Brazil’s Central Bank Head Shoots Down De-Dollarization Hype: ‘Not in Our Lifetime’

Another day, another central banker clinging to the dollar’s coattails. Brazil’s top monetary authority just poured cold water on the crypto crowd’s favorite pipe dream—global de-dollarization.

Wake-up call: The USD isn’t going anywhere

For all the chatter about BRICS nations ditching the greenback, reality bites harder than a bear market. The Brazilian central bank chief minced no words: the dollar’s dominance will outlast most millennials’ crypto portfolios.

Funny how fiat defenders suddenly sound like Bitcoin maxis when it comes to network effects. The dollar might be inflationary garbage, but it’s *our* inflationary garbage—and the world’s stuck with it. For now.

BRICS Currency, Local Alternatives, and Why De-Dollarization May Fail

Brazil’s Sobering Assessment

Brazil’s Central Bank director Gabriel Galipolo recently delivered a quite blunt evaluation of de-dollarization prospects during an event that took place in Rio de Janeiro.

Galipolo stated:

This declaration essentially undermines the ambitious plans for BRICS currency development that some member countries have been promoting in order to reduce their United States dollar dependency.

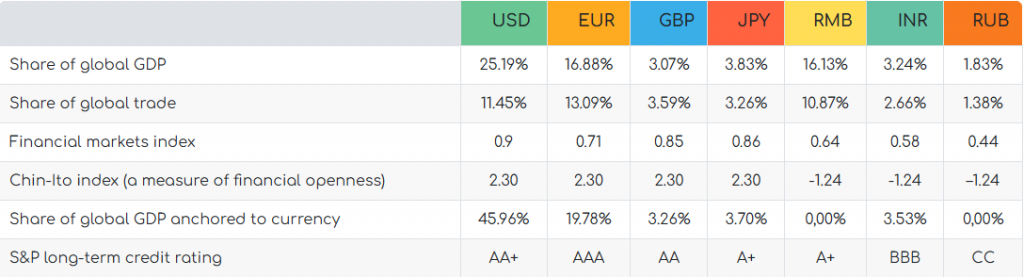

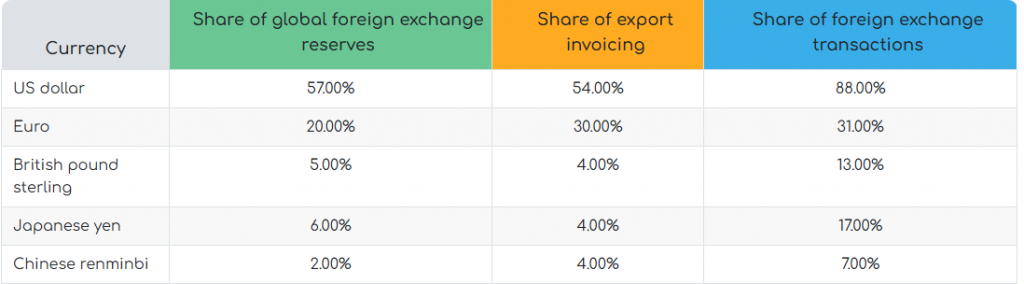

Challenges to De-Dollarization

De-dollarization efforts are currently facing substantial and also quite practical limitations despite the ongoing push from countries such as Russia and China. The lack of sufficient assets among BRICS nations represents what appears to be a fundamental obstacle to creating viable United States dollar alternatives.

BRICS expansion has, in recent months, brought new members into the discussions about local currency usage, but reaching any sort of consensus remains somewhat elusive when it comes to actually implementing alternatives to the dollar-based system.

How Will De-Dollarization Affect The Economy?

Digital solutions including, but not limited to, cryptocurrency have been explored as potential pathways for dedollarisation, though Brazil’s assessment at this point suggests that fundamental asset issues cannot be easily overcome.

Galipolo emphasized:

The realistic timeline for any meaningful de-dollarization appears to be much longer than what proponents might suggest, with United States dollar dominance likely continuing for the foreseeable future and beyond.

BRICS nations are exploring alternatives to the United States dollar for international trade, but as Brazil’s central bank notes, they currently lack sufficient assets to create a viable BRICS currency.

Some nations seek to reduce vulnerability to U.S. sanctions and gain more monetary independence, though practical limitations remain substantial.

De-dollarization remains, at the time of writing, more of a long-term aspiration rather than an imminent reality for BRICS nations, despite their ongoing efforts to develop a BRICS currency and also promote various forms of local currency trading.