Bitcoin Slashes Traditional Finance, Claims Its Throne in Global Portfolios

Wall Street’s old guard never saw it coming—Bitcoin isn’t just knocking on finance’s door anymore. It’s bulldozing the walls.

The digital asset revolution cuts through bureaucratic red tape, offering borderless transactions while traditional banks still process paper checks. Modern portfolios now demand crypto exposure—or risk becoming relics.

Hedge funds scramble to rebalance, but Bitcoin laughs at their 60/40 models. Meanwhile, central bankers clutch their fiat currencies like fading Hollywood stars at a Gen Z party.

One cynical truth remains: the suits will eventually adopt crypto… right after they finish shorting it.

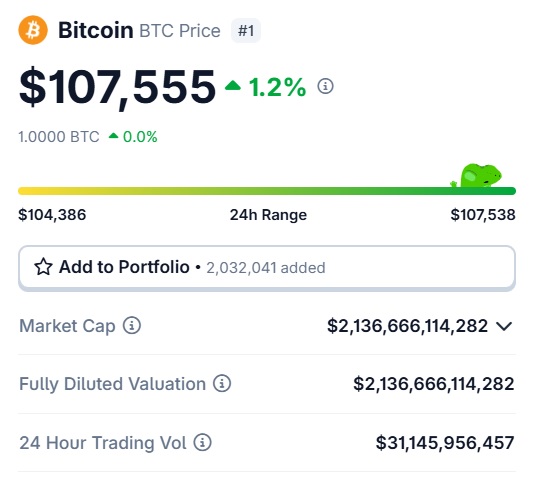

Source: Coingecko

Source: Coingecko

Bitcoin Towers Around the Financial System: BTC Reshaping Portfolios

Tracy Jin, the COO of MEXC,, highlighting how Bitcoin is catching up with gold. She opined that gold is a hedge against market volatility, while BTC is now a hedge against fiat-based risks. Jin explained that BTC is ironing out financial imbalances and maintaining a bridge between the old and the new economic sectors. It could be the gateway to the financial future where BTC will be equally compared to gold.

said Jin to.

She continued stressing that Bitcoin’s ecosystem is growing, and taking an entry position now could be beneficial.she summed it up.