BlackRock’s Bitcoin Binge: How the Giant Gobbled Up Crypto in May 2025

Wall Street’s trillion-dollar whale just took another bite out of Bitcoin—but how big was the haul?

While retail investors were busy staring at memecoins, BlackRock quietly executed its latest crypto power play. The asset management titan’s May 2025 Bitcoin shopping spree signals institutional adoption isn’t slowing down—it’s accelerating.

Sources confirm the firm added to its already massive crypto treasury last month, though exact figures remain locked tighter than a cold storage wallet. The move comes as traditional finance finally admits what crypto natives knew years ago: digital gold isn’t going anywhere.

One thing’s certain—when BlackRock sneezes, the market catches a cold. Their continued accumulation proves even the most conservative players now view Bitcoin as mandatory portfolio armor—whether they understand it or not.

After all, nothing warms a banker’s heart quite like buying the dip... at institutional scale.

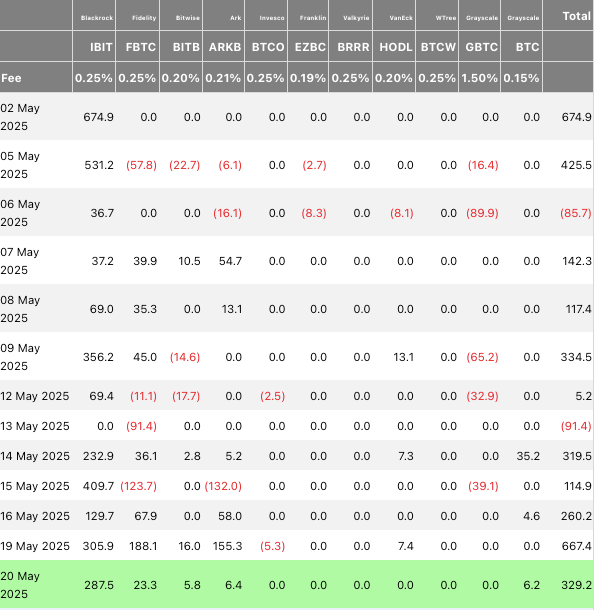

Source: Farside

Source: Farside

Will Bitcoin Hit a New All-Time High Amid BlackRock’s Big Purchases?

BTC is currently down by just 2% from its all-time high of $108,786. There is a high probability that the original crypto will hit a new peak very soon. Institutional investments are central to an asset’s price. BlackRock’s bullish outlook could inspire other investors to go long on BTC. Such a development could lead to a surge in demand and price.

There is also a high probability that the Federal Reserve will cut interest rates soon. A rate cut may trigger another market-wide rally. Such a scenario could further boost investor sentiment.

According to CoinCodex analysts, BTC may be in for another bullish leg over the coming weeks. The platform anticipates the asset to breach its peak later this week on May 23. CoinCodex further anticipates BTC to climb to a new all-time high of $161,540 on Aug. 18. BTC’s price will rally by 51.63% if it hits the $161,540 target.

There is also a possibility that Bitcoin (BTC) will not rally as predicted. The asset could face a correction instead. The current rally is likely due to institutional investments. Retail players may be sitting this rally out. If institutions slow down their investments, BTC’s rally could become cold.