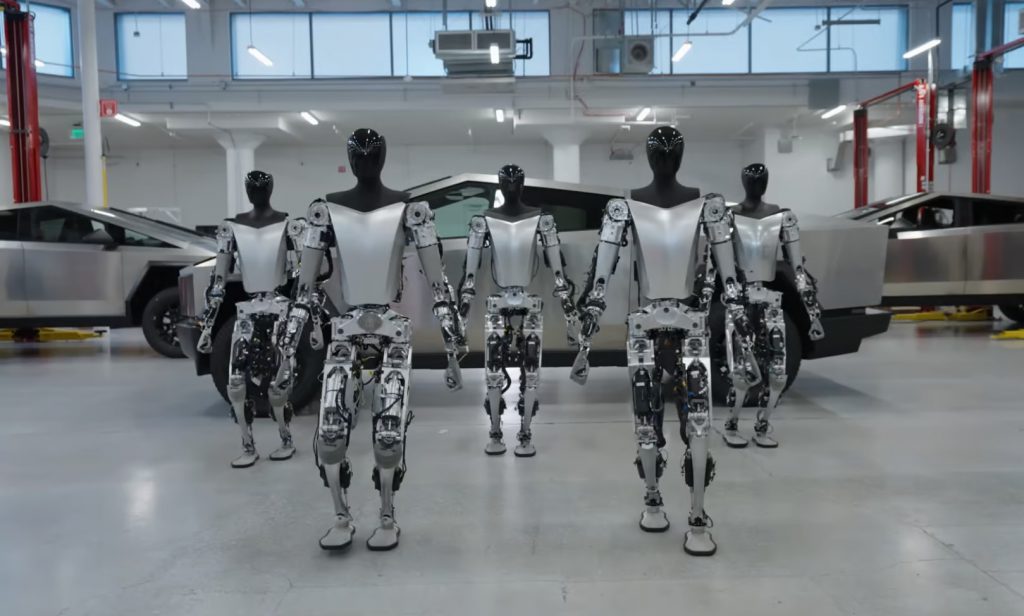

Thus, the company is set to make notable gains amid sky-high Optimism for both the brand and its offerings. The company is poised to unveil new headway in its Robotaxi endeavor, with investors excited at what that could mean. This and some important data show that Tesla may well be on its way to setting a brand new all-time high.

According to a new TradingView report, Tesla is up more than 60% from the lows it reached in March. Moreover, its propulsion back to the $355 level has seen it reach its highest price in three months. This has it set up to retest the $475 landmark price point set in December of last year.

Although Musk is a major reason why sentiment has improved, technical indicators show a golden cross is forming for Tesla. This means that the 50-day exponential moving average has crossed the 200-day exponential moving average. The pattern is a strong bullish indicator, with its recent surge turning the $325 level into a key support.

Tesla shares will find their next great obstacle at the $380 level. This will see it confront 2025 lows and the 61.8% Fibonacci level. If it can successfully breach this, it has a path to breaking through above $400. With the Robotaxi launch and Musk’s refocusing, it certainly does not appear impossible.