Take-Two Plays Wall Street Poker: $4.75M Share Offering at $225 as Morgan Stanley Doubles Down with $265 Target

Wall Street’s favorite game? Printing money while pretending it’s strategy. Take-Two just dealt itself a fresh $4.75 million hand at $225 per share—because why not dilute when the suits are bullish?

Morgan Stanley upped the ante, slapping a $265 target on the table. That’s a 17.8% upside from the offering price, proving analysts still believe in video game magic (and questionable DLC monetization).

Meanwhile, retail investors check their wallets—again.

Take-Two Stock Rallies as GTA 6 Buzz and Targets Align

Take-Two stock is, right now, really benefiting from this secondary offering announcement and also from the analyst upgrades that have followed. The timing of the $225 share price offering seems to be, in many ways, aligned with growing market confidence in Take-Two’s future revenue potential, particularly as GTA 6 development continues to progress and generate excitement.

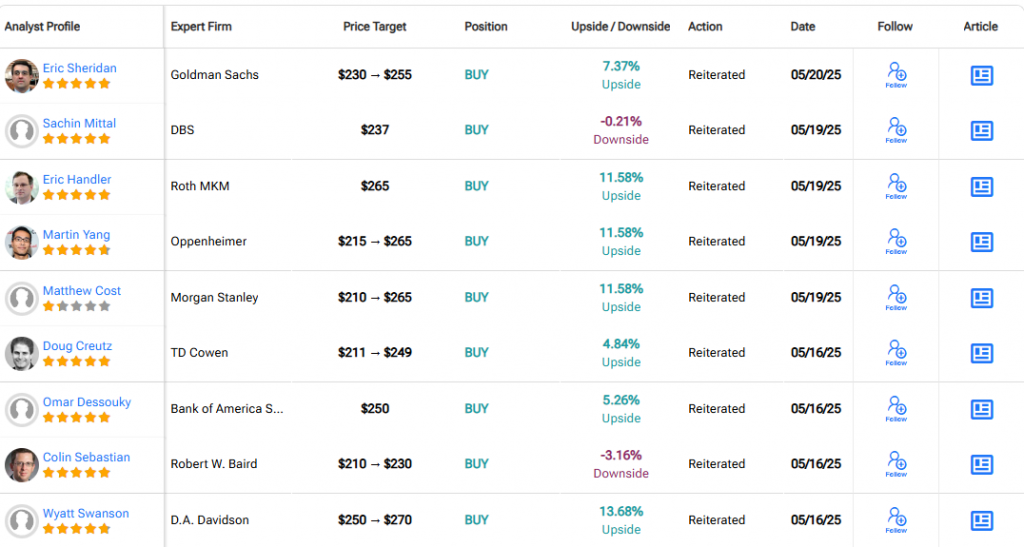

Analyst Optimism Fuels Growth

Morgan Stanley analysts stated:

UBS analysts had this to say:

Will Take-Two Stock Go Up?

Take-Two stock appears, based on current information, that it’s positioned for some potential growth, according to multiple analysts and industry watchers. The recent $225 share offering and the positive reception it received suggests that there is some market confidence in Nasdaq: TTWO. Many analysts view the anticipated GTA 6 release date as a major catalyst that could, in the coming years, significantly boost future earnings and company valuation.

Wedbush analysts stated:

UBS analysts said: