Moody’s Axes Last AAA Rating—Here’s How Markets Will Bleed Trillions

Wall Street’s sacred cow gets slaughtered—again. Moody’s just cut its final AAA-rated holdout, and the financial ecosystem is bracing for shockwaves.

Why it matters: When the ’smart money’ loses its gold-plated stamp of approval, pension funds, insurers, and algorithmic traders all get forced into messy portfolio triage. Expect fire sales in ’safe’ assets and a scramble for yield.

The cynical twist: This downgrade comes 17 years after ratings agencies missed the 2008 crash. Maybe AIs will do better at judging credit risk than humans who get paid to look the other way.

Source: Moodys.com

Source: Moodys.com

Moody’s Downgrade Fuels Market Volatility, Debt Risk, and Crypto Fear

Moody’s AAA rating cut wasn’t really an impulsive decision but rather the culmination of years and years of fiscal deterioration. The rating agency specifically cited America’s inability to address, such as, growing deficits, which has caused treasury yields to jump immediately after the announcement, for sure.

Moody’s stated:

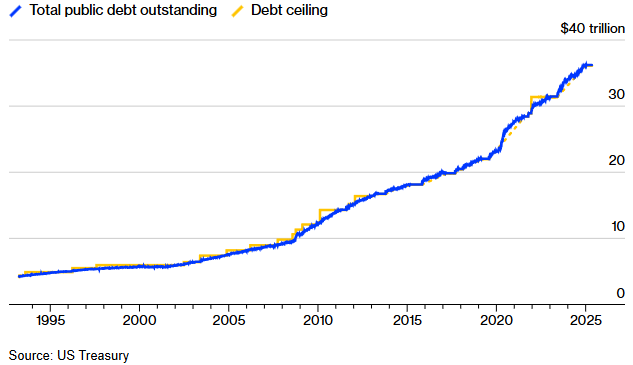

Trillion-Dollar Interest Burden

The most alarming effect of Moody’s AAA rating cut is, right now, the projection for U.S. interest payments. The market volatility following the downgrade has, in many ways, worsened the outlook for U.S. credit rating prospects and such.

Moody’s explained:

Market Implications and Treasury Yields

The market response to Moody’s AAA rating cut has been, like, immediate and also quite pronounced. Treasury yields spiked as investors demanded higher returns for holding U.S. debt, while the dollar also weakened against major currencies and other financial instruments.

Gene Dodaro, U.S. Comptroller General and head of the GAO, warned:

Long-Term Economic Impact

For average Americans, Moody’s AAA rating cut will likely mean, in many ways, higher borrowing costs. The downgrade’s impact on treasury yields influences, such as, mortgage rates, credit cards, and also auto loans, creating persistent and ongoing market volatility.

The GAO’s fiscal health report notes that interest payments will exceed, like, $1 trillion in FY 2025, highlighting the severe strain on the U.S. credit rating and also the potential for further deterioration if not addressed soon.

Moody’s noted: